Key findings

- Ginnie Mae Veterans Affairs (VA) loans have shown extraordinary refinance speed in recent months, which has raised concerns among investors.

- Substantially lower refinance mortgage rates offered to VA borrowers provide a partial explanation, while the VA’s efficiency gains could further steepen the prepayment S-curve.

- Agencies need to continue to monitor lenders and ensure proper mortgage-financing practices, while investors may wish to pay close attention to the nonlinear behavior of VA refinance activities.

The pause in the Federal Reserve's aggressive monetary tightening since last year has led rates to plateau at their current high level. As this plateau endures, with new mortgages issued over time, refinance risk has started to emerge. Although the vast majority of mortgage-backed securities (MBS) are priced at a discount, with very slow prepayment, some extraordinary refinance rates for Ginnie Mae U.S. Department of Veterans Affairs (VA) loans have revived investor concerns about refinance risk.

Rapid prepayment speeds for Ginnie Mae VA loans

Compared to the conventional government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, Ginnie Mae focuses more on socially disadvantaged borrowers. These borrowers typically obtain mortgage insurance via agencies such as the Federal Housing Administration (FHA), VA, Rural Housing Service (RHS) and Public and Indian Housing (PIH). VA loans account for about 41% of all Ginnie Mae securities, which have shown extraordinary prepayment speeds in recent months, as shown in the exhibit below.

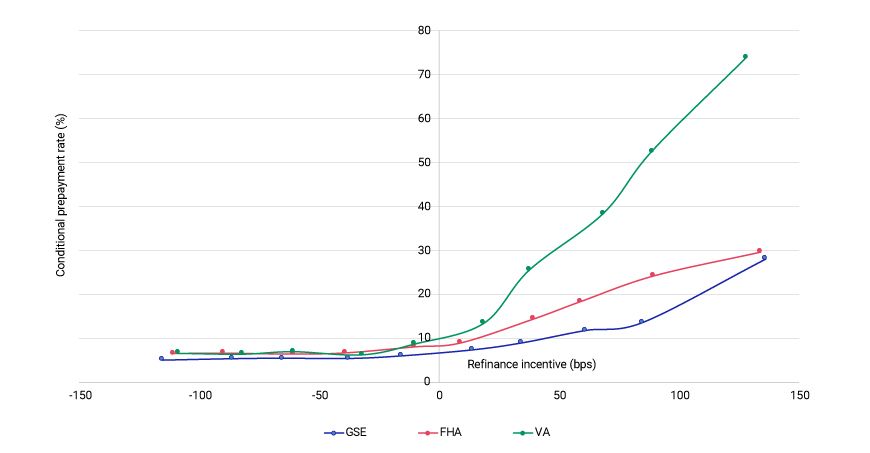

S-curve analysis shows VA refinance speeds are much faster than for counterparts

Performance period from February 2024 to March 2024. Loan age between six and 36 months. Source: Fannie Mae, Freddie Mac, Ginnie Mae, Recursion, MSCI

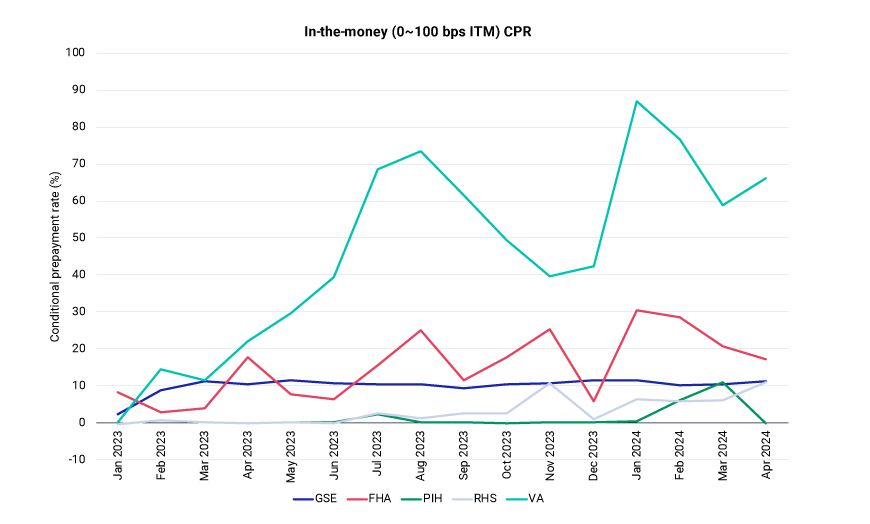

Primary mortgage rates have risen from below 3% during most of the COVID-19 pandemic to about 7% near the end of 2022. Since then, the rates have been range-bound. During this period, refinance volume plummeted. But some homeowners still relocate for various reasons, although less frequently compared to historical norm. Hence, MBS continue to be issued at the prevailing rate, backed mostly by purchase loans and modified delinquent loans. These newly issued MBS with high coupons are subject to substantial refinance risk. VA borrowers' refinance behavior has been highly responsive for more than just the past three months, as shown in the following exhibit, but has become more noticeable as more loans have been issued during this plateau period and newly passed the seven-month-aging rule (where Ginnie Mae requires a loan to age seven months before a borrower can refinance).

