Are EU corporate bonds all alike?

Blog post

November 27, 2019

- The integration of the eurozone's economy may tempt investors to view corporate debt issued by European companies as undifferentiated.

- On average, this view has seemed approximately correct. However, during periods of distress, we have seen that the market has distinguished corporate bonds according to where the majority of a company's revenue is generated.

- For example, spreads for German corporates exhibited "flight to quality" behavior as their spreads contracted during market dislocations in Spanish and Italian spreads.

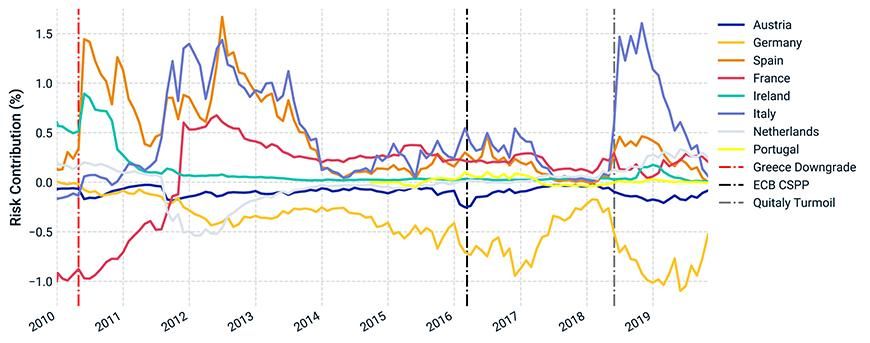

Distressed: EU spreads widened around key market events

Risk contributions as a percentage of total risk for the Markit iBoxx EUR Corporates Index are calculated for month-ends using MSCI's BarraOne's risk-contribution functionality. Note that this index has an average term-structure contribution of 70%, so these contributions make up a much larger portion of the spread contribution.

In the exhibit above, we model a subset of larger EU countries' spread risk in the MSCI Fixed Income Factor (FI400) model with "duration times spread" exposures2 to sector factors (e.g., EU industrials) and to market-neutral country factors.3 The resulting country factors reflect a pure country effect net of the return captured by their primary risk drivers, the sector factors. If the debt of these European issuers were in fact undifferentiated according to their country of risk, we would expect these country factors to have very little contribution to portfolio-level risk.

The exhibit above plots the factor risk contributions4 for the Markit iBoxx EUR Corporates Index for month-ends using BarraOne's risk-contribution functionality. In general, spreads for German corporates exhibited "flight to quality" behavior as their spreads contracted during market dislocations in Spanish and Italian spreads. A recent example of this effect occurred during the Italian sovereign sell-off in May 2018. During this episode, net of other effects, it appears that investors dumped Italian and Spanish corporate bonds and bid up spreads of German and Austrian corporates. This dynamic demonstrates the importance of country effects as distinct drivers of spread risk for euro-denominated corporate debt

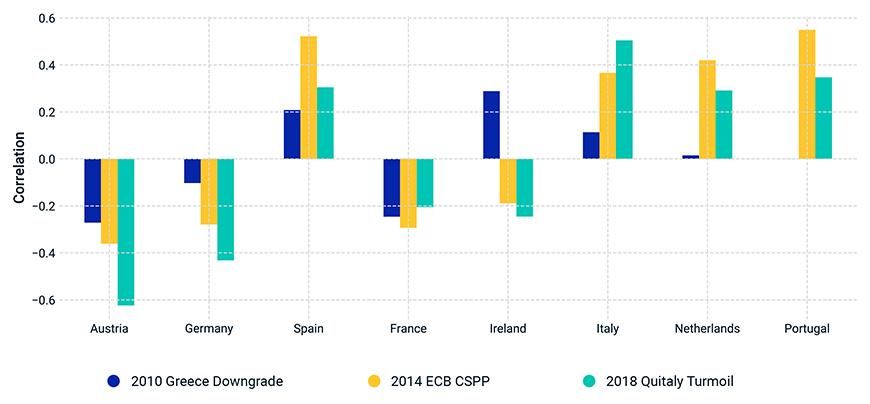

Country correlations have changed over time

Correlations for corporates' country factors with the EU Corporate IG Spread factor on the Friday of or immediately after market events. We can see from the above how select EU countries' corporate-debt markets react to sovereign-market news.

Correlation between country-level factors and the all-sector investment-grade Europe factor5 provides further insight into the country effect. The exhibit above plots these correlations by country as of the date of large sell-offs. For example, note how Irish corporates have transformed over the past decade from being positively correlated with European corporate spreads to negatively correlated during periods of market turmoil. While Irish corporates suffered along with other EU corporates during the European sovereign crisis, they revived during subsequent trouble spots. Meanwhile, Austrian and German spreads became more negatively correlated with the all-Europe sector factor with the passage of time.

Treating European corporates as interchangeable within a monetary union is an entirely reasonable intuition. And yet we have seen from our analysis that the market hasn't always agreed, especially during periods of distress. In this way, the market seems to agree with Mr. Smith. The challenge for investors today is then to quantify how much ruin there is in a nation.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1Ross, I.S. . Oxford University Press, 1995.2This is a model for fixed-income market risk. Details of the model can be found in “The MSCI Fixed Income Factor Model.” The full list of countries covered by this model are: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain3This “sector first” approach constrains the market-capitalization-weighted sum of country factor returns to zero.4Factor risk contribution is defined as factor exposure × factor risk × factor correlation with the portfolio.5This factor covers all of Europe, though country factors are estimated for only 11 countries.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.