How Property Type and Location Affected US Lenders’ Losses

Some U.S. commercial-real-estate lenders have experienced significant distress this year due to concerns over their exposure to falling property values.1 Although the overall size of exposure is relevant, the nature of the collateral pool is also critical. What type of property were the loans made against? Where are the properties? When were the loans made? The answers to these questions drive how the value of the collateral has evolved over the lives of loans.

Price changes for loan collateral

We matched loan-by-loan data for 6,648 lenders from the MSCI Mortgage Debt Intelligence database with granular price-growth trends to analyze the collateral pools. The analysis estimated that about one-third of lenders had unrealized losses in aggregate.2 We further examined a subset of 1,189 lenders, excluding smaller lenders and those that often have loans concentrated in just one or two properties.3

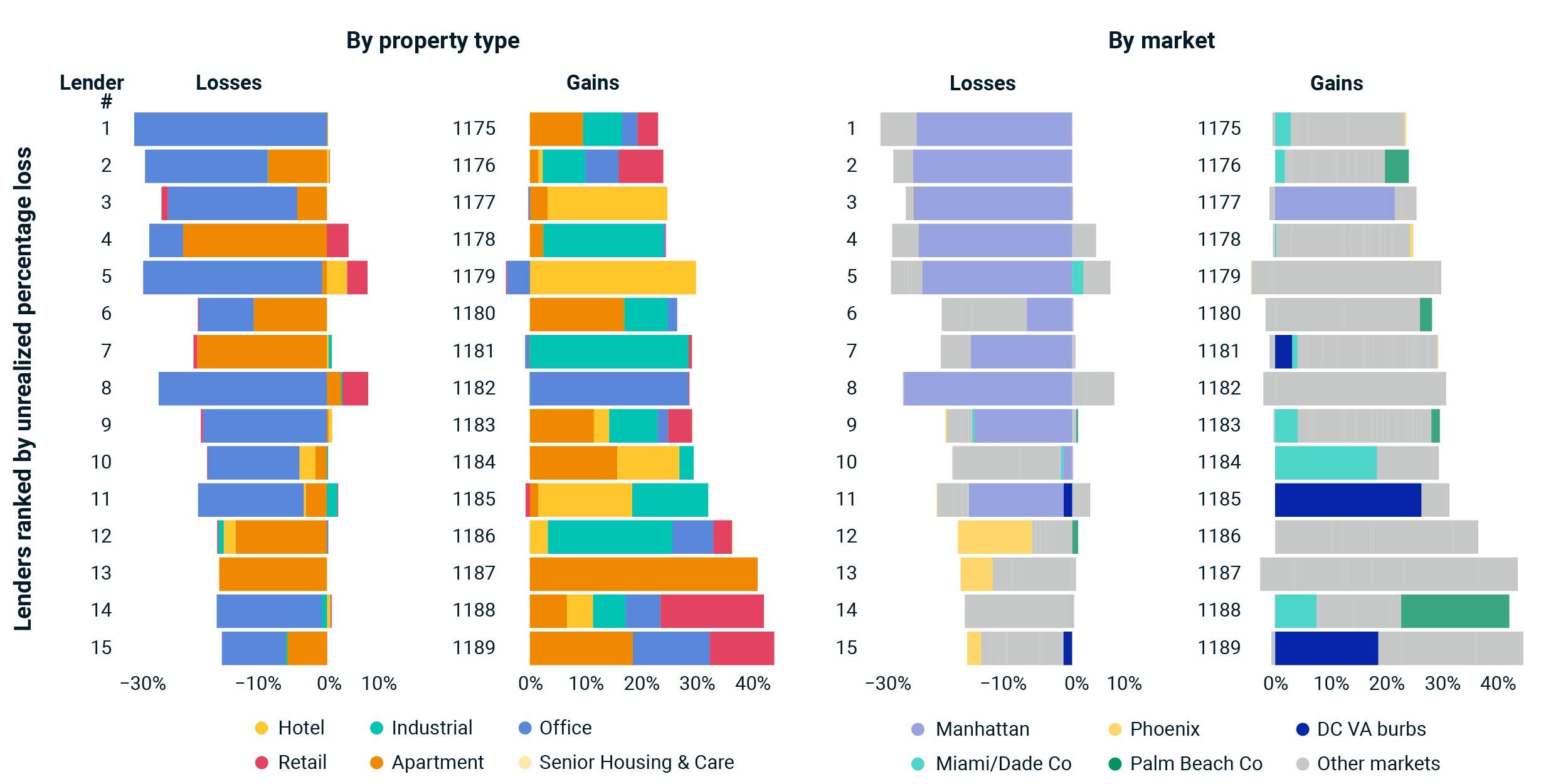

The lenders with the worst-performing pools were those with highly concentrated exposures to challenged property-type and market segments, such as Manhattan office. Those with the best-performing collateral pools were generally more diversified across markets and had greater exposure to industrial and hotel properties.

For example, Lender 1, which had an estimated -28% unrealized loss as of Q1 2024, was almost exclusively exposed to offices in Manhattan and Washington, D.C. Conversely, Lender 1,188, with a 42% unrealized gain, had more exposure to retail, industrial and hotel than any of the 15 worst-performing lenders and was more diversified geographically.

Offices and Manhattan were the main drags on worst-hit lenders

Each asset in a lender’s collateral pool was marked to market by increasing its origination value by the MSCI hedonic price index most relevant to the property type and location, to Q1 2024. These were aggregated and expressed as a percentage of the total origination value of the pool. Each color block on the chart represents the weighted contribution of a market or property-type exposure to a lender’s total percentage gain or loss.

Subscribe todayto have insights delivered to your inbox.

Real Assets in Focus: Are We Nearly There Yet?

Investors are still waiting for a recovery in commercial real estate. We outline the state of play in early 2024 and identify potential signposts for an upturn in the asset class.

Assessing the Health of US Real Estate’s Loan Collateral

How impactful will the coming wave of U.S. property-loan refinancing be? Two significant shifts have characterized the real-estate debt market over the past 18 months: a drop in property values and a corresponding change in the availability of debt financing.

Wave of Property-Loan Maturities Amplified by Extensions

Higher interest rates and a pricing slump have challenged the refinancing of commercial-property debt. We calculate the volume of U.S. loans likely extended from 2023 and chart the lenders behind the slate of maturities starting in 2024.

1 Luca Casiraghi and Libby Cherry, “The ‘Greatest Real Estate Crisis’ Since 2008 Starts to Hit Banks,” Bloomberg, Feb. 10, 2024.2 According to the MSCI Real Capital Analytics transaction database, no sale of the associated collateral has occurred and as such any loss on the loan has not been realized as of Q1 2024.3 Lenders with at least five real-estate loans for a total not less than USD 100 million were analyzed. Commercial-mortgage-backed-securities lenders were excluded from the analysis, as well as government-agency lenders. Mezzanine loans excluded.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.