A Sector Explanation for Small vs. Large Caps’ Emissions-Intensity Gap

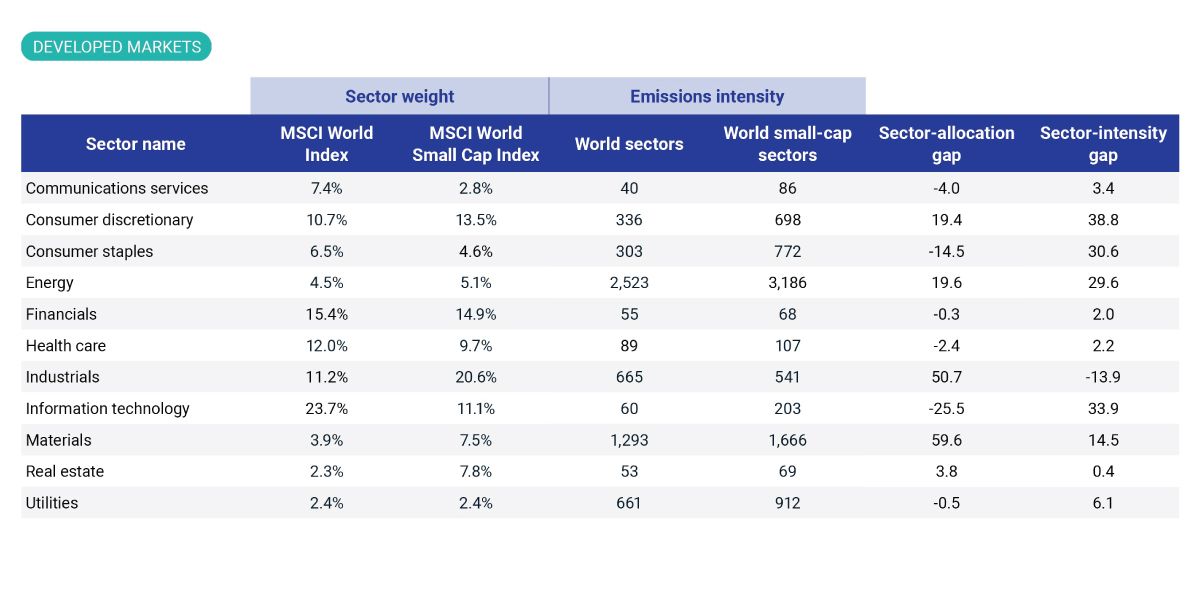

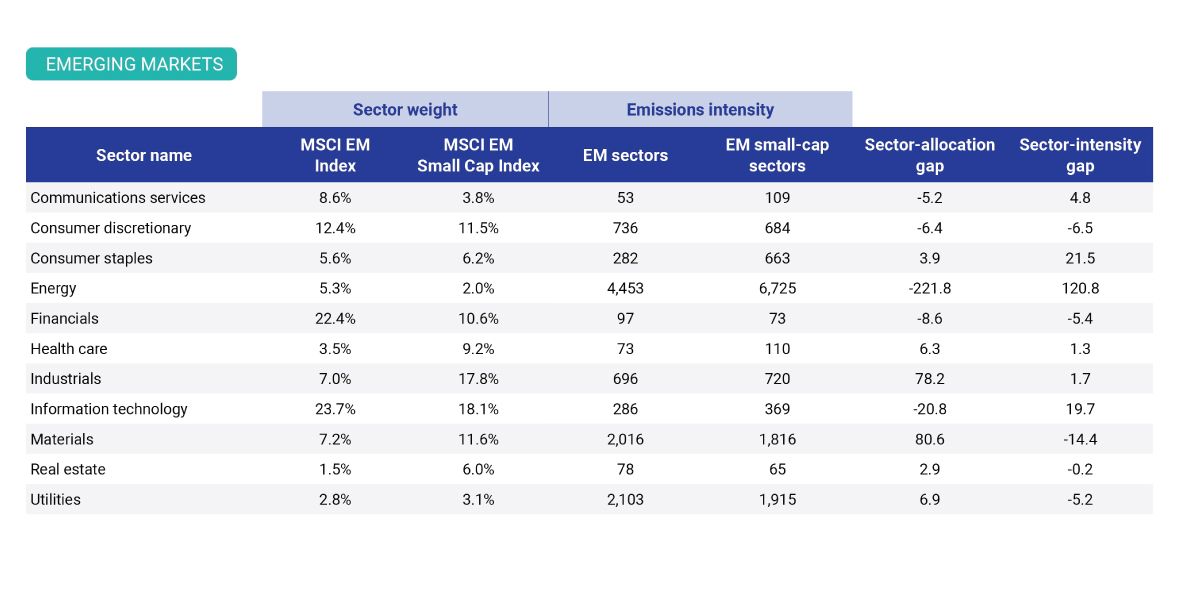

Previously, we highlighted the difference in emissions intensity between small-cap stocks (proxied by the MSCI World Small Cap and MSCI Emerging Markets Small Cap Indexes) and large- and midcap stocks in the developed markets (DM) and emerging markets (EM) (proxied by the MSCI World and MSCI Emerging Markets Indexes, respectively). Small caps' emissions intensity exceeded that of their larger-cap peers for the four years ending March 2024.

Why the gap?

We traced the higher emissions intensity of DM small caps to the higher emissions intensity associated with most of the sectors in the MSCI World Small Cap Index. In EM, small caps' higher emissions intensity arose primarily from a handful of sectors, with the main contributor being energy.1 However, the sector composition difference between small caps and large- and midcaps in EM helped reduce the emissions-intensity gap.

In DM, the higher emissions intensity of the sectors in the small-cap universe accounted for 60% of the disparity between the size segments. For example, in the aggregate, the consumer-discretionary stocks in the MSCI World Small Cap Index had more than double the emissions intensity of their counterparts in the MSCI World Index (698 vs. 336 t CO2e/USD million enterprise value including cash (EVIC)), whereas small-cap energy stocks had about a 20% higher emissions intensity than larger-cap energy stocks (3,186 vs. 2,523 t CO2e/USD million EVIC).

"Gap awareness" can help manage a portfolio's carbon footprint

