Building Predictive Stress Tests: MSCI’s Best Practices

Blog post

September 19, 2016

Stress testing has experienced a resurgence of interest in the wake of the 2008 financial crisis. The lessons from that period, perhaps more than any previous one, taught the risk industry that expert judgment and economic insight may help investors anticipate and avoid exposure to major financial downturns by using forward-looking models.

But what are best practices for creating these forward-looking scenarios? Currently, there is no consensus.

As we see it, stress testing is the practice of evaluating risks whose likelihood can be better estimated by an expert, using economic reasoning and fresh information. Stress testing is the most direct way to insert human experience into risk models.

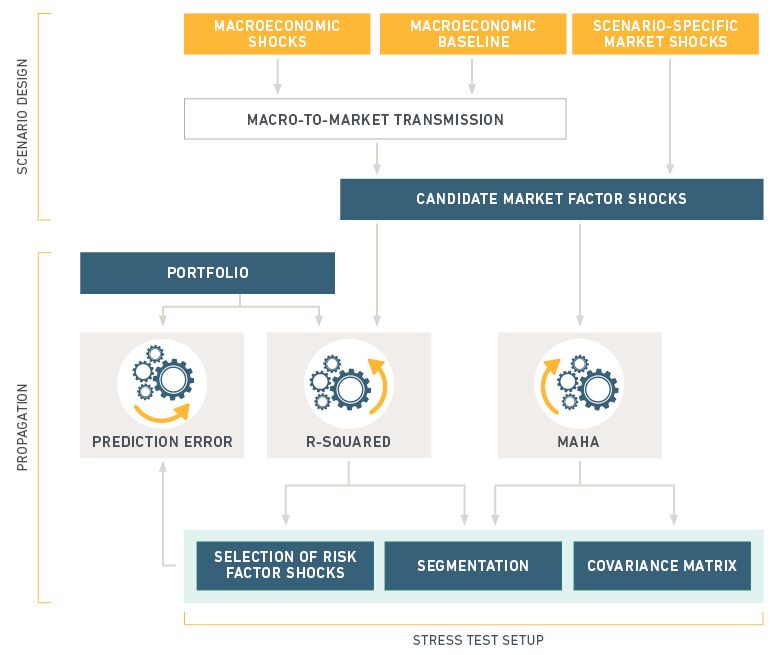

The subjective nature of stress testing involves a delicate balance between art and science. The flowchart below delineates a protocol that guides risk managers and other investors through a series of steps that lead to a structured way of stress testing portfolios:

- In the first phase, we describe the scenario quantitatively, ensuring that it is both consistent and complete. Modeling macroeconomic shocks helps achieve this goal.

- In the second phase, we propagate the shockwave onto all the relevant risk factors of an actual portfolio, testing that our final result is robust.

MSCI protocol for stress test design

The framework enables risk managers to tailor stress tests for their own portfolios. MSCI uses this same methodology in designing stress tests for real-world scenarios, such as the possibility of an oil-price shock or the Federal Reserve raising interest rates.

Predictive stress testing offers a comprehensive and forward-looking way to evaluate the exposure of individual portfolios to potential risks. By combining expert knowledge with a structured protocol, this approach offers risk managers guidance in designing these scenarios, which are becoming a key element of modern risk management.

The author thanks Thomas Verbraken for his valuable contributions to this article.

Further reading:

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.