Global Real Estate Returns at a Turning Point?

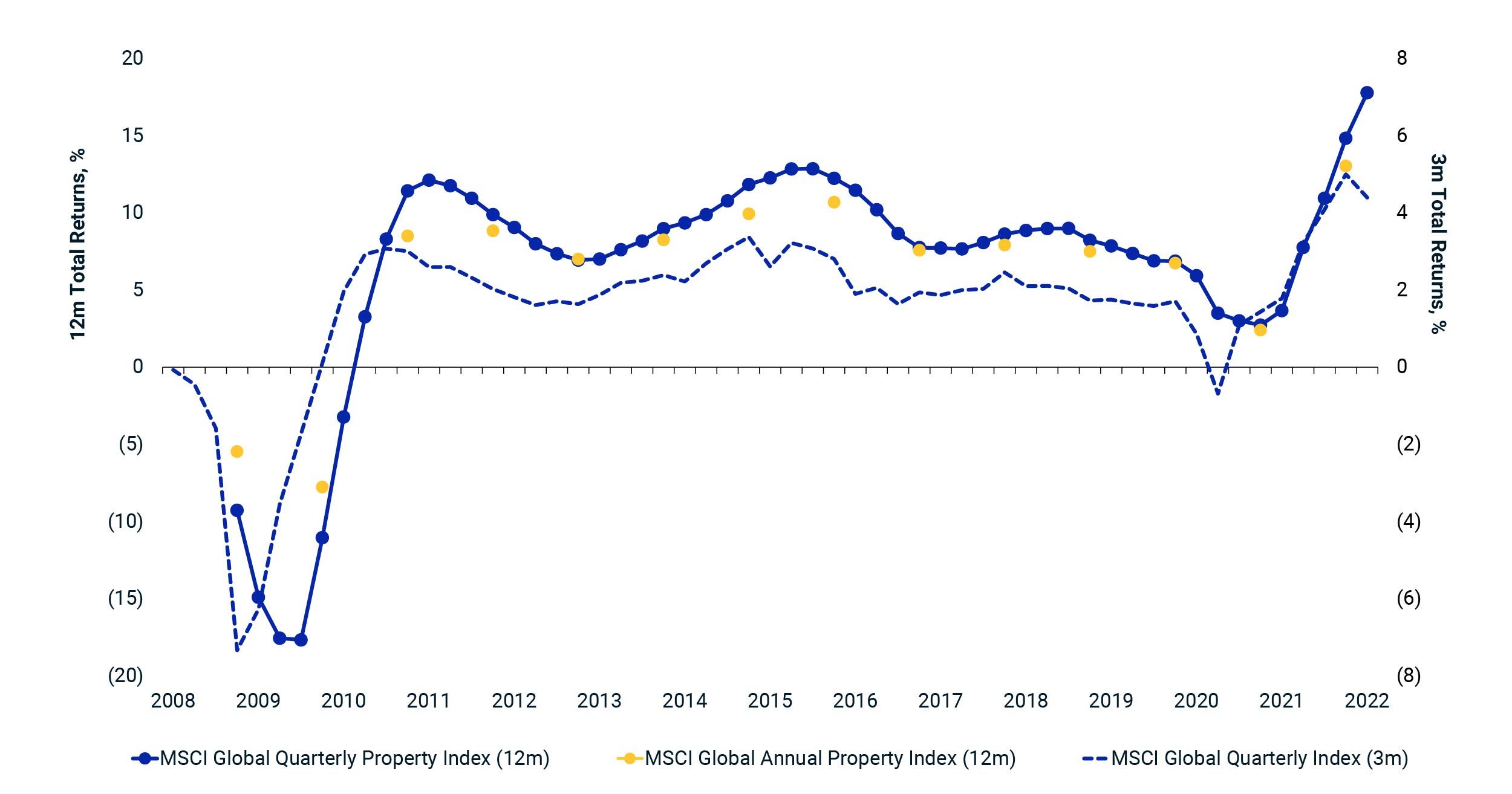

Global real estate returns accelerated to 17.8% on a 12-month rolling basis in the first quarter of 2022 despite the growing headwinds of geopolitical tensions and associated rising inflation and interest rates, the debut results of the MSCI Global Quarterly Property Index show.1

The three-month return was 4.4%, which, while still strong in a historical context, constituted a deceleration from the record high 5.0% return seen in Q4 2021. Strong returns at the end of last year were the culmination of positive momentum that had built through 2021 as markets bounced back from COVID-19 weakness.

