Are Factors Only for Quants?

Video

May 26, 2022

Explore why Factors are the domain of every investor

This is the second of our 'Fact(or) Fiction?' series, which aims to debunk some common myths around Factor investing. In this instalment, we explore why Factors are the domain of every investor, not only quants. Factors were first implemented in the 1970s by systematic and quantitative active investors with access to unique data sets and state-of-the-art processing tools and techniques. In those days factor returns were considered alpha, as these strategies were highly specialized and not well understood. Over time, with advances in technology and the burgeoning availability of data, MSCI has democratized Factor investing by providing models and replicable indexes. Bottom-up stock investors are increasingly using technical analysis and data processing, giving rise to terms like quantamental investing, blurring the lines between Quantitative and Fundamental approaches.

Fundamentals of Factors

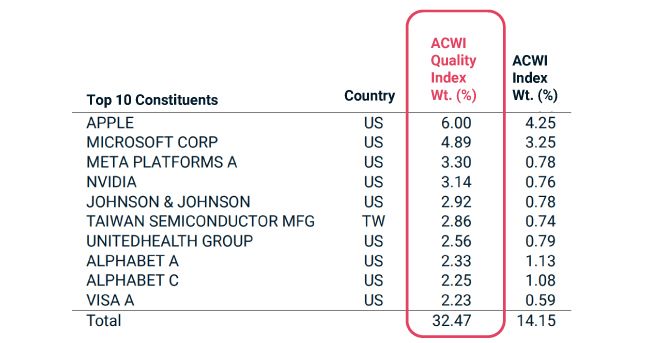

For example, a fundamental researcher focused on picking "high quality" global stocks might find it difficult to apply their high-touch, bottom-up, approach across a broad investible universe. Some investors are narrowing the breadth of the research universe by starting with the MSCI ACWI Quality index, thereby filtering the universe from around 3,000 stocks in the MSCI All Country World Index to around 500 names in the MSCI ACWI Quality Index, a more manageable starting point. Furthermore, the weightings of the Quality index - being calculated by the product of their quality score and market cap - can be also used as an initial prioritization list of "high quality" companies to analyze. By filtering the universe with an appropriate Factor index, researchers can focus their efforts on the higher value activity including deeper fundamental analysis on a manageable universe.

MSCI ACWI Quality Index

MSCI ACWI Quality Index with Top 10 constituents

Resilience and risk

Regardless of their approach to security selection and portfolio construction - asset owners, asset managers and wealth managers demand transparency into the underlying drivers of investment returns. Performance attribution achieves this by decomposing returns into their different underlying dimensions, allowing managers to separate the stock-specific component from common factors like country, industry, or style factor exposures. This decomposition often reveals important insights.

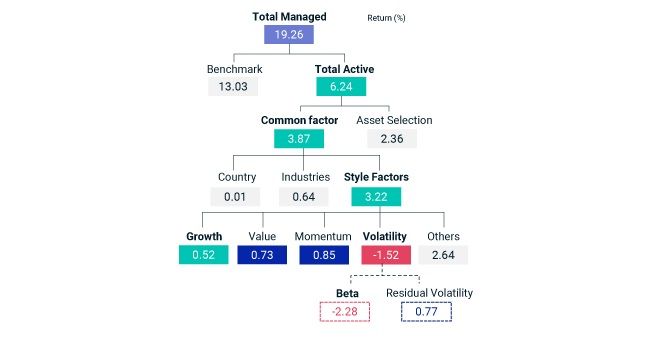

Absolute analysis on a US Growth Fund portfolio

Performance attribution of a US Growth Fund Portfolio Here we take an example of a US Growth Fund portfolio that had an active return of 6.24% over a 3-year period ending April 2022, versus the benchmark MSCI USA IMI Index. On the surface, it's easy to conclude that the manager of this fund has added significant value relative to the market cap index. However, when we examine the drivers of performance for this portfolio across style factors using MSCI's portfolio attribution tools, a much more nuanced story emerges. The Growth component of the Style factors returns was in fact strongly positive (+0.52% on positive exposure to the Growth factor) in the portfolio. However, it's also noteworthy that the negative exposure to the Value factor over this period also positively contributed, adding 0.73% across Value dimensions and Momentum added 0.85% positive contribution. Volatility on the other hand detracted, largely due to the beta exposure of the manager, which detracted -2.28% from active returns. In this case, using a factor lens, the portfolio manager may have been able to hedge or reduce the exposure to higher beta names, reducing the negative impact of the names with higher systematic risk. Understanding the underlying drivers of portfolio performance allow investors to make more informed decisions and ultimately build better portfolios. Whether it is a portfolio manager building a robust investment strategy, a risk manager performing performance analysis or a sales team articulating their value proposition, MSCI's Factor solutions can deconstruct portfolio returns into their granular components, empowering investors to build better portfolios, precisely measure and manage risk, and more clearly articulate their investment approach.

Contact us to learn more about our Factor solutions

Take a look at First Fact(or) Fiction where we debunk the myth that Factors are a thing of the past.

Subscribe todayto have insights delivered to your inbox.

FaCS™

Classification standard and framework for evaluating, implementing and reporting style factors in equity portfolios.

Portfolio Management

Analyze the sources of portfolio performance on an absolute or relative basis.

Factor Indexes

Benchmark factor-driven performance of specific investment strategies, as well as define factor-based stock universes.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.