Investors who believe in the diversification benefits of adding small caps to their portfolios could — unintentionally — also be impacting the carbon footprint of their portfolios. Understanding the difference in the sectors' emissions intensity between small- and larger-cap stocks could help investors anticipate and better control the carbon footprints of their portfolios as they actively incorporate climate considerations into their investment strategies.

The author would like to thank Rahul Suresh Kumar for his contribution to this quick take.

Emissions intensity of small-cap sectors higher than for larger caps

Panel A: Developed markets

Panel B: Emerging markets

Data as of March 29, 2024. We use the Brinson attribution analysis to examine the gap in emissions intensity between small caps and large- and midcaps. Emissions intensity is defined as carbon intensity (Scope 1 + 2 + 3) divided by enterprise value including cash (EVIC).

Subscribe todayto have insights delivered to your inbox.

Small Caps’ High Emissions Intensity — Turn Lemons into Lemonade?

Small-cap firms that adopt science-based targets and increase green revenues could be viewed as turning the lemons of high emissions into the lemonade of low-carbon transition, broadening the opportunity set for investors supporting decarbonization.

Steering Toward an Aligned Portfolio

Using MSCI Climate Change Metrics and the Net Zero Investment Framework, we assessed listed companies in developed and emerging markets to see how well they were aligned with the goals of the Paris Agreement and global net-zero emissions by 2050.

How Prepared Are Markets for a Low-Carbon Transition?

With climate change amplifying, global markets are facing uneven readiness for the low-carbon transition. A capital shift from emission-intensive assets to zero-carbon alternatives could redefine market performance and business winners.

1 We define sectors using the Global Industry Classification Standard (GICS®). GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.