Top Global Investors: Piling Into Apartment, Industrial in 2021

There was record momentum behind capital deployed by the top global investors in 2021. It was not exactly a risk-on type of trend in acquisitions, however. Much of this capital was deployed to the asset types viewed as safer in the face of elements of economic uncertainty. Some elements of this uncertainty are growing into 2022, but it is unclear how the current environment will impact this momentum of capital.

As a group, the top 100 global investors — based on the office, industrial, retail, apartment and hotel assets they own — were more active buyers of assets than the market overall. While total global deal activity rose 67% in 2021 from the pace set in 2020, these top investors purchased 83% more than a year earlier. On a net basis, these investors bought more than they sold and collectively added $179.7 billion of commercial real estate assets to their portfolios last year.

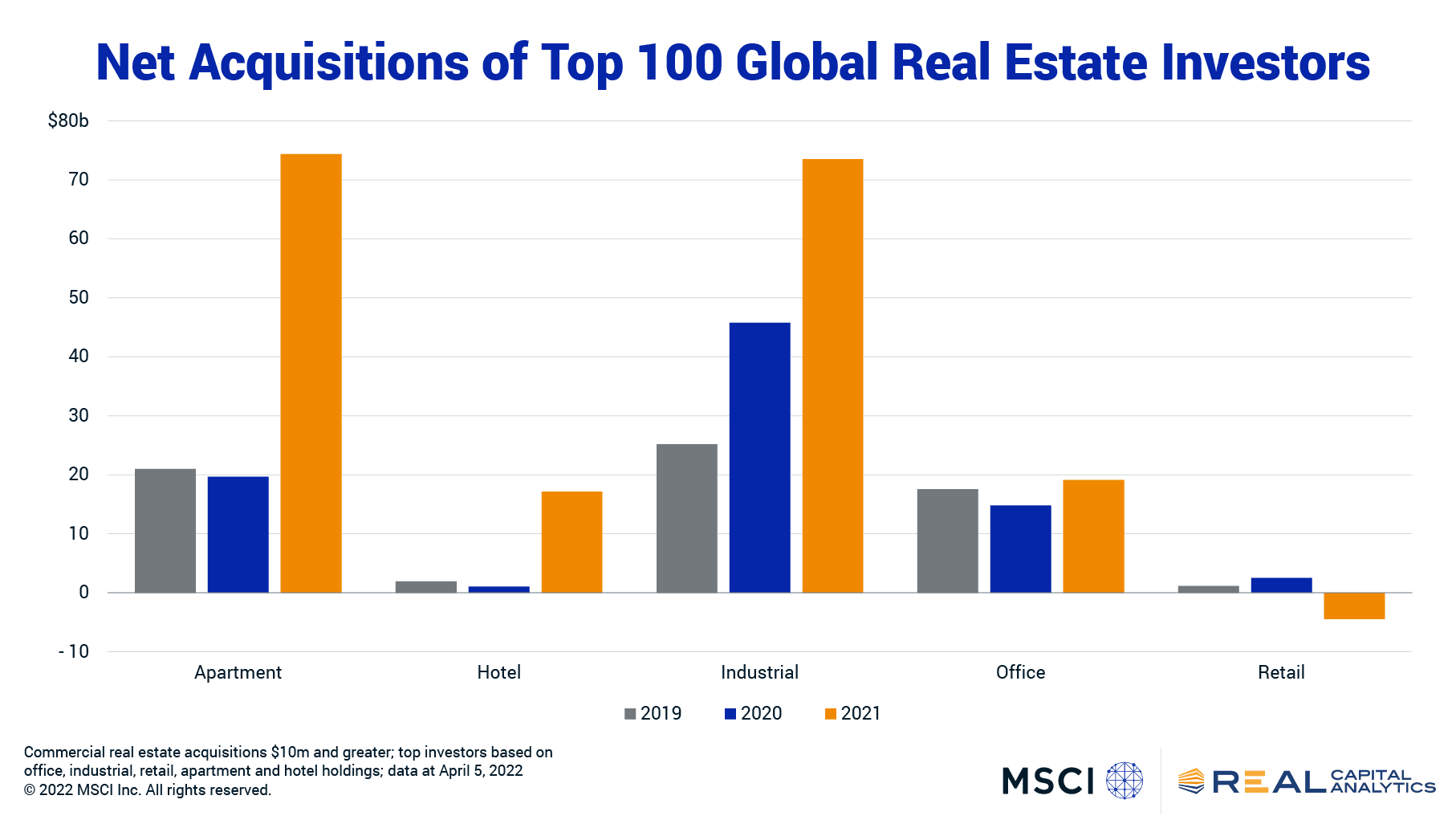

Examining the behavior of this group can help to identify broader trends. Investors who hold the most assets, after all, will see more potential deals and thus have more insight into pricing and capital flows. These investors were clearly most interested in the apartment and industrial sectors in 2021, with 82% of their net investment focused on these two property types.

This overweighting to industrial and apartment is nothing new: these two sectors accounted for 78% of the net acquisition of these investors in 2020. Still, that overweighting in 2020 occurred in a period when the net investment in hotels and offices was falling relative to a year earlier.

Net investment by these investors climbed in 2021 for the hotel and office sectors. The fears over falling travel and tourism with the pandemic faded into 2021 and investors jumped back into the hotel sector. Likewise, net investment in the office sector slipped in 2020 on fears over the work-from-home phenomenon but activity climbed in 2021.

In both cases however, it was not a wholesale embrace of any hotel or office asset on the market. The acquisitions were targeted on plays more resistant to the demand challenges presented in the Covid era. Hotel purchases were more weighted towards automobile-focused properties and vacation-type destinations, and less focused on the big business hotels that struggled as people could not congregate at conferences. The growth in investment for the office sector was aided by growing investor interest in life sciences assets which are naturally resistant to remote work challenges.

One of these sectors is not like the others: retail. Net investment in retail properties fell from $2.5 billion in 2020 to a net deficit of $4.5 billion in 2021. Concerns over growth in online shopping have weighed heavily on investors considering brick-and-mortar investments for some time now. Late into 2021 however, inflation concerns entered the mix.

Inflation is a tax on consumption activity and acts to limit discretionary spending on the part of consumers. While investors were concerned about the impact of inflation back in 2021, commentary and handwringing on the topic has surged in 2022. With the focus on consumer activity, will retail properties be the first target of investor fears or was this pullback in 2021 an early sign of that fear?

Targeted plays on unique assets where income and expense structures were sheltered from the uncertainty of the pandemic were the focus of investors in 2021. As this surge in fear over inflation gathers steam, one might expect that this group will focus on those assets resistant to these pressures. What is unclear is if each property sector can provide such protection broadly or if such safety is only seen in targeted plays.

==

Data analysis by Michael Savino.

Subscribe todayto have insights delivered to your inbox.

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.