- Derivatives contracts like futures and options are often employed by institutional investors to hedge against market risks or express views on certain performance/risk characteristics.

- Increased levels of liquidity in futures based on the MSCI EM and MSCI China Indexes during recent years have allowed some market participants to augment asset-allocation policies based on these "integrated" multicurrency futures contracts.

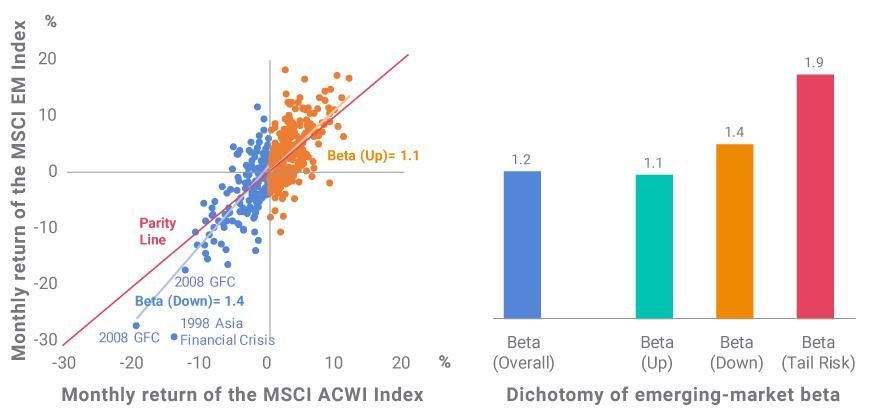

- The percentage increase in trading activities in futures based on the MSCI EM Index was higher than in the EM equity cash market during recent market crises.

Approach | Cash/OTC market | Basket of local futures | Integrated futures |

|---|---|---|---|

Approach Why it may have been chosen | Cash/OTC market Provided direct way to adjust portfolio holdings Allowed for highly customized, high precision in exposure management Have handled both systematic and idiosyncratic risk exposures | Basket of local futures Provided flexibility in accessing various liquidity avenues Proved cost-efficient May have avoided exacerbating potential cash/currency-market distress | Integrated futures Allowed for absolute alignment in targeted exposure Provided operational efficiency in handling multilocation and multicurrency trades May have avoided exacerbating potential cash/currency-market distress |

Approach Why it may not have been chosen | Cash/OTC market Transaction costs historically rose during market crisis, and there was potential for double-layer fees Potential liquidity issues in cash and currency markets arose It was operationally challenging to deal with different time-zone settlement cycles and exchange rules Potential for collateral damage and contagion risk arose when active portfolios rebalanced in scale Potential counterparty risk arose for OTC transactions | Basket of local futures Required additional currency overlay/ exposure management Potential liquidity issues in currency markets arose It was operationally challenging to deal with different time-zone settlement cycles and exchange rules Tracking error to the actual exposure was sometimes high | Integrated futures Were readily available There was a potential lack of liquidity and ecosystem at early stage of contract initiation Did not always allow for precision, especially when investors wanted to adjust specific exposures to certain local markets |

Crisis event | Event date | Cash market volume change | Futures market volume changes |

|---|---|---|---|

Crisis event U.S. debt | Event date 8/8/2011 | Cash market volume change +40% | Futures market volume changes +71% |

Crisis event China currency | Event date 8/24/2015 | Cash market volume change +31% | Futures market volume changes +79% |

Crisis event "Volmageddon" | Event date 2/5/2018 | Cash market volume change +41% | Futures market volume changes +89% |

Crisis event COVID-19 | Event date 3/6/2020 | Cash market volume change +70% | Futures market volume changes +156% |

Subscribe todayto have insights delivered to your inbox.

Hawkins, J. and Klau, M. 2000. “Measuring potential vulnerabilities in emerging market economies.” BIS Working Papers.

Chiṭu, L. and Quint, D. 2018. “Emerging market vulnerabilities – a comparison with previous crises.” ECB Economic Bulletin.2China’s equity market underperformed other EM and global markets during the first phase of the outbreak when the impact was largely within China. With COVID-19 going global and China’s domestic outbreak more under control, China started to outperform other markets since Feb. 4, 2020. Similar market-cycle dyssynchronization was observed during the 2008 global financial crisis.3See: Fabozzi, F. and Markowitz, H. 2011. , John Wiley & Sons.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.