Asian retail resilience: Have store hours affected performance?

Blog post

July 9, 2019

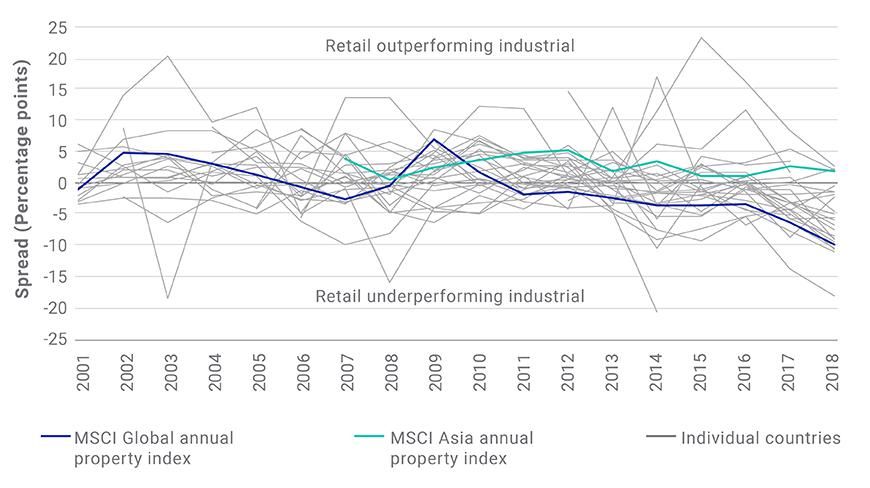

- Globally, industrial real estate assets have outperformed retail assets in recent years, with the gap widening as e-commerce growth has boosted the industrial sector while weighing on retail returns.

- The trend has been most pronounced in Western markets, but less notably in Asia, where several factors (from macroeconomic fundamentals to differences in retail culture) have potentially led to a more resilient retail performance.

- The divergence between Western and Asian markets highlights how nuanced real estate can be and why investors may look beyond headline trends to better understand their portfolio exposures.

Asian retail-industrial spread bucks global trend

The picture was different a few years ago

For the first 10 years of the MSCI Global Annual Property Index, retail assets showed an annualized 8.7% total return, almost 200 basis points above what industrial assets achieved. However, from 2011 through 2018, the retail sector consistently underperformed the industrial sector in the index, and the gap steadily widened during that time. By 2018, the difference in annual total returns was almost 10 percentage points. The trend was more pronounced in some countries than in others, but occurred in most developed markets and became more visible in the last couple of years of our analysis period, as we can see in the exhibit above. However, what is notable is that retail returns for the MSCI Asia Annual Property Index continued to outpace industrial returns during that time.

Shifting market dynamics

E-commerce growth has benefited the industrial sector thanks to the stronger demand it has created for warehousing and distribution assets. These tailwinds have helped the industrial sector outperform the overall index for most of the decade. On the flipside, increasing online competition, coupled with low wage growth and high debt levels have been worrying retailers, and by extension retail landlords, for some time. Taken together, it is therefore not surprising that we have seen retail and industrial returns drifting apart.

But why has Asia seemingly been more resilient?

Different macroeconomic and local real estate market conditions may have played a part. For example, better wage growth, lower debt levels and a growing middle class in parts of Asia could have been less of a drag on retail spending growth. However, it is also possible that factors like differences in retail culture and the way people use shopping centers have played a role.

It has been reported that some Asian malls have been ahead of the curve in creating experience-rich retail environments. However malls in parts of Asia may also be benefiting from other tailwinds. For example, in tropical regions, the presence of air-conditioning could be a draw. On a more speculative level, even late shop-opening hours might have played a part, by offering more opportunity to shop, eat and socialize after work, reducing the appeal of online retail and helping make Asian retail assets less vulnerable (by contrast, in certain Western markets, more constrained opening hours that limit the average worker's ability to shop during the week might have contributed to the increased relative attractiveness of online competition and helped put additional pressure on retail markets).

Ultimately, there is probably a complex set of factors that have helped to shape the divergence we have seen, and how much impact different individual factors have had is hard to prove. However, the fact that Asia's retail performance has remained more resilient highlights how real estate remains a nuanced asset class where it may be important to look beyond headline trends to fully understand a portfolio.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1 “Libraries, Gardens, Museums. Oh, and a Clothing Store.” New York Times, Nov. 19, 2018.2 “Amazon in Asia faces hurdle from air conditioned malls.” Australian Financial Review, Oct. 9, 2017.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.