US Inflation and Interest Rates: A Sectors’ Perspective

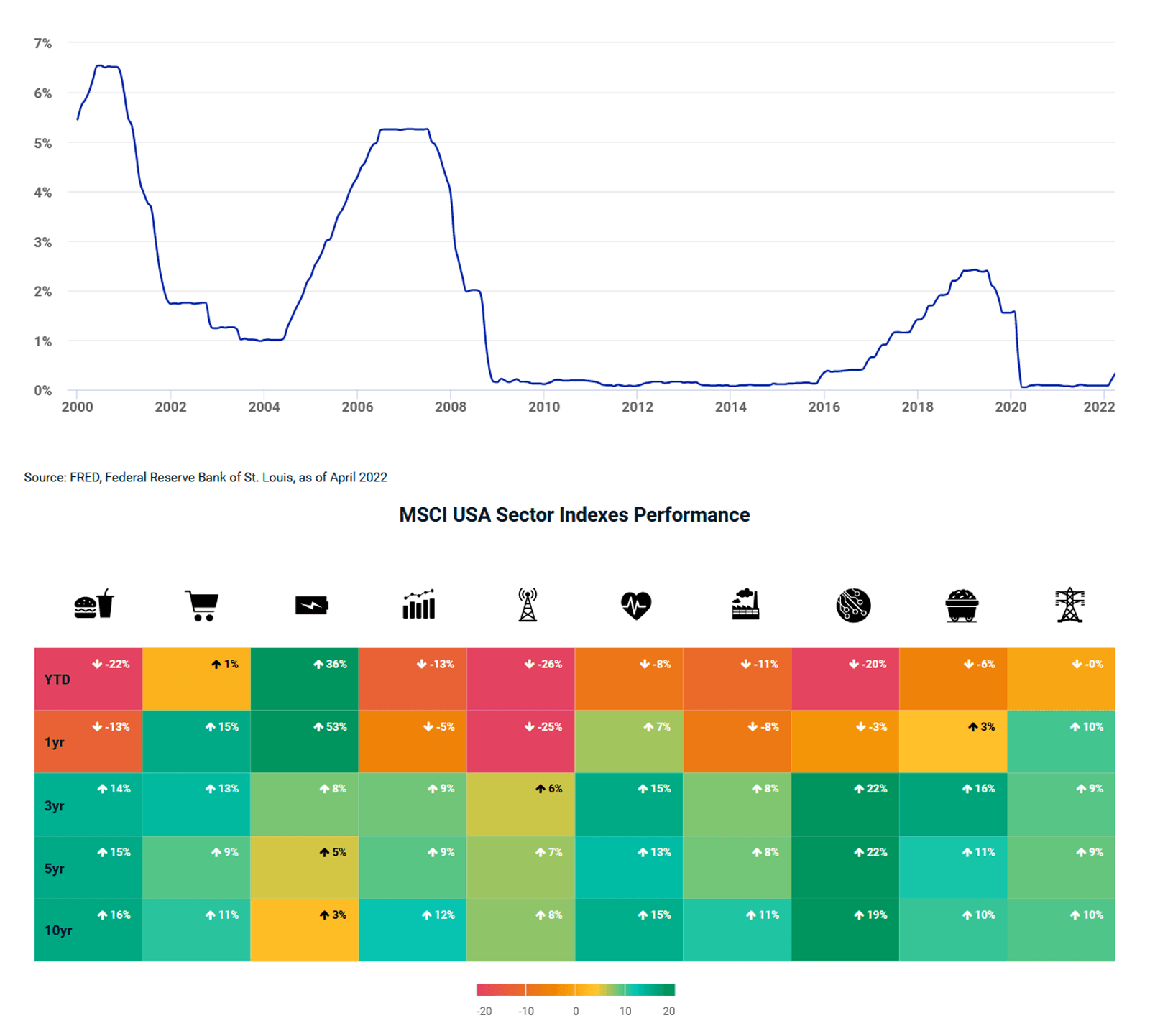

Inflation in the U.S. has accelerated over the last 18 months to a high of 8.5% in March (8.3% in April), a level that was last observed in the early 1970s.1 In response to this surge, the U.S. Federal Reserve instituted a series of interest rate hikes (shown by the slight uptick in rates in the chart below) in an attempt to slow down inflation without further endangering the post-COVID 19 economic recovery.

And while inflation has been surging, the economic recovery has sputtered, with gross domestic product (GDP) contracting 1.4% (year-over-year) in the first quarter of 2022.2 On a historical basis, defensive sectors such as healthcare, consumer staples and energy have benefited the most in times of rising inflation. Information technology (IT) was the other sector with positive excess returns during periods of rising inflation and performed even better in falling-inflation environments.

However, when inflation and economic growth trends were combined, the outcome was slightly altered. On average, the defensive sectors that performed well in rising inflation environments (healthcare, consumer staples and energy), continued to benefit during periods of slowing growth, which was in line with their defensive bias. On the other hand, while IT typically did well in periods of rising inflation, it lagged in periods of rising inflation and lower growth. One sector outlier is utilities, which generally underperformed during periods of high inflation and rising growth but did well in lower-growth environments with high inflation due to its regulated nature and consistent dividends.

As shown in the chart below, energy, utilities and consumer staples have been the best-performing sectors year-to-date, with the recent energy-sector surge largely idiosyncratic and linked to a supply shock from the Russia-Ukraine war and associated international sanctions on Russia.

While research and historical analysis can help us understand U.S.-sector performance, evaluation has become increasingly difficult with soaring inflation that will continue to impact consumer spending and influence the Fed's actions. Interest rate hikes by the Fed could influence the economic growth outlook and may lead to any number of economic regimes. The resulting regime, in turn, may impact the performance of equities, since economic growth, inflation and interest rates affect companies' cash flows. The impact on cash flows will vary by sector, depending on their ability to adjust prices for inflation and how economic growth impacts the demand for that sector's products and/or services.

Stay tuned.

USA Federal Reserve Effective Rates

Source: MSCI, monthly net returns in USD, as of April 2022

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends

You’ll find insights provided in research papers, blogs and a Chart of the Week that succinctly puts topical issues in context.

Energy-Sector Drivers

Looking at sectors through a factor lens may provide additional insights for investors in terms of explaining performance.

Valuations Can Help in Evaluating Sectors

Along with other factors, comparing current sector valuations to longer-term averages has helped investors as they make decisions about whether to rotate in or out of specific sectors.

1 U.S. Bureau of Labor Statistics', 'U.S. Bureau of Economic Analysis

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.