MSCI Wealth ManagerClients expect personalized portfolios and proposals. Now deliver them at scale.

Introducing MSCI Wealth Manager

MSCI Wealth Manager is designed to streamline client portfolio management for investment teams and the financial advisors they support. Leveraging MSCI’s financial expertise, firms can deliver personalized portfolios at scale and facilitate efficient portfolio design, monitoring, and investment proposal generation while ensuring consistency with the firm’s investment strategies. We work with CIOs and investment teams across major banks, brokerages, RIAs, multi-family offices, and external asset managers to make it happen.

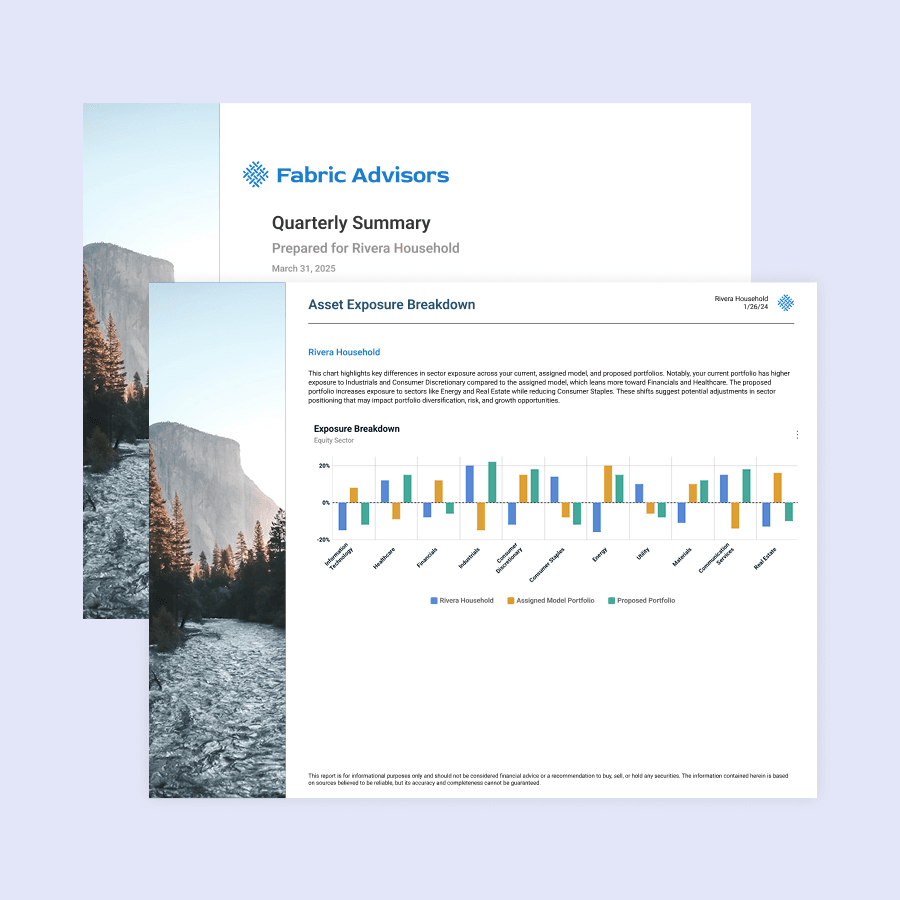

Generate proposals

Deliver insights and proposals tailored to client needs, fostering stronger relationships through personalized, data-driven conversations.

