40 Years of History - With Deeper History Comes New Insights

Blog post

April 11, 2014

We recently extended our simulated index factor history to 40 years, providing a unique set of data compared to others available in the marketplace. This extended history, combined with IndexMetrics, MSCI's analytical framework, offers investors sharper tools for creating and analyzing portfolios.

Originally, the simulated history that came along each factor index went back 25 years. We are now providing an additional 15 years.

This richer data set covers more market regimes, political events and market shocks. For example, it captures the performance of these factors in previously untested periods. The crash of 1987 and the high inflation of the 1970s come to mind, but there are a slew of other examples. Sure, these events will not be duplicated, but this additional set of data provides asset managers a better grasp of the behavior of a given strategy or security under different conditions.

For example, Quality was the best-performing factor index for the 25-year period ending 2014. However, during the full 40-year period, the Quality index trailed the other factor indexes except for the Minimum Volatility index, driven by the Quality index underperforming from 1975 to 1987.

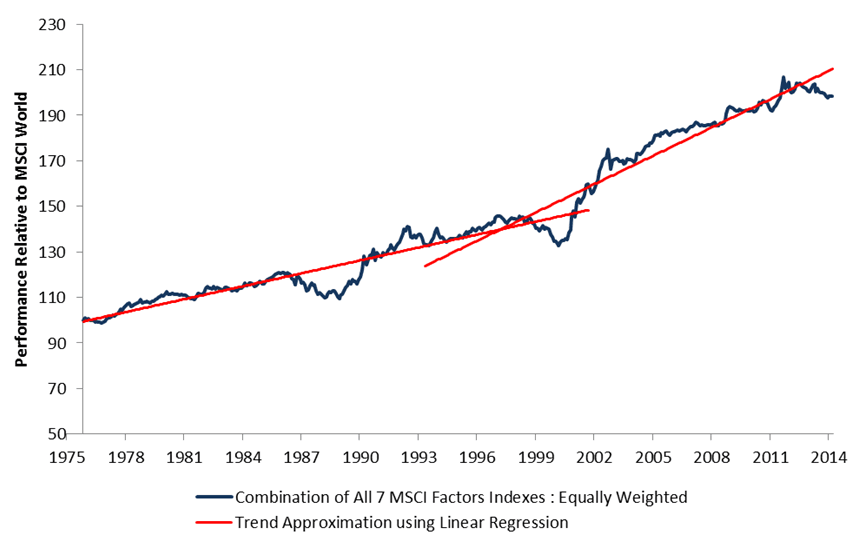

While not indicative of future performance, back-tested data indicated that when we combined all seven equally weighted MSCI factor indexes since 1975, performance did not diminish during the 40-year period, as shown in the below graph.

Sustainability of Factor Premia from 1975 through 2014

Read the paper, "MSCI Factor Indexes in Perspective: Insights from 40 Years of Data."

Do we want to reference the Spotlight too?

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.