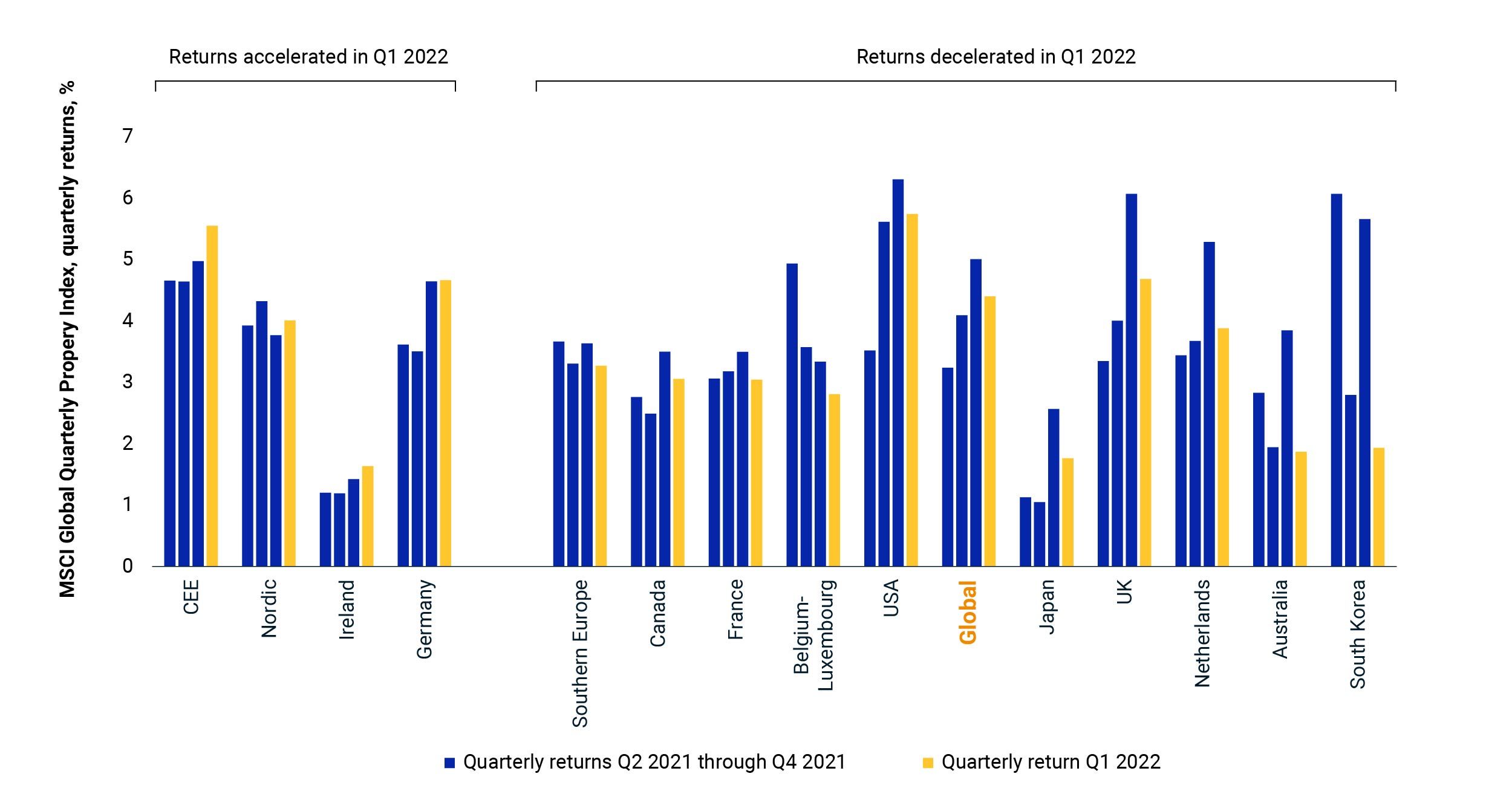

Only Central and Eastern Europe, the Nordic region, Ireland and Germany posted higher returns in Q1 2022 than in Q4 2021. Other regions contributing to the index registered weaker three-month returns than previously. Some of the countries with the most marked slowdowns had particularly strong ends to 2021.

One datapoint does not make a trend. However, in the context of broader weakness in economic and market sentiment, slowing three-month returns at the global aggregate level and across many individual markets could indicate that the recent run of stellar global real estate performance is starting to fizzle out.

Returns accelerated over 12 months but slowed on a three-month basis

CEE includes Bulgaria, Czech Republic, Hungary, Poland, Romania and Slovakia. Display sequence of markets is by the difference between Q4 2021 and Q1 2022 returns.

Most but not all individual markets posted decelerating quarterly returns

Subscribe todayto have insights delivered to your inbox.

Real Estate's Income Risk in an Inflationary World

The constituents of the MSCI Pan-European Quarterly Property Fund Index have, in aggregate, more significant exposure to industrial and retail property types, when measured by remaining income instead of by capital value.

Real Estate Has Bucked the Deglobalization Trend

Deglobalization has had profound implications for portfolio construction in listed assets. Conversely, with real estate, there are indications that the asset class has become more global in recent years.

How Eurozone Inflation and ECB Policy Could Impact Markets

With eurozone inflation at elevated levels and recession risks lurking, jittery European financial markets seem to be driven by monetary policy and how the bloc’s economy will evolve.

1 The MSCI Global Quarterly Property Index, which starts 2007, provides a more-frequent indicator of global and national property performance by tracking only properties that are valued on a quarterly basis, but with a reduced sample of eligible properties versus the MSCI Global Annual Property Index.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.