Climate solutions for capital markets

Climate change is not just a risk for the future but also an opportunity to create value now. Our integrated data, analytics, indexes and research-led insights help leading investors, financial institutions, insurers, corporates and advisors build climate-aware strategies and find their competitive edge.

Simplify the process of establishing, monitoring and reporting financed emissions across your entire portfolio with broad asset class coverage and deep insights into both public and private markets.

Take control of emissions disclosure and reporting of climate-related financial information for both mandatory and voluntary frameworks with solutions designed to help you align with evolving requirements.

Track progress with integrated solutions for analytics, risk management and reporting, powered by data and an intuitive set of climate metrics aligned with global frameworks.

Monitor climate-related financial risks and investment resilience across strategies and asset classes, and physical hazards by location, using detailed insights under various risk scenarios and geospatial asset intelligence to visualize exposures and drivers enterprise-wide.

Identify clean-energy opportunities in every sector of the economy with tools designed to help you maximize insights into innovation investments.

Construct climate-resilient portfolios, mitigate climate risks, capture opportunities or align your strategies and index-linked products with the goals of the Paris Agreement.

The MSCI Difference

Tap into a climate finance team with decades of experience and a record of success developing industry-leading methodologies to measure the risk and impact of sustainability across asset classes.

Examine decarbonization drivers, quantify risk and sharpen strategy, from portfolio analytics and construction to risk management and reporting, with climate solutions designed for integration.

Get a complete picture of climate and nature exposures, including within listed and unlisted equities and fixed income, commercial real estate and infrastructure.

See trajectories for climate and nature risk, opportunity and impact, including carbon footprinting, transition and physical risk, low-carbon opportunities, carbon markets, nature and biodiversity.

Get climate data and metrics aligned with global frameworks and disclosure rules, Use our ready-to-share reports to inform clients, shareholders and stakeholders while addressing regulatory demands.

Work with a critical connector

We have 50+ years of experience compiling sustainability data.

86%

Of the world’s 50 largest asset managers use our climate data1

2250+

Climate change metrics covering nearly 20,000 issuers2

No. 1

Climate index provider by equity ETF assets linked to indexes3

4 million+

Asset locations covered by our GeoSpatial Asset Intelligence that can be expanded upon request4

Climate tools for capital markets

Physical Risk Solutions

Analytical tools and data from MSCI designed to support investors and banks in assessing and managing physical risk.

Total Portfolio Footprinting

Measure, monitor and report your portfolio’s complete carbon footprint. Compare financed emissions across public and private asset classes.

Carbon Markets

Access investor-grade carbon markets data and analytics with proprietary data and advanced modeling for companies, investors, banks, project developers and others.

