Will a Rail Strike Stop the US Economy in Its Tracks?

While a U.S. railroad strike was averted in September, and the U.S. Congress is currently working on legislation to prevent the planned December strike, there is a chance it might not be avoided this time. This adds to investors' concerns about the U.S. economic situation and its potential impact on their portfolios.

Estimating the economic toll

According to the Association of American Railroads (AAR), a shutdown could affect consumers and businesses across nearly all sectors of the economy. They estimate the economic damage could amount to USD 2 billion per day.1 Another analysis, by the American Chemistry Council (ACC), is more pessimistic, with a potential output decline of 1 percentage point and a surge in the producer price index of 4%.2

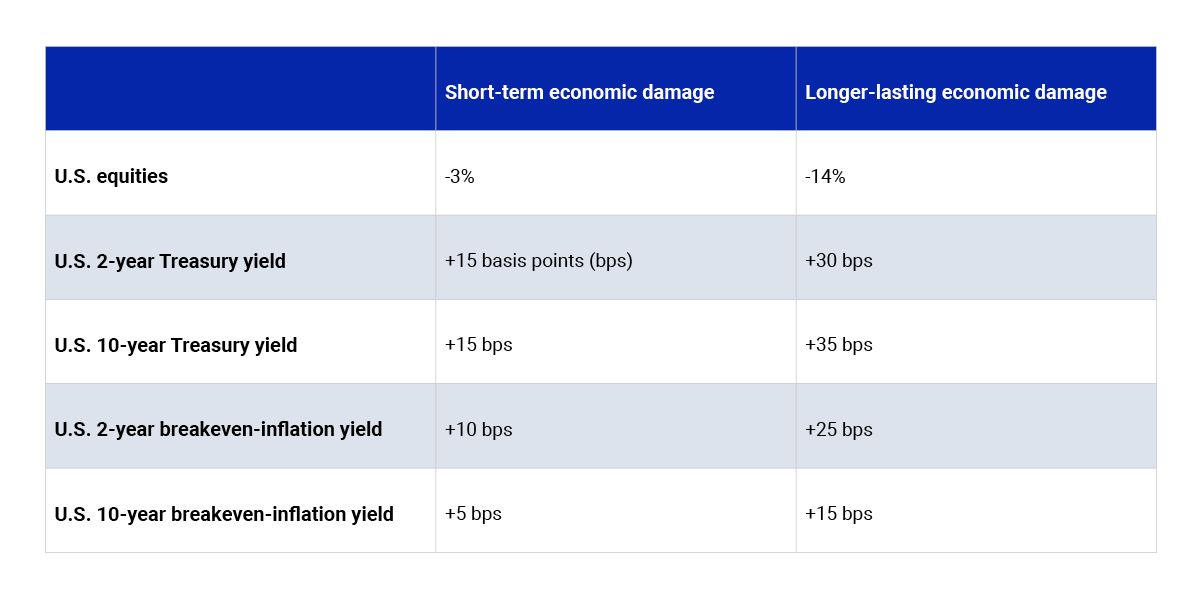

While these estimates vary significantly in their severity and might not be the most likely outcomes, they can help investors prepare for potential worst-case impacts to their portfolios. And so we use them to analyze two scenarios: a milder one based on the AAR's assessment, assuming a monthlong strike causing a short-lasting drop in output and additional inflationary pressure; and a more severe scenario based on the ACC's projections, assuming more severe and longer-lasting damage to the U.S. economy, along with a spike in inflation.

