US Property Prices Fell in October from September

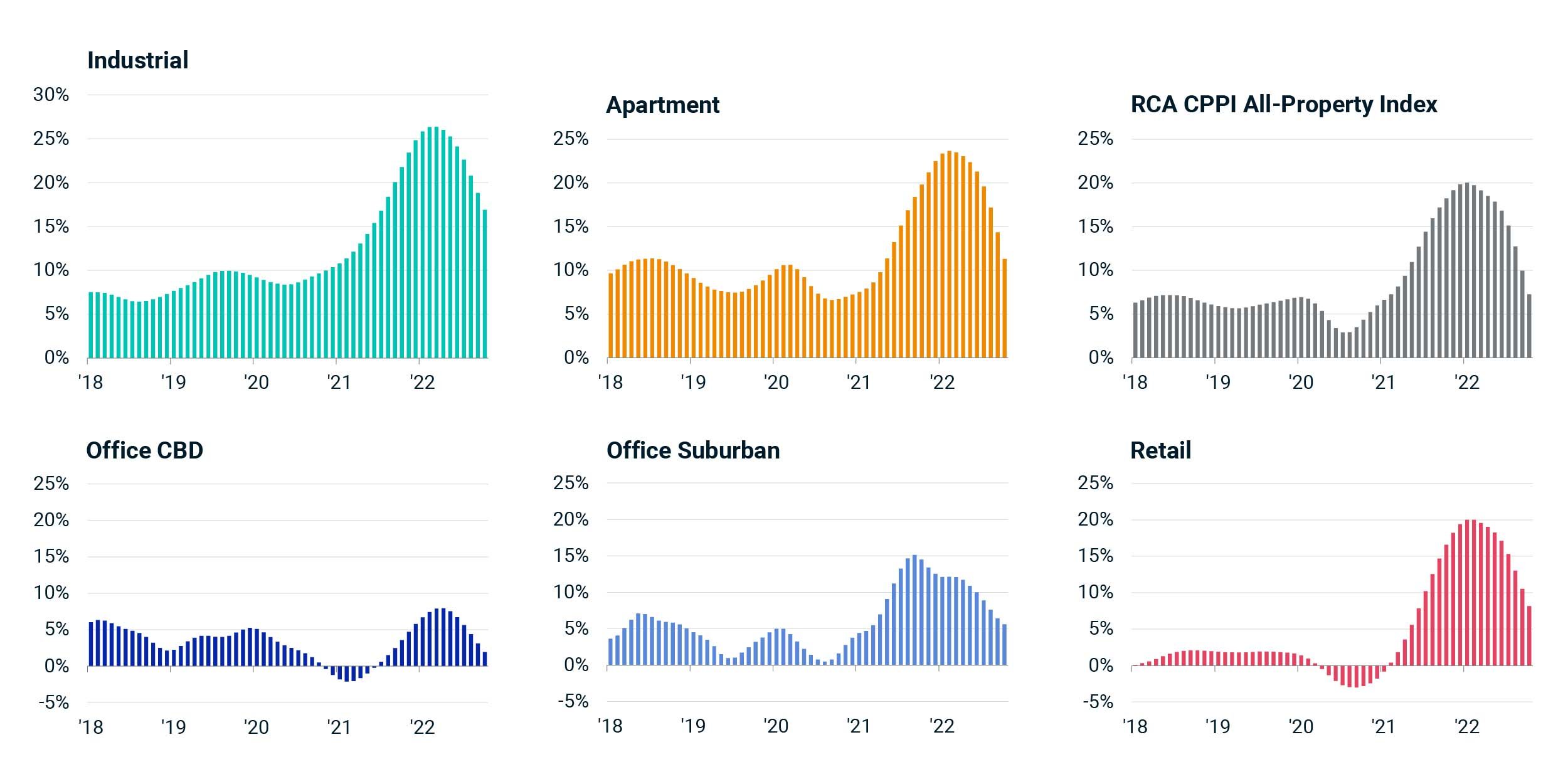

Prices of U.S. commercial property fell in October from September, though they still increased compared to October of 2021. The RCA CPPI National All-Property Index dropped 0.4% on a monthly basis — which, when annualized, would be a decline of 4.5%. The posted annual change was a 7.3% increase.

Most property-type indexes showed monthly declines, and all showed slowing annual growth rates in October. Pricing of commercial property has come under pressure amid a spike in debt costs and a slowdown in deal activity in 2022.

Most sectors posted monthly drops

Prices of apartment buildings declined 0.6% from September and rose 11.3% from a year prior. The monthly decline, when annualized, would be a drop of 7.0%. Retail prices fell 0.3% from September, and the annual rate of growth slowed to 8.2%. The industrial-sector index stood out with a 0.7% monthly gain and a 16.9% annual growth rate.

The index for suburban offices rose just 0.1% from a month earlier and 5.6% from a year earlier. The index for offices in central business districts again posted a monthly decline, falling 0.3%. The index rose 1.9% from a year ago, the smallest annual gain across the property types.

Annual change in the price of US commercial property

Source: RCA CPPI (commercial property price indexes)

Subscribe todayto have insights delivered to your inbox.

Examining UK Real Estate’s Worst Quarter Since 2009

Following its recent sharp increase, the 10-year U.K. government bond-yield has risen above the net-operating-income (NOI) yield of U.K. real estate for the first time since 2007.

A Correction in US Commercial Real Estate

The U.S. market for offices has slowed, with sellers hesitant to take a loss and buyers sitting on the sidelines.

Getting the Full Picture on Tenant-Default Risk in Real Estate

Tenant-default risk analysis in real estate portfolios is often focused on the largest tenants by rental income due to resource or data constraints, but the underlying data suggests this practice may be inadequate.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.