Derivatives Tell a Protective Story

The MSCI EAFE Index and MSCI Emerging Markets (EM) Index have fallen 26.8% and 26.9% year-to-date, respectively,1 as geopolitical and macroeconomic risks persist and investors remain concerned about ongoing turmoil. For developed markets, elevated inflationary levels in food and energy prices, aggressive monetary-policy tightening by central banks and currency volatility could continue to cloud the market. Europe also faces additional risks due to the escalation and continuation of the Russia-Ukraine war.

With the U.S. Dollar Index (DXY) recently hitting 20-year highs, capital has flowed to safe-haven instruments, and emerging markets could experience a further weakening of currencies. This, in turn, may cause higher import prices and higher inflation.

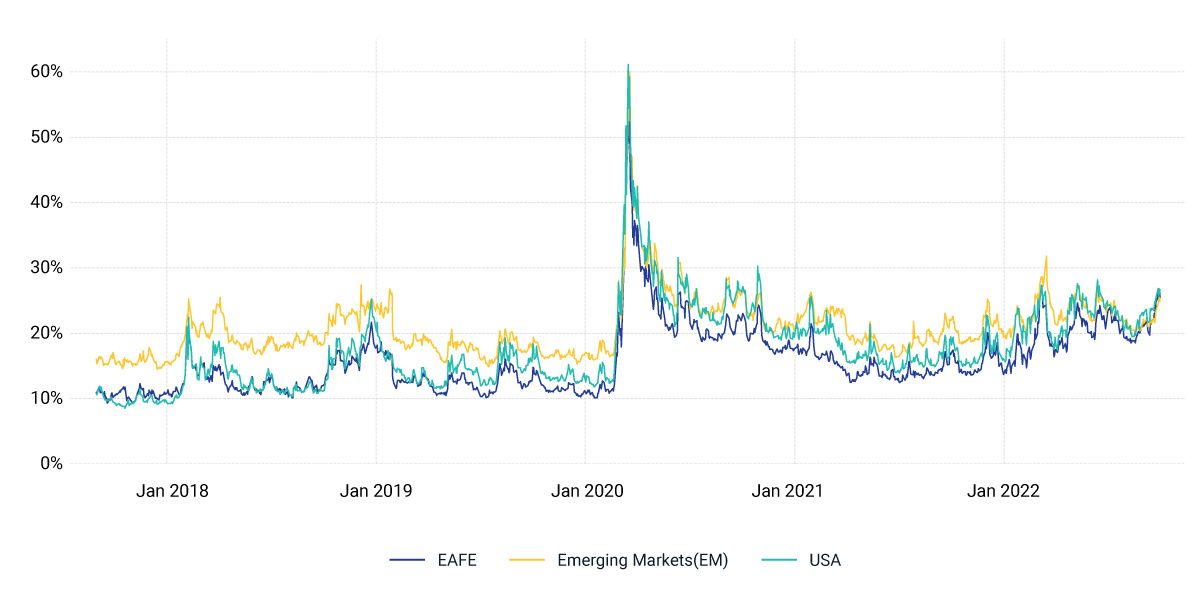

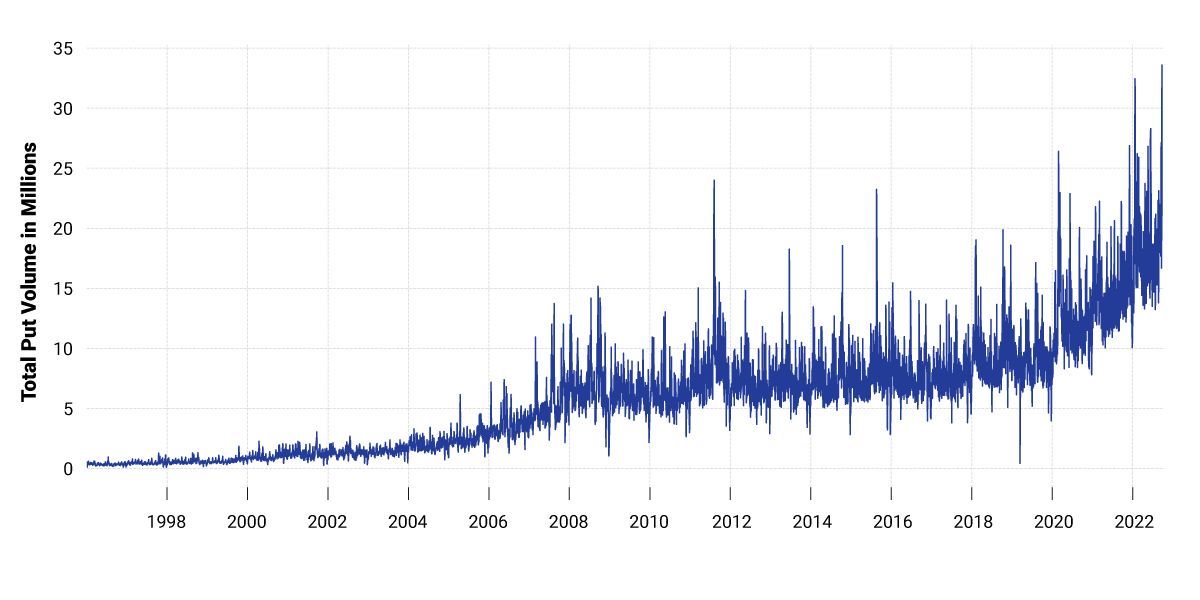

The options market has also experienced high levels of volatility, with the three-month implied volatility in the top decile for EAFE and the U.S., and in the top quartile for EM (based on the last five years of implied volatility). The elevated volatility coincided with the highest recorded levels of put volumes, which occurred on Sept. 23, 2022. This could indicate that investors are hedging portfolios going into the final quarter of 2022, and beyond, due to their risk-off sentiment.

The implied volatility of the options market

Implied volatility is based on the 91-day ATM call and put options. Options linked to the MSCI EAFE, MSCI Emerging Markets and S&P 500 indexes have been used for the EAFE, EM and U. S. implied volatility calculations. Sep. 1, 2017, to Sep. 30, 2022. Source: Optionmetrics

Total put volumes traded

Total put volumes traded calculated as sum of all put options traded on any given date for any maturity across securities. Jan. 15, 1996, to Sep. 30, 2022. Source: Optionmetrics

Subscribe todayto have insights delivered to your inbox.

Market Uncertainty Has Favored Low-Volatility Indexes

The global market rally that began in April 2020 came to a halt with a sell-off that started at the end of last year and increased in intensity this February with the invasion of Ukraine.

Inflation Sensitivity and Equity Returns

The steep rise in inflation after decades of low inflation raises many questions for investors.

The Impact of High Inflation on Equities

Inflation in the U.S. and in many other countries has accelerated for more than a year, as the U.S. consumer price index reached 8% earlier this year and has remained around that level.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.