Do Not Fear the Impact of AI on Commercial Real Estate

- Worries about artificial intelligence (AI) supplanting knowledge workers have created more pain for the office market.

- A broader view on the economic impact of AI should consider possible positive impacts.

- AI could boost worker productivity and economic demand — and thus demand for other types of commercial real estate.

Cause and (more than one) effect

People tend to think in linear fashion: Event X happens and condition Y is achieved. It can be challenging at times to think about the world in an equilibrium context — meaning, how the new condition Y and other factors then in return impact event X. The linear worry that people have about AI is that high-paying knowledge-driven jobs go away as AI takes hold. Indeed, there is the possibility of a substitution effect where workers are displaced. But in an equilibrium context, there is an income effect to consider as well.

Improvements to productivity can create new sources of income and higher rates of economic growth. The introduction of online travel tools, for instance, devastated travel agencies as consumers no longer needed to turn to a person to book hotels and flights. As self-service tools flourished with the growth of the internet, consumer spending on transportation, recreation and accommodation services grew at a faster pace. Data from the Bureau of Economic Analysis shows that such services grew at a 1.93% compound average growth rate from 2002 to 2023, versus 1.79% for services in general. If the growth in AI tools has a similar positive shock to economic productivity, would it help demand for commercial real estate?

