EM Emissions Trading Schemes Await Wider Reporting

To date, emissions trading schemes (ETS) have mostly been a developed-market phenomenon. This has led to criticism that they may potentially be driving carbon-intensive industries into less-regulated markets.1 Two developments may alter the status quo: emerging economies such as Turkey, Indonesia and Colombia have recently announced plans for their own ETS, and, in October 2023, the EU introduced a Carbon Border Adjustment Mechanism (CBAM).

The CBAM requires importers of carbon-intensive products such as steel, cement and aluminum to report emissions generated throughout production and transport. From 2026 importers will also need to pay a levy equivalent to the difference in carbon prices.2 This could potentially incentivize other markets to adopt domestic carbon-pricing policies and ETS to redress the differences. And there is plenty of scope for these schemes to grow — according to the World Bank, existing ETS covered 23% of global emissions as of 2023, up from 7% in 2010.3

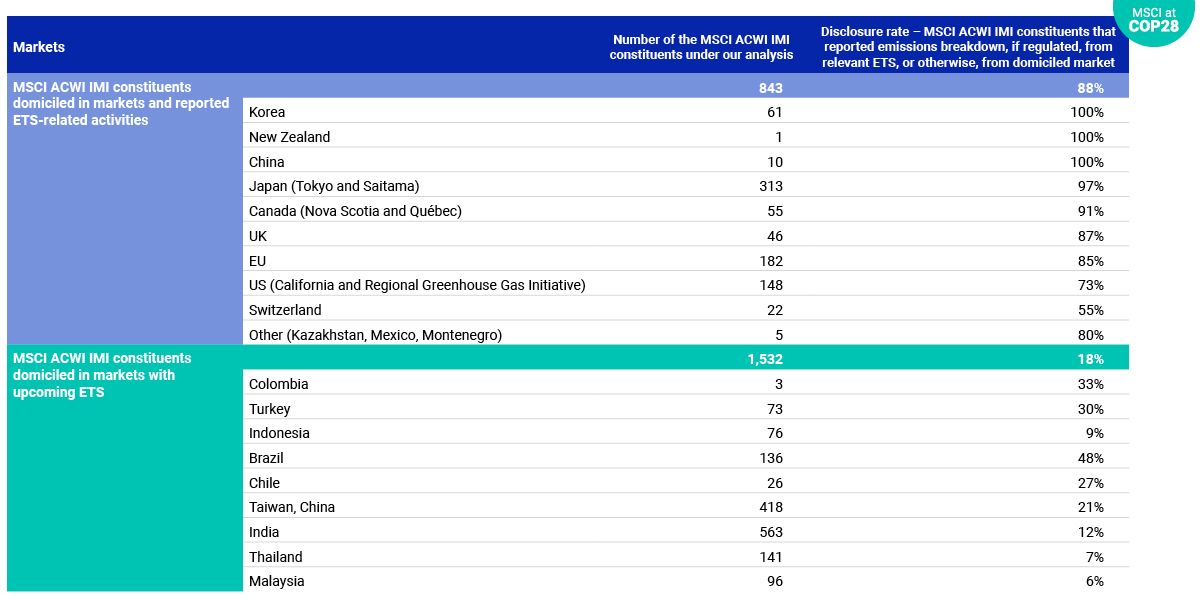

Our research found that 843 companies, or 9% of constituents in the MSCI ACWI Investable Markets Index (IMI), reported that they were regulated by an existing ETS in 2023. Of these 843 companies, 88% reported emissions breakdown from regulated markets. Yet among constituents in markets planning or considering ETS, the overall disclosure rate dropped to 18% (272 out of 1,532). Robust and transparent emissions reporting is the basis for carbon crediting mechanism.4 In the absence of clear starting points, investors and governments alike may find they are neither able to track corporate emissions reduction progress, nor analyze the effect of potential drivers such as ETS for country-level emissions trends. As the saying goes: you can't manage what you can't measure.

Regional ETS and corporate emissions disclosure rates by market

Companies in the coverage sector may only fall under ETS regulation if they meet certain criteria such as operation size, therefore the disclosure rate was calculated based on the total number of companies reported to be regulated by ETS. For companies that do not fall under existing ETS or do not have such disclosure under CDP C11.1, we use total number of companies from domiciled markets for disclosure rates in the corresponding cells (grey shading). Russia, Ukraine, Vietnam, Nigeria and Pakistan also have ETS under development or consideration. These are not included in the table as there were no constituents in the MSCI ACWI IMI universe domiciled in these markets. Data as of November 2023. Source: International Carbon Action Partnership, MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

Carbon Markets: An Emerging Derivatives Class

Carbon markets can play a significant role in managing carbon risk within equity portfolios to hedge against price risks. Our research focuses on applications, carbon-risk management and correlations to other assets classes.

Introducing the Carbon Market Age

The carbon market can play a significant role in the decarbonization of the global economy by putting a price on carbon and giving polluters an incentive to reduce their emissions.

Carbon Markets 101

This week the voluntary carbon markets integrity initiative or VCMI launched a consultation to assess companies use of carbon offset credits and how they impact progress towards their climate targets.

1 Dieter Helm, Net Zero: How we stop causing climate change (Glasgow: William Collins, 2022).2 “Taxation and Custom Union,” European Commission, last accessed in October 2023.\xa03 “State and Trends of Carbon Pricing 2023,” The World Bank, 2023.4 “Recommendation: Requirements for the development and assessment of mechanism methodologies (version 01.0),” United Nations Framework Convention on Climate Change, Nov. 17, 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.