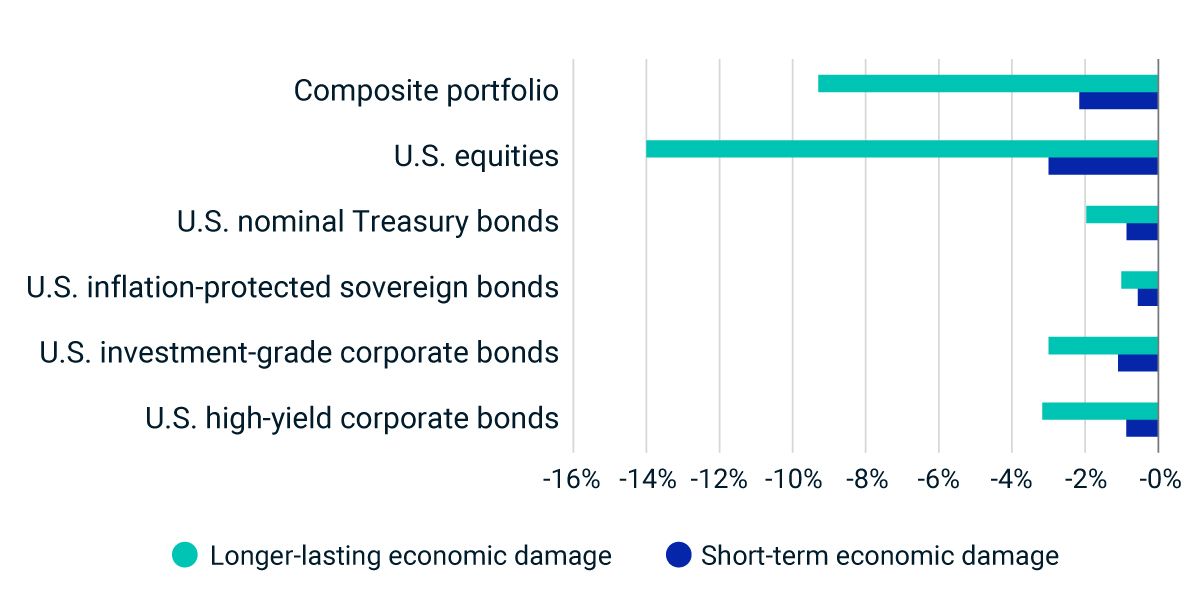

We assess the impact of these two scenarios on a hypothetical portfolio of U.S. equities and bonds. According to our assumptions and methodology, the portfolio could lose between 2% and 9%, depending on how severely this potential strike affects the U.S. economy.3

Impact across US asset classes under our scenarios

Portfolio impact of the scenarios based on market data as of Nov. 29. Equity markets and nominal sovereign and corporate bonds are represented by MSCI indexes. Inflation-linked sovereign bonds are represented by the Markit iBoxx TIPS index. The composite portfolio is represented by the following weights: 60% U.S. equities, 20% U.S. nominal sovereign bonds, 5% U.S. inflation-protected sovereign bonds, 10% U.S. investment-grade bonds and 5% U.S. high-yield bonds. Source: S&P Global Market Intelligence, MSCI

What we assume in our scenarios

Scenario assumptions are based on the AAR’s and the ACC’s estimates of economic damage and the MSCI Macro-Finance Model.

Subscribe todayto have insights delivered to your inbox.

Three Scenarios for Investors in European Credit

Year to date, European credit spreads have approached levels seen during the pandemic, with real estate, financials and energy-dependent sectors being most affected.

Fed Policy and the Threat of Stagflation

Russia’s invasion of Ukraine has amplified supply-driven inflation and growth concerns in the U.S. and led to a recognition that last year’s high, demand-driven inflation might not have been transitory.

Building Balanced Portfolios for the Long Run

We are witnessing the rise of private assets to the core of many asset allocations from a peripheral “alternative,” and we have entered a new period of heightened macro uncertainty.

1 “The Economic Impact of a Railroad Shutdown.” Association of American Railroads, Sept. 1, 2022.', '“New Economic Analysis Finds Rail Strike Could Fuel Recession.” American Chemistry Council, Nov. 16, 2022.', 'The shocks in these scenarios are not meant to be instantaneous, but rather on a horizon of roughly three months, as changes in the market will take time to materialize.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.