Still a Long Way Down for US Equities?

Markets are experiencing two major events together: a correction from bubble-territory valuations combined with the economic fallout of trade tensions. Despite a partial reversal of tariffs and some calls to "buy the dip," macro fundamentals suggest U.S. equity valuations are still high, and risk much greater drawdowns.

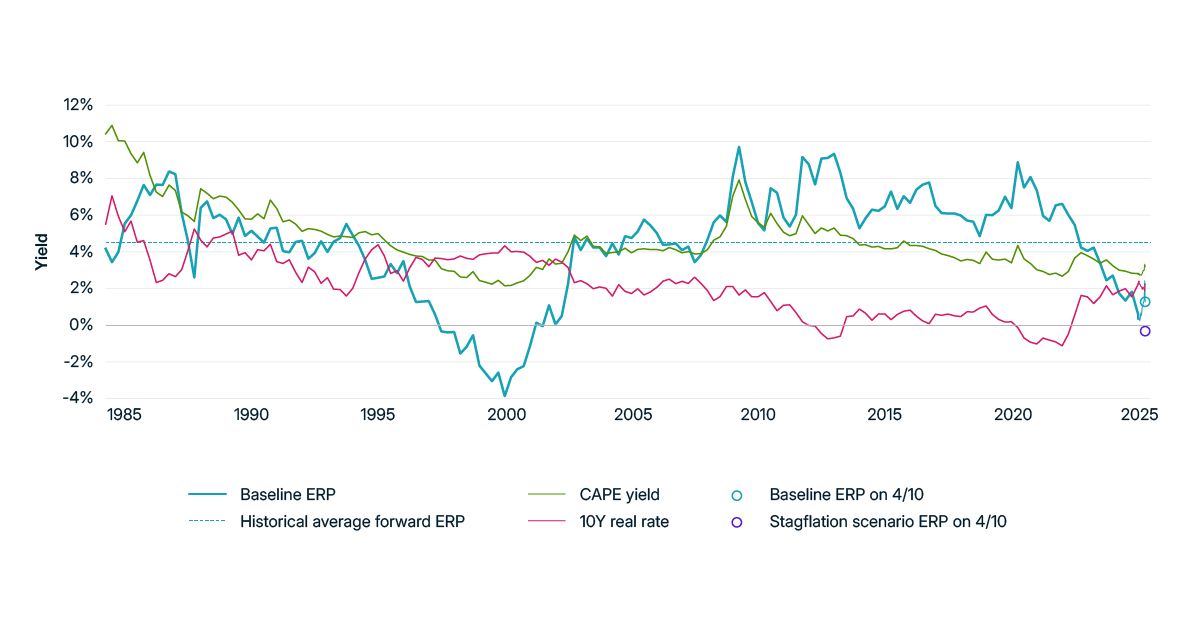

First, even if we ignore the tariffs, the MSCI Macro-Finance Model still sees U.S. equity valuations as well above historical averages. As we observed last month in A Long Way Down for US Equities? — valuations for U.S. equity have been exceptionally high. As of April 10, valuations still appeared at least 18% high, even assuming no negative impact from trade turmoil.

If tariffs bring modestly lower growth and higher inflation, the model suggests U.S. equity is an additional 15% overvalued. But drawdowns greater than 40% could arise if we see worse stagflation or if the equity risk premium goes to the levels of previous crises.

MSCI's forward equity risk premium (ERP) reflects the expected return premium needed to reconcile market prices with macro fundamentals.1 Traditional valuation measures like price-to-earnings ratios also see valuations as high, but accounting for changing growth expectations and higher real rates significantly amplifies the signal.

The Fed has few options

The macro-finance model sees tariffs as especially risky. There is not likely to be a "Powell Put" this time. The Federal Reserve was able to moderate previous crises — from Black Monday in 1987 to the burst of the dot.com bubble, the 2008 global financial crisis and the onset of the COVID-19 pandemic — by lowering interest rates to stimulate demand and help revive a faltering economy.

There may be no such rescue if tariffs spur inflation and squeeze the inputs to growth. Tighter supply could force the Fed into a Volcker-like rate hike — or risk letting inflation expectations loose. This time may be different.

The author thanks Will Baker and John Burke for their contributions.

US equity valuations are still historically high

Subscribe todayto have insights delivered to your inbox.

A Long Way Down for US Equities

Markets may still be overvalued after the recent correction. The sell-off in U.S. equities brought a 10% drawdown, but macro fundamentals suggest the market may still be 20% overvalued, and could go even lower if tighter supply brings higher inflation and lower growth.

The MSCI Macro-Finance Model

Our new framework links financial markets to macroeconomic factors, focusing on cash flows, discount rates, growth and inflation. It helps investors in their capital-market assumptions, risk management and asset allocation, using the MSCI Macro-Finance Model.

How Tariffs Could Impact Equity Markets: Building Scenarios

Tariff risks are at center stage for investors. To help manage the uncertainty, this blog post shows how revenue-exposure data and a scenario-analysis framework enable equity investors to translate targeted industry assumptions into potential portfolio-level impacts.

1 A low premium corresponds to high market prices relative to future cash flows, and suggests both lower long-term returns and a higher risk of a near-term market correction.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.