MSCI Introduces ESG Quality Scores for Mutual Funds, ETFs

Blog post

March 8, 2016

Initiative establishes a framework for environmental, social and governance measurements at the fund level.

A new initiative by MSCI ESG Research is designed to allow asset managers to differentiate funds based on the environmental, social and governance (ESG) characteristics of the underlying investments.

The MSCI ESG Quality Score for Funds, which MSCI introduced on Tuesday, offers institutional investors an indication of the overall ESG quality of the holdings of mutual funds, exchanged-traded funds (ETFs), or pension assets, as measured by the ability of constituent companies to manage medium- to long-term risks and opportunities arising from ESG exposures.

The mutual fund and ETF scores show clients data on the potential environmental, social, political or environmental consequences of their investments, a view that especially matters to investors between ages 19 and 35, who stand to inherit an estimated $30 trillion over the next 20 years.

Millennials stand to inherit an estimated $30 trillion over the next 20 years and are twice as likely as their parents to invest in funds that target specific ESG outcomes and divest because of objectionable corporate activity, a study last year by Morgan Stanley found.

"The ESG Quality Score establishes a framework for ESG transparency at the fund level," says Laura Nishikawa, head of fixed income ESG research at MSCI. "We offer asset managers the tools to report the ESG characteristics of their funds, including the underlying data as well as the quality score. The whole point is transparency."

Scoring funds on a scale of 0 to 10

The MSCI Fund ESG Quality Score covers more than 21,000 equity, fixed-income, and multi-asset class funds from the Lipper universe worldwide.1

The measure assesses funds on a scale from 0 to 10, with 10 reflecting underlying holdings that rank best-in-class globally based on their exposure to—and management of—ESG risks and opportunities, while a score of 0 reflects holdings that generally rank worst in class globally based on their exposure to similar factors. The score focuses on the ESG quality of a fund's holdings; not the extent to which an asset manager incorporates ESG into its investment process.

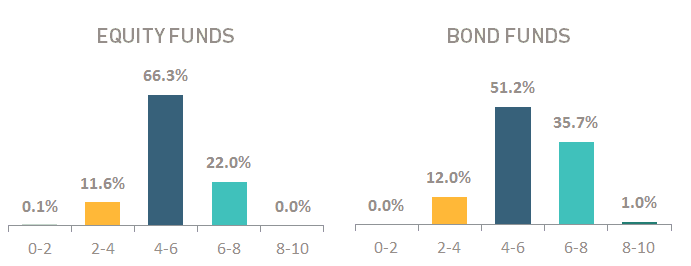

As the chart below shows, the majority of equity and fixed-income funds scored by MSCI ESG Research earned median scores.2 Two-thirds of stock funds scored by MSCI earned an ESG Quality Score of between 4 and 6, while 22% earned scores between 6 and 8, and 12% earned a score of between 2 and 4.

Among bond funds, 51% earned ESG Quality Scores between 4 and 6, while 36% earned a score of between 6 and 8, and 12% scored between 2 and 4.

Distribution of MSCI ESG Quality Scores

Source: MSCI ESG Research, as of Feb. 1, 2016; n = 13,866 equity funds, 4,569 bond funds

Percentiles are calculated based on the fund's ESG Quality Score relative to all global funds that receive a score, as well as relative to the fund's peer set as determined by the Lipper Global Classification.

A new dimension for wealth management

The MSCI Fund ESG Quality Score may add a new dimension to the traditional conversation about risk tolerance that wealth managers can have with their clients.

"It's not that a high score is always good, it's just that it reveals a characteristic of the fund's holdings," adds Nishikawa. "The key is that you have to know what you own."

In research published by MSCI ESG Research as of March 1, the ESG Quality Score showed that:

- One hundred and forty-six diversified U.S. equity funds had more than 10% exposure to companies owning high-impact fossil fuel reserves such as coal or oil sands that could lose value under strengthening regulation. Meanwhile, one thousand and fifty-one U.S. equity funds are virtually fossil fuel free, even though very few of the funds, if any, are marketed as such.

- More than 6,900 funds, representing 46% of funds analyzed by MSCI, had exposure to companies that manufacture controversial weapons, such as cluster bombs and land mines.

- Nearly 3,160 funds worldwide that had significant exposure to sustainable impact themes, including alternative energy, health care or nutrition, yet only 14% of those funds were flagged as specialized ESG funds.

- Government-bond funds and European equities scored highest on ESG Quality, while U.S. small-cap, emerging market equity, and high-yield bond funds scored lowest.

- Target-date funds with shorter time horizons tended to score higher on ESG Quality, while longer-horizon funds showed lower ESG quality.

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.