Have Sectors Driven Stock Returns?

When investors construct portfolios, they may do so based purely on bottom-up stock selection, or they may incorporate an element of top-down construction by adjusting the portfolio's allocation to sectors, countries or factors.

But how does an investor decide how to weight the top-down variables?

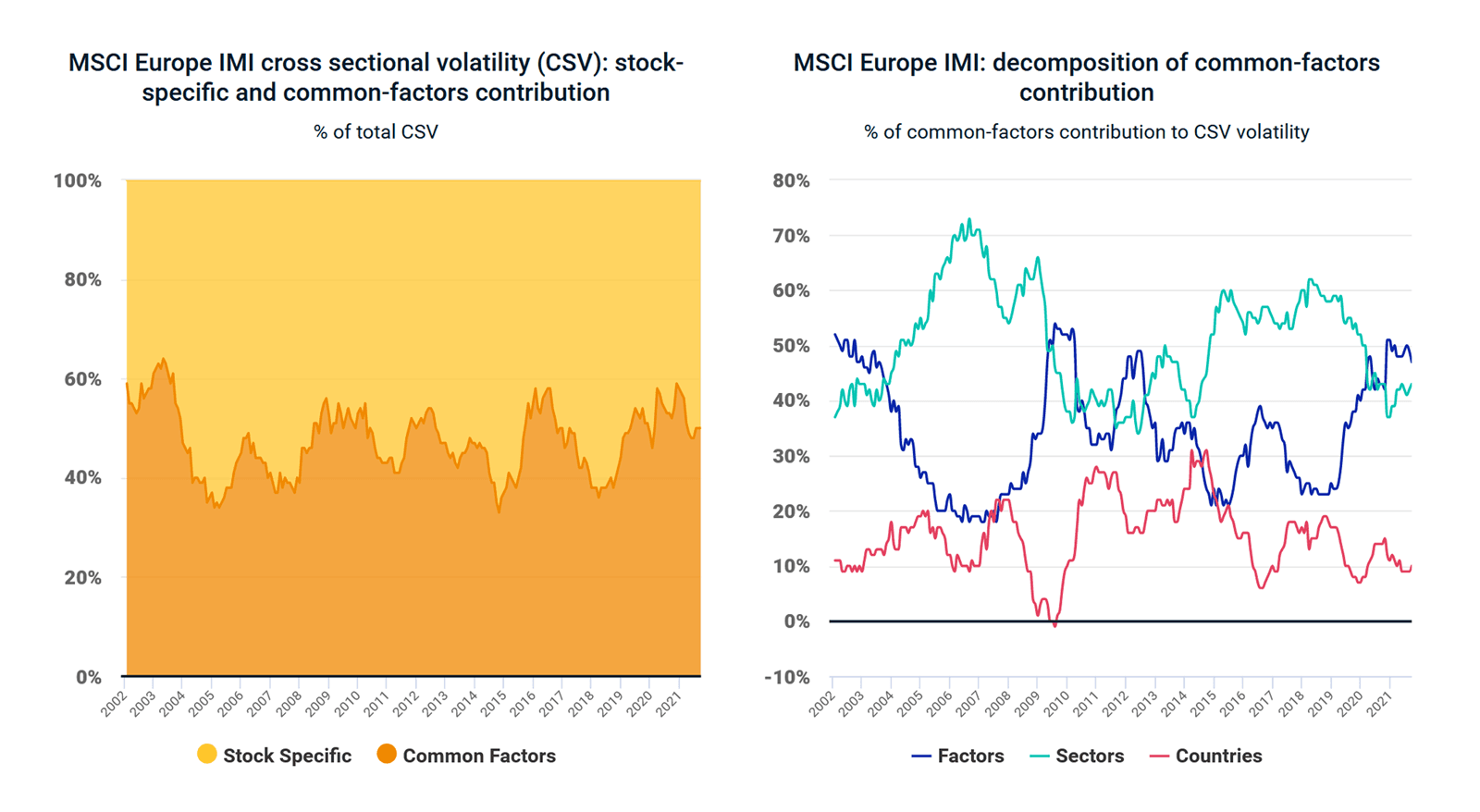

One approach: Look at each variable's individual impact on asset returns.1 To do so, one can leverage the information contained in a given market's cross-sectional volatility (CSV), which is a measure of dispersion of asset returns. At a first level, CSV can be decomposed into stock-specific contribution (what is unique and specific to each stock) and a common factor contribution (what is common across stocks and not unique). On a second level, this common factor can be decomposed into the top-down elements we are after: sectors, countries or factors.

In the chart below, we can see the decomposition of the common factor contribution to the CSV of the MSCI Europe Investable Market Index (sum of sectors', countries' and factors' contribution will equal 100%). One can see that the main contribution would have come from either factors or sectors. Over 20 years, countries' contribution has averaged 15%, while sectors have contributed 51% and factors 34%, on average.

In recent times, the contribution of factors has steadily increased and actually overtaken the contribution of sectors in Europe. This is in line with prior observations that factors have tended to become more important during periods of severe market stress, like in the 2008 global financial crisis, the eurozone crisis in 2011 and the start of the COVID-19 outbreak.2

Breaking down returns

Data from January 2002 to September 2021. Source: MSCI Barra EU LT Model (Europe)

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends

You’ll find insights provided in research papers, blogs and a Chart of the Week that succinctly puts topical issues in context.

The Regional Breakdown of Market Sectors Over Time

The composition of the global stock market has changed substantially over the last 10 years.

How Crowded Are Sectors and Industry Groups?

The MSCI Security Crowding Model estimates crowding in individual stocks and allows us to estimate the crowding of portfolios by aggregating the stock-crowding scores.

1 Gupta, Abhishek, and Subramanian, Raman Aylur. “Harvesting Sector Beta through Broad Sector Indices.” MSCI Research Insight, October 2013.', 'Melas, Dimitris. “Five Lessons for Investors from the COVID-19 Crisis.” MSCI Blog, May 19, 2020.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.