The Futures of Emerging Markets Decoupled

Investors in emerging markets (EM) begin 2023 with historically low valuations and softened U.S. dollar strength. And in some regional blocs, notably the one represented by the MSCI EM Asia Index, forecasted growth is higher than in developed markets.1 When we look back at 2022, while the MSCI Emerging Markets Index was down nearly 20%, there was significant dislocation in the underlying performance. The three-month implied volatility for EM options has remained elevated.2

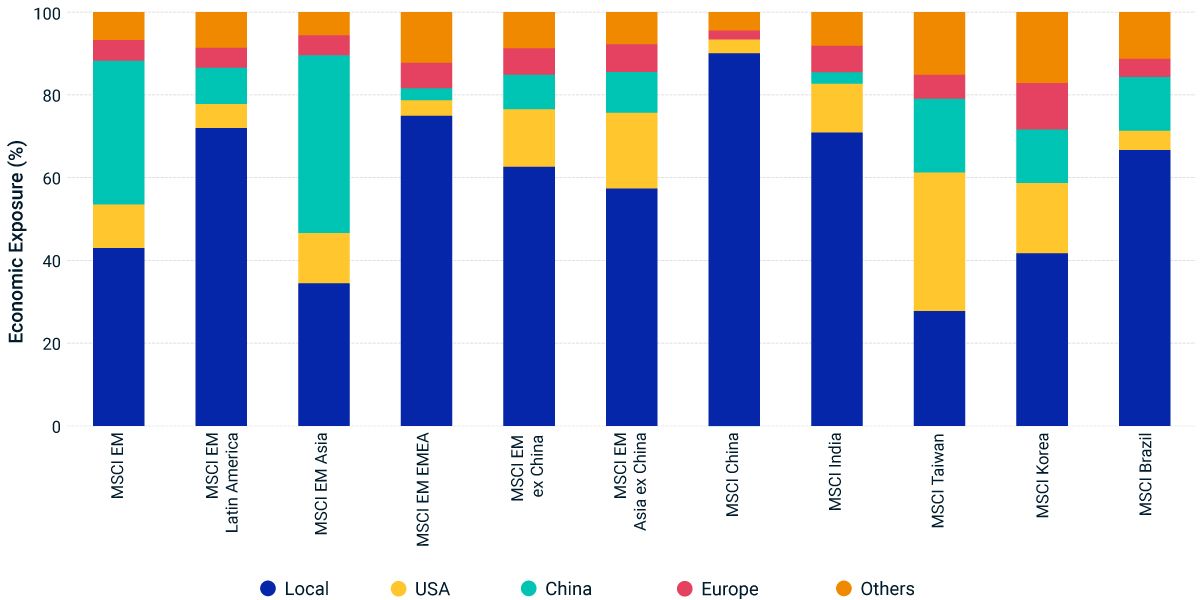

Differentiating local and international revenue exposure

Emerging markets generally have high economic exposures to local companies as shown below. For example, Brazil contributed the most to the outperformance of the MSCI EM Latin America Index, benefitted mainly due to cheaper valuations, high commodity prices and currency appreciation. The outperformance of the MSCI India Index in 2022 coincided with a sharp rebound in economic activity and relatively higher GDP growth forecasts. Chinese equities declined due to a variety of factors, and the strong U.S. dollar weighed down Taiwanese equities, as more than a third of their revenues were linked to U.S. firms.

Listed futures linked to EM, blocs and single countries

The wide decoupling within EM may present opportunities for investors to consider multi-country, multi-currency EM or single-country futures, to express asset allocation decisions, make tactical adjustments or cash equitization. International investors may seek to replicate currency-unhedged or hedged single-country exposures using USD denominated futures contracts. Some investors that benchmark China separate from the rest of EM have found futures linked to the MSCI China A50 and MSCI EM ex China indexes effective tools in aligning exposures.

Active performance attribution and P/E ratios (current, 10-year average)

Current and 10-year average forward P/E ratios. As of Dec. 31, 2022.

Emerging markets’ economic exposures

Subscribe todayto have insights delivered to your inbox.

India Futures for the World

Buoyed by a relatively strong GDP growth rate, Indian equity markets have historically delivered positive active returns to emerging and developed equities and may be considered by investors for strategic asset allocation and diversification purposes.

Index Replication with Futures in a Deglobalized World

Deglobalization could result in lower correlations and higher regional-market volatility, which may lead to higher tracking error when replicating the performance of indexes with a basket of local-index futures.

Putting Futures to Work

Futures linked to MSCI indexes are increasingly being used as a tool to manage market exposure and maintain exposures to target investment benchmarks.

1 Source: OECD Economic Outlook. As of Nov. 2022.', 'Source: Option metrics. Three-month implied volatility for EM options was 22.8% as of Dec. 30, 2022, with levels briefly crossing the 95th percentile in March while topping 70th percentile for most of 2022. Based on the last five years of implied volatility on the 91-day ATM call and put options on the MSCI Emerging Markets Index.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.