Russian Corporate Bond Markets: Braced for Default?

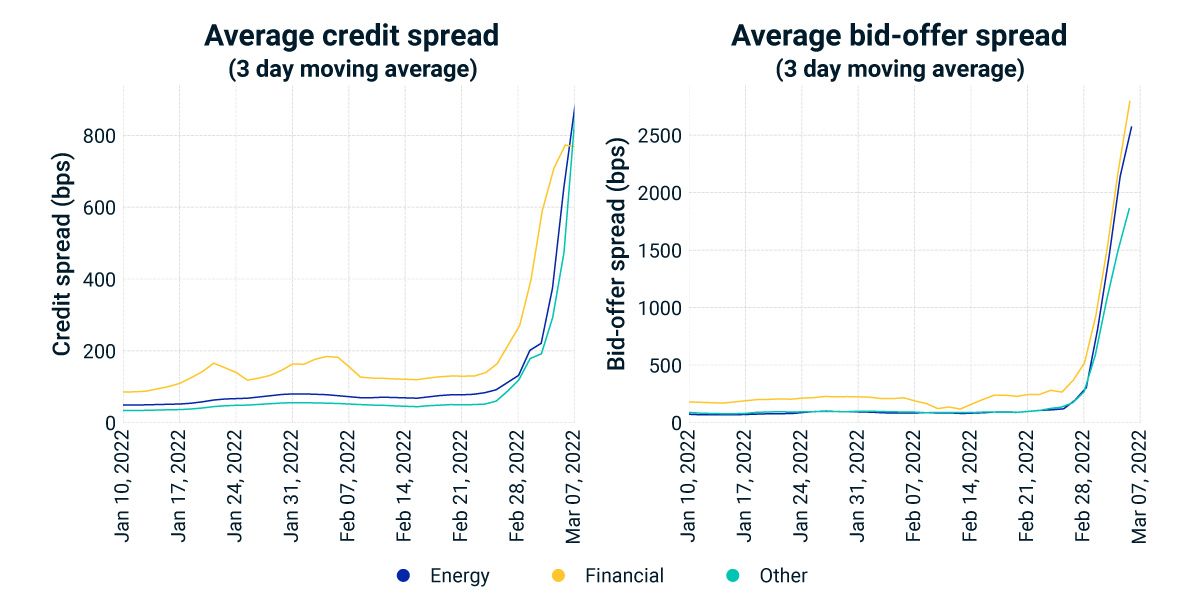

Much like with Russian government bonds, we've seen signs of distress in Russia's corporate bond market since Russia invaded Ukraine on Feb. 24. There has been a large spike in credit spreads across all sectors. Such a steep rise occurring so quickly may indicate that investors are worried that Russian corporations will be unable, unwilling or even banned from servicing their debt.

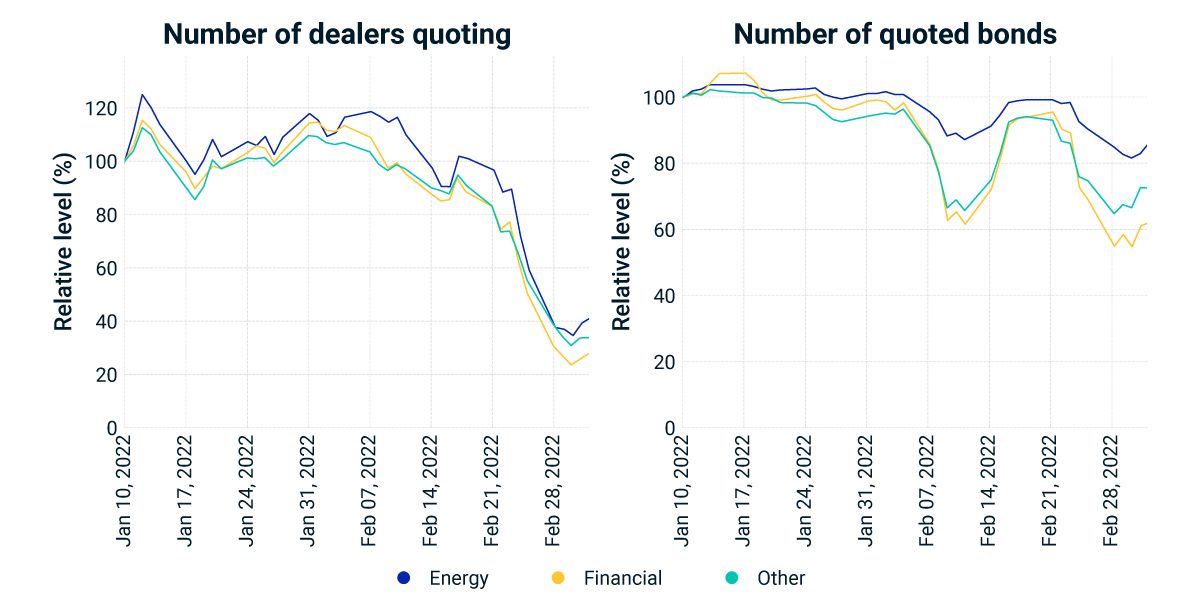

Additionally, broker-dealers appear to be in a difficult position when pricing Russian corporate bonds. As we show in the exhibits below, as well as in the latest edition of the MSCI Liquidity Risk Monitor, transaction costs have skyrocketed and the number of bonds being quoted, as well as the number of dealers doing that quoting, has significantly decreased.

Source: IHS Markit

Source: IHS Markit

Subscribe todayto have insights delivered to your inbox.

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.