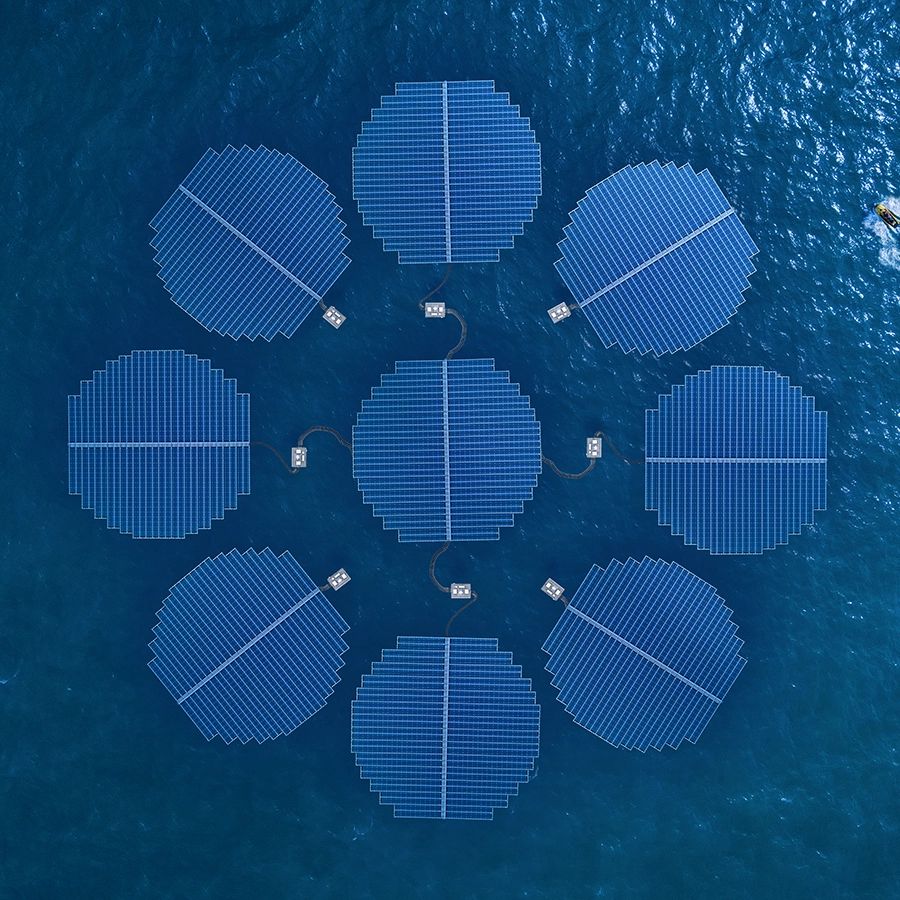

GeoSpatial Asset Intelligence

Deepen insight into physical risk and nature-related exposure at more than one million corporate and real-estate sites in your portfolio or loan book.

Energy Transition Framework

Assess how the energy transition may impact your portfolio and see which companies are positioned to lead.

Nature and Biodiversity

Get the highest-quality, location-based data and TNFD-aligned metrics to help you assess and manage nature- and biodiversity-related risk.

Climate Scenario Analysis

Quantify financial climate risks based on NGFS and IPCC scenarios with insights designed to help you manage portfolios, optimize performance and align with regulations.

See our solutions in action

How the United Nations Joint Staff Pension Fund is leading the way to net-zero

Learn how this asset-owner investor uses data, indexes and analytical tools from MSCI to put the risks of a changing climate at the center of its investment strategy.

The UN Joint Staff Pension Fund’s chief discusses its climate progress

Pedro Guazo, representative of the Secretary-General for the investment of the United Nations Joint Staff Pension Fund, speaks with MSCI Chairman and CEO Henry Fernandez about the fund’s progress in addressing the risks and opportunities of the low-carbon transition.

Driving our own corporate sustainability goals

How we used our own climate tools at MSCI to chart our pathway to net-zero carbon emissions by 2040.

Interested in our climate solutions?

Discover MSCI research

The Bill is Due: Physical-Hazard Revenue Losses Mount, Plans Lag

USD 1.3 trillion in potential impact underscores physical hazards as today’s problems, demanding urgent attention to adaptation, resilience and integration into corporate and investor strategies.

Hidden in Plain Sight: Physical Risk in Asset Owners’ Portfolios

Where assets are located matters. MSCI and Swiss Re Risk Data Solutions uncover how physical hazards are reshaping asset-owner portfolios — and how insight can drive resilience.

Making Sense of the Climate Paradox

MSCI CEO Henry Fernandez explains the realities that will continue to shape the low-carbon transition and the larger global economy.

Why sustainability data is financially relevant

Driving stronger outcomes with actionable insights from MSCI.

The MSCI Institute

Advancing knowledge, research and discovery to solve global sustainability challenges.

1 MSCI’s climate solutions are used by 43 of the top 50 world’s largest asset managers as determined by the report “The world’s largest 500 asset managers” — a Thinking Ahead Institute and Pensions & Investments joint study. AUM and rankings calculated as of December 2023. Report published October 2024. MSCI clients as of September 2024.

2 MSCI Sustainability and Climate, as of September 2023.

3 As of Jan. 1, 2024.

4 Source: MSCI Sustainability and Climate, as of January 2026.