Speedy prepayment of VA loans not just a 2024 phenomenon

Loan age between 6 and 36 months. Source: Fannie Mae, Freddie Mac, Ginnie Mae, Recursion, MSCI

Lower mortgage rates offered to VA borrowers provide only partial explanation

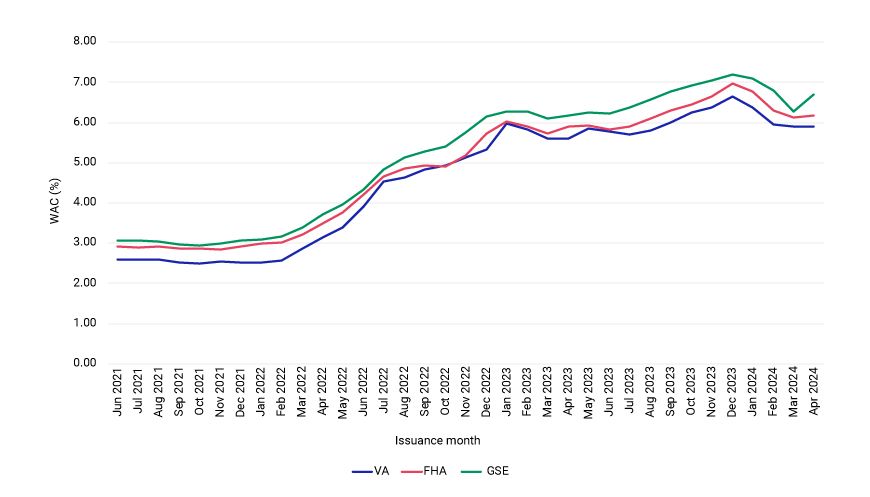

Mortgage rates offered to VA borrowers are typically much lower than conventional loans. This is shown by the average gross weighted-average coupon (WAC) for newly issued loans.

VA rates have been consistently lower than GSE rates

Source: Fannie Mae, Freddie Mac, Ginnie Mae, Recursion, MSCI

There are many factors contributing to lower VA rates. Ginnie Mae's favorable MBS pricing in the to-be-announced market leads to par coupon rates that are 10 to 20 basis points (bps) lower than those for GSE loans. The quoted mortgage rates for GSE loans include a roughly 40-bp running g-fee, while VA borrowers pay the credit fee separately.

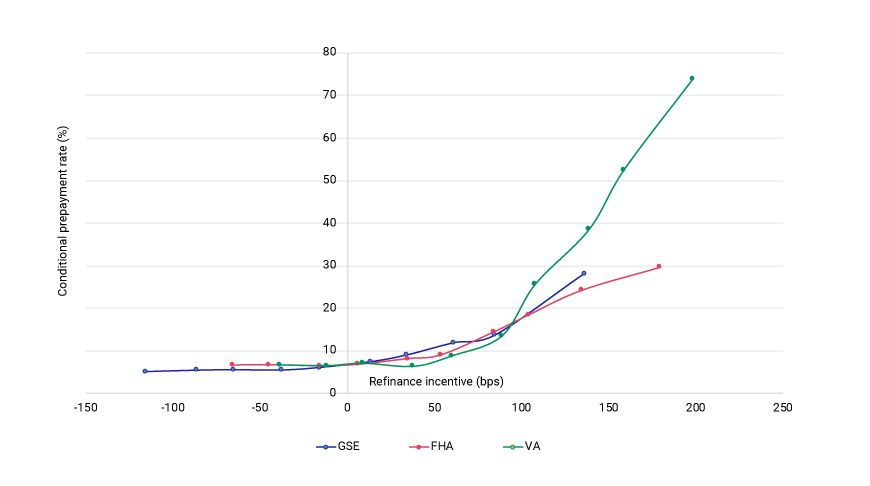

To a lesser degree, lenders' preference for a buydown (borrower pays more up front for lower rate) vs. buyup (lender lends more up front for higher rate), influenced by mortgage-servicing-rights multiples, can also contribute to the more favorable VA rates. An updated S-curve analysis can be done with an adjusted refinance incentive based on the WAC difference of the most recent three months of originations. This has brought the S-curve for FHA and GSE more in line, while the VA S-curve is still significantly steeper.

Adjusting refinance incentive brings the S-curves much closer to each other

Efficiency or churning?

