The Dimensions of Income Risks in your Global Real Estate Portfolio

Blog post

June 25, 2015

Income is the principal foundation of real estate investment returns. For most markets, particularly over the longer term, the vast majority of the real estate return comes through income rather than capital appreciation. The income generating nature of real estate has become even more relevant in an era of ultra-low interest rates, and in the context of the search for yield.

Given the importance of income to institutional investors, increasing attention is being placed on the monitoring of real estate cash flows in order to drive stronger performance and to reduce risks. MSCI has produced the first set of multi-national analyses drawn from its IRIS income risk product, providing powerful insights on four main dimensions of income: Lease Term Risk, Market Risk, Credit Risk and Concentration Risk. These risks are critical for investors to understand, as they can vary widely between real estate markets, sectors and portfolios.

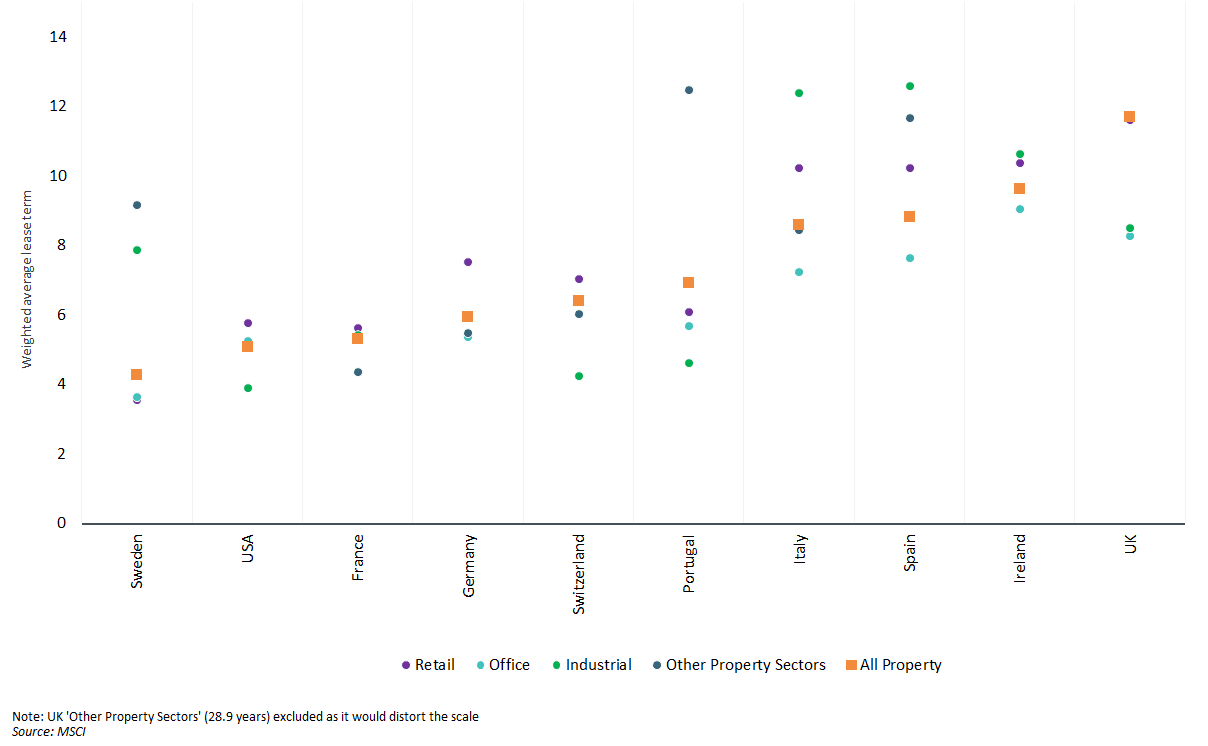

Lease Term Risk: Reflects the length of remaining lease terms and is a fundamental driver of income security. The analysis shows these risks varied widely across markets and real estate sectors (see exhibit), with levels for the U.K. and Ireland around twice those for Sweden and the U.S. In market upturns, shorter leases may be preferred, as they allow the owner to benefit from rental increases. But, in market downturns, investors tend to prefer longer lease terms, to insulate them from deteriorating cash flows.

Remaining Lease Terms (Weighted by Rental Income, Years), at Dec 2014

Market Risk: Reveals the extent to which rents currently paid by tenants are above or below market rents and indicates the potential for future income growth. This measure ranges widely across markets, with the U.K. and U.S. – where market rents rose – showing potential for rental gains at lease-end. However, in many parts of Europe rents still remained significantly above market levels.

Credit Risk: Indicates the level of counterparty risk for individual tenants, the probability of default and loss of income. Differences in economic structure and the credit-worthiness of tenants mean that markets vary significantly in their exposure to tenant default risk. At year-end 2014, the potential risk of a tenant defaulting in 2015 varied from less than 0.25% in Italy, the U.K., Sweden and Spain, to nearly 1.75% in Ireland.

Concentration Risk: Stems from a portfolio's focus on specific market segments, industries or individual companies. Over-concentration is a significant risk for investors and one attracting increasing attention from regulators (e.g., for Alternative Investment Funds in Europe). Some portfolios in this analysis have taken more than 10% of their income from five companies or fewer.

The growing demand for transparency is leading to more systematic analysis of the drivers of real estate risk and return through the investment process. Given the importance of income to real estate investors, there is increasing pressure to understand the various dimensions of cash flow at the level of the market, portfolio and individual property.

Read the paper, "Multi-National Real Estate Income Risk Analysis."

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.