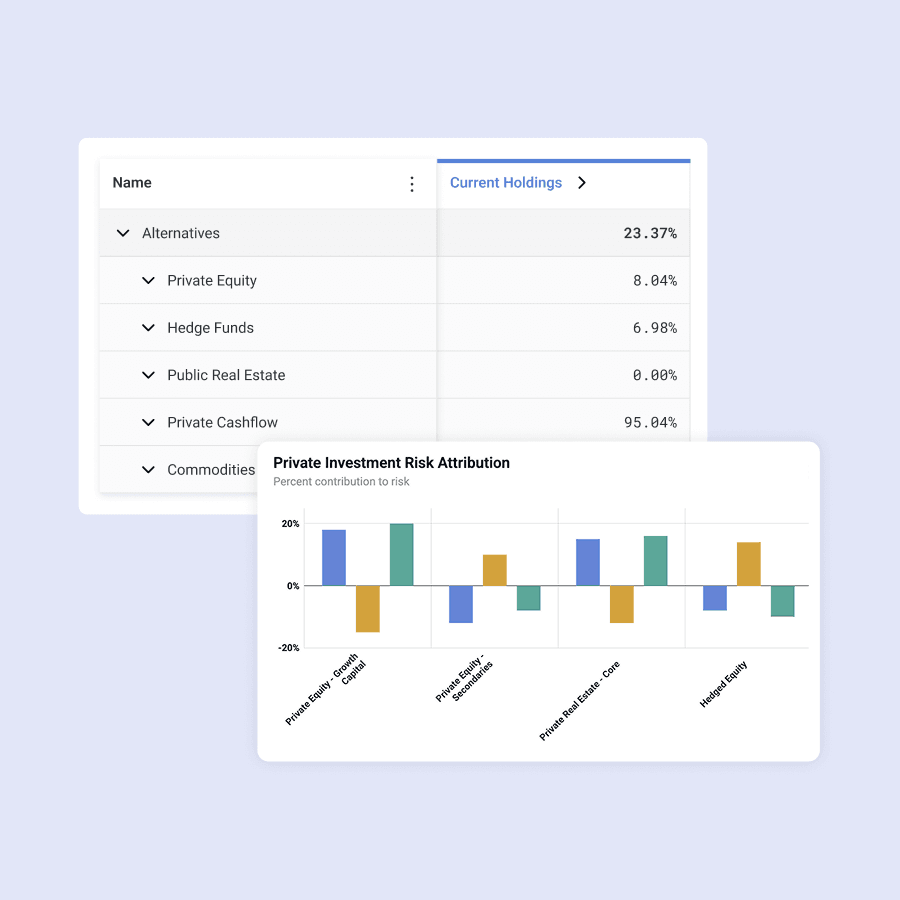

Analyze private assets

Model private asset risks and returns to show clients the performance of multi-asset portfolios, including those with private equity and real estate assets.

Monitor adherence

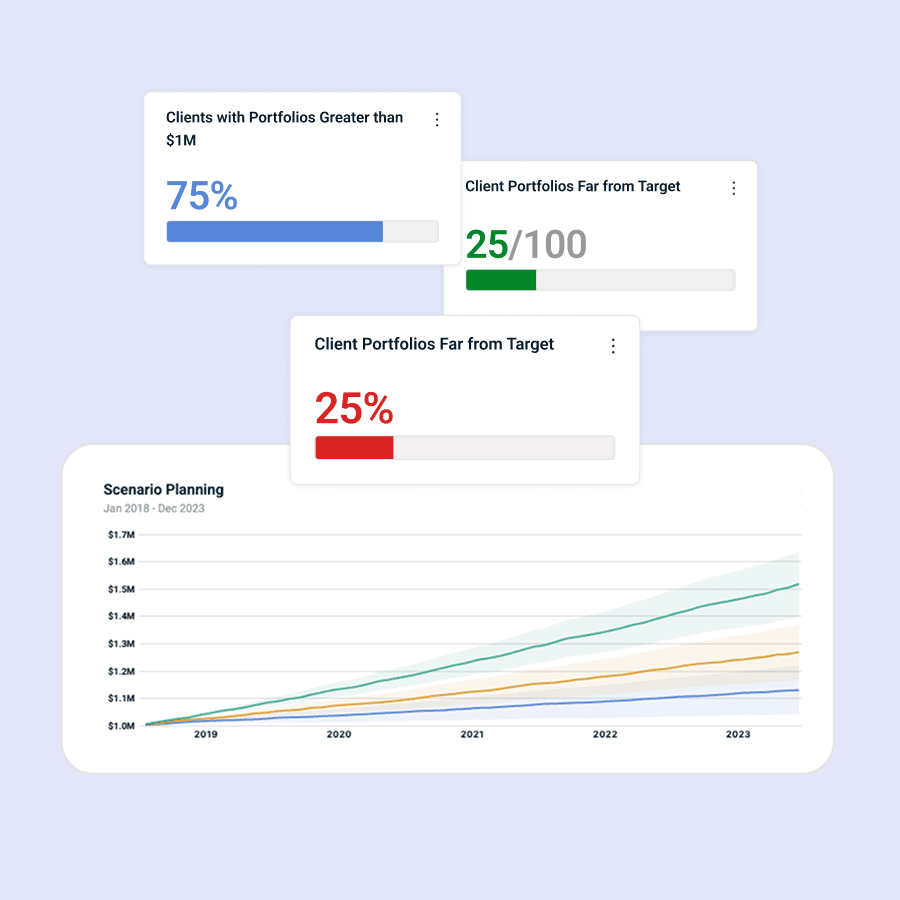

Monitor portfolio alignment with target models, run stress tests and generate tailored reports to communicate risk and performance to clients.

Personalize portfolios

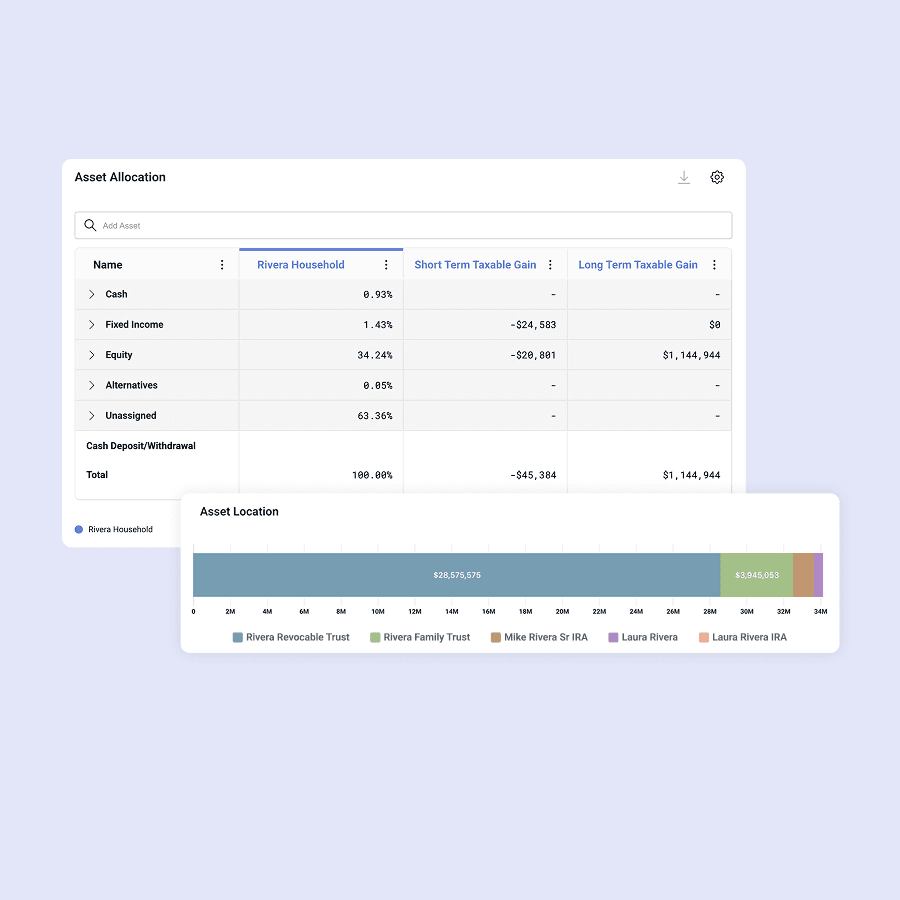

Design portfolios aligned with clients’ unique goals with enhanced ability to personalize around taxes, risk tolerance, values and climate.

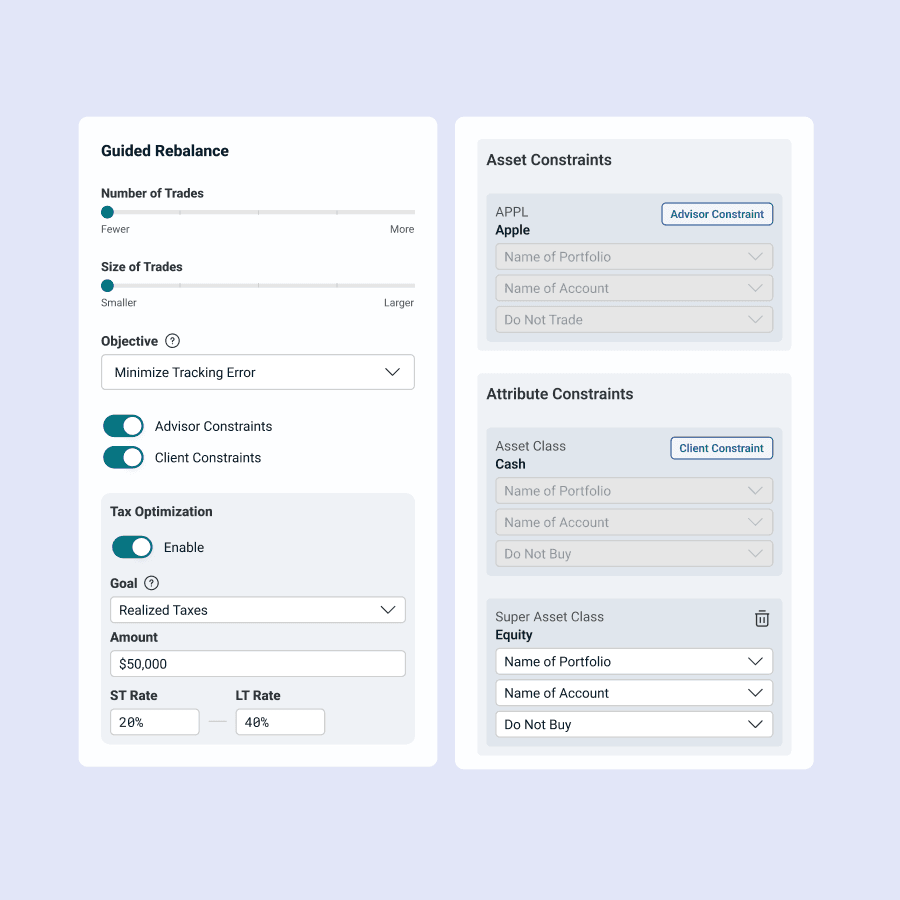

Rebalance to needs

Assess the impact of portfolio changes on client goals, optimizing for taxes and transaction costs, with rebalancing to fit client needs.

Share house views

Set and distribute your firm-wide investment strategies and models directly within your advisors’ workflows.

See how one family office scaled risk insights with MSCI

By unifying public and private asset insights in a single platform through MSCI Wealth Manager, Callan Family Office was able to deliver personalized, risk-aware portfolio guidance at scale across their client portfolios.

“A total portfolio perspective helps us visualize how risk is distributed across a client’s portfolio, including both public and private assets, and how risk changes over time.”

— Daniel Burke, CTO, Callan Family Office

Introducing the MSCI Similarity Score

Redefine portfolio alignment by tracking investment team and client outputs through one simple, common score. Focus on portfolio risk and return rather than the exact holdings using a factor-based approach.

Find your competitive edge in portfolio management

Distribute firm-wide strategies directly within advisor workflows to ensure portfolio consistency. Enable advisors to build client portfolios using house view models and approved funds.

Monitor deviations between house view, client targets and actual portfolios. Identify misaligned portfolios and drill down into specific reasons to take corrective action efficiently.

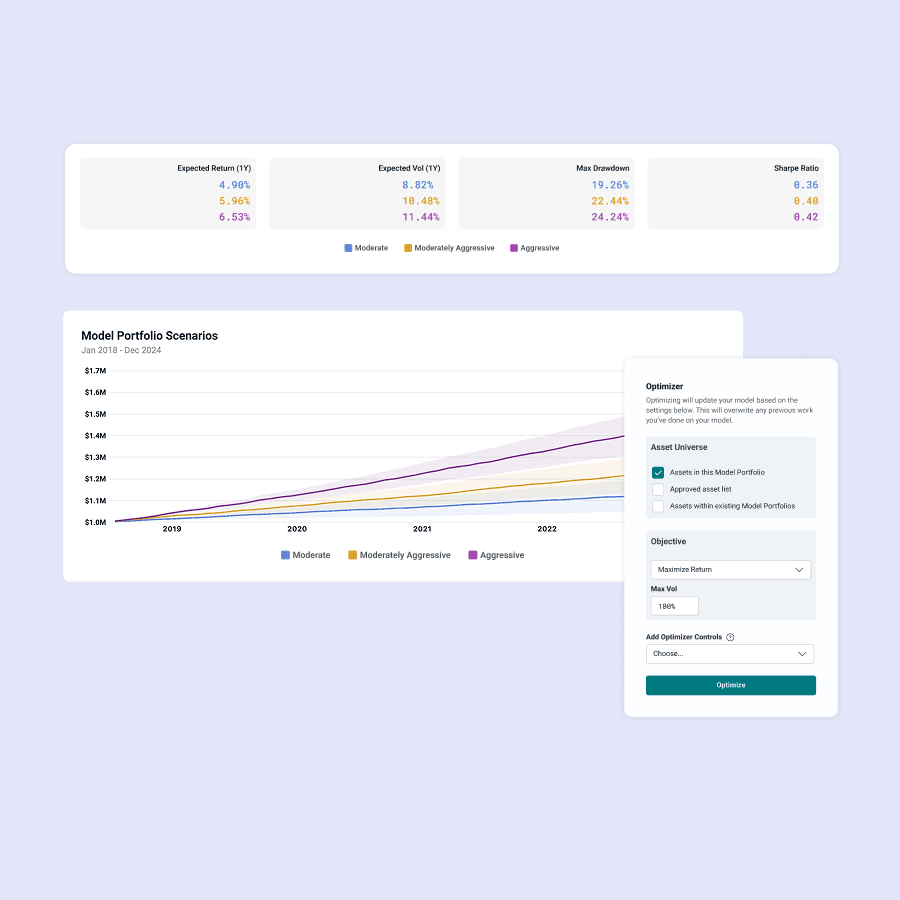

Develop projections and scenario analysis to help understand how portfolios may perform under different market conditions for a clearer view of potential outcomes and better decision-making.

Facilitate prospecting by enabling advisors to build relationships and deliver personalized solutions. Import prospect data to generate insights, create reports and position to win new business.

Research and resources

MSCI forges strategic collaboration with PNC Bank to expand personalized wealth management

Experience the power of MSCI Wealth Manager firsthand.

Custom Direct Indexing for wealth

Discover how direct indexing can help wealth managers personalize investments, optimize taxes and align with client values.