The VA offers interest-rate-reduction refinance loans (IRRRL) — a program that provides borrowers with an efficient way to refinance VA loans. Borrowers do not need to provide documentation for their income and property value, which reduces the refinance cost to as low as a few hundred dollars. Subsequently, the VA streamlines the refinance process, which can be finished in as little as two weeks. Furthermore, the funding cost can be capitalized into the new balance,[1] which effectively grants borrowers "no-fee" refinancing. According to the IRRRL rules, there must be at least a 50-bp rate reduction.[2] As soon as this test is passed, refinance efficiency starts to pick up drastically and large volumes of refinance applications can be processed with minimal labor. This leads to the extraordinary refinance response for moderately in-the-money VA loans. Let's use an extreme case to make this point: If the refinance cost and paperwork are absolutely zero, all the VA loans will be refinanced as soon as they encounter a 50-bp rate-reduction benefit. Lower refinance rates and more streamlined and efficient refinancing certainly benefit VA borrowers.[3]

Given the historical churning concern for VA loans,[4] investors may ask if VA lenders deliberately offer higher rates for purchase loans and then refinance these loans at lower rates after seven months, when loans are eligible for refinancing?

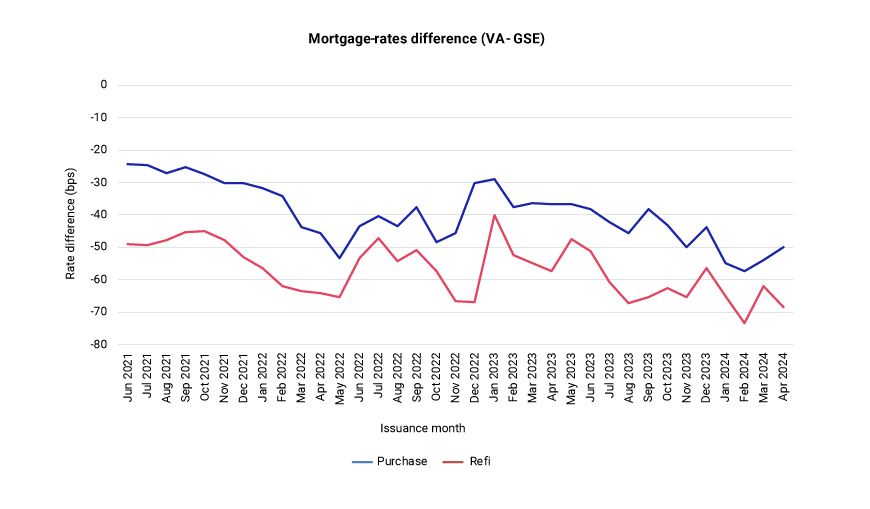

VA lenders offer significantly lower refinance rates than purchase rates, compared to GSE

Refinance-loan rates are usually lower than purchase-loan rates, given the same borrower and property, due to reduced paperwork and shortened timeline. Compared to GSE loans as the benchmark, recent VA purchase-loan rates are about 50 bps lower, while refinance-loan rates are almost 70 bps lower. This additional 20-bp benefit might be completely attributable to the efficiency of the VA's streamlined refinance program. Ginnie Mae officials recently reiterated their effort to monitor the lenders, to ensure proper mortgage-financing practices.

From investors' perspective, the efficiency of the VA's streamlined refinance programs has steepened the VA S-curve, regardless of the exact reason for the difference in purchase and refinance rates. The nonlinear refinance behavior of VA loans has posed additional modeling and risk-management challenges. (The MSCI Agency MBS Model Suite Version 2.2 has been updated to account for this phenomenon.)

In summary, most of the MBS universe trades at a discount nowadays, with prepayment speed at a historically low level, but newly originated VA loans have shown extraordinary refinance speeds in recent months. Put simply, in a traffic jam of slowly moving cars, it's worth paying attention to the cars that are moving fast

Subscribe todayto have insights delivered to your inbox.

How Making Agency Mortgage-Backed Securities Portable May Impact Housing and Mortgage-Backed Securities Investors

1 The Housing Policy Council recently wrote a letter to the FHA commissioner to urge the FHA to allow borrowers to roll the streamlined refinance closing cost into the loan amount. It's uncertain if the FHA could make any major policy change during the election year. This change, if enacted, could significantly increase the Ginnie Mae prepayment speed.2 The borrowers also need to be able to recoup the closing cost in 36 months to prevent lenders from bypassing this rule with buydowns.3 One may argue that faster refinance prepayment from VA loans may adversely impact the Ginnie Mae TBA pricing, pushing up the par rate and subsequently mortgage rates. But this effect is second-order, from borrowers' perspective.4 Kelsey Ramírez, “Ginnie Mae boots 3 VA lenders from mortgage bond programs,” HousingWire, June 1, 2018.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.