The Next Generation of Global Investors

Blog post

January 21, 2014

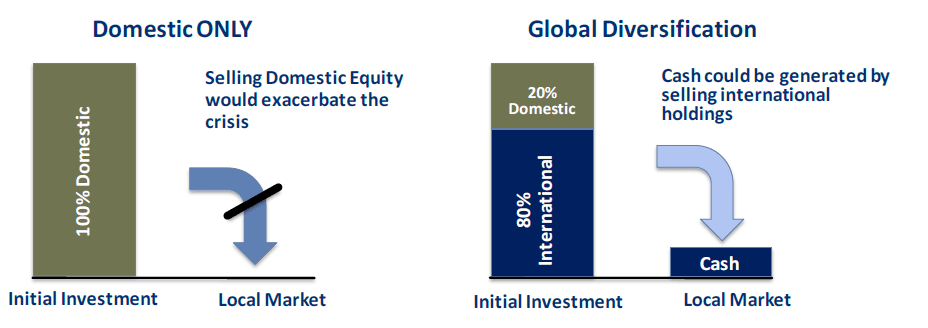

We've observed that many institutional investors have abandoned their historical domestic-equity bias and now view global equities as a single, broad asset class. In high-growth economies, however, particularly in Asia, Central and Eastern Europe, Africa and Latin America, many investors remain focused primarily on domestic stocks. A study by MSCI shows that during, the period between January 1, 1990 to December 31, 2010, adopting a global investment framework assisted institutional investors from high-growth countries to:

- Access a broader range of global investment opportunities.

- Avoid the risk that high-growth in local economies fails to translate into above-average investment returns.

- Reduce portfolio risk and improve return-to-risk profiles, based on results over the last two decades.

In short, unless investors have a strong conviction on the future performance of domestic equities versus global equities, home-biased equity allocations can bring significant active risk to investors' portfolios. A global equity framework has the potential to reduce risk and improve a portfolio's return-to-risk profile.

To read the paper, "The Next Generation of Global Investors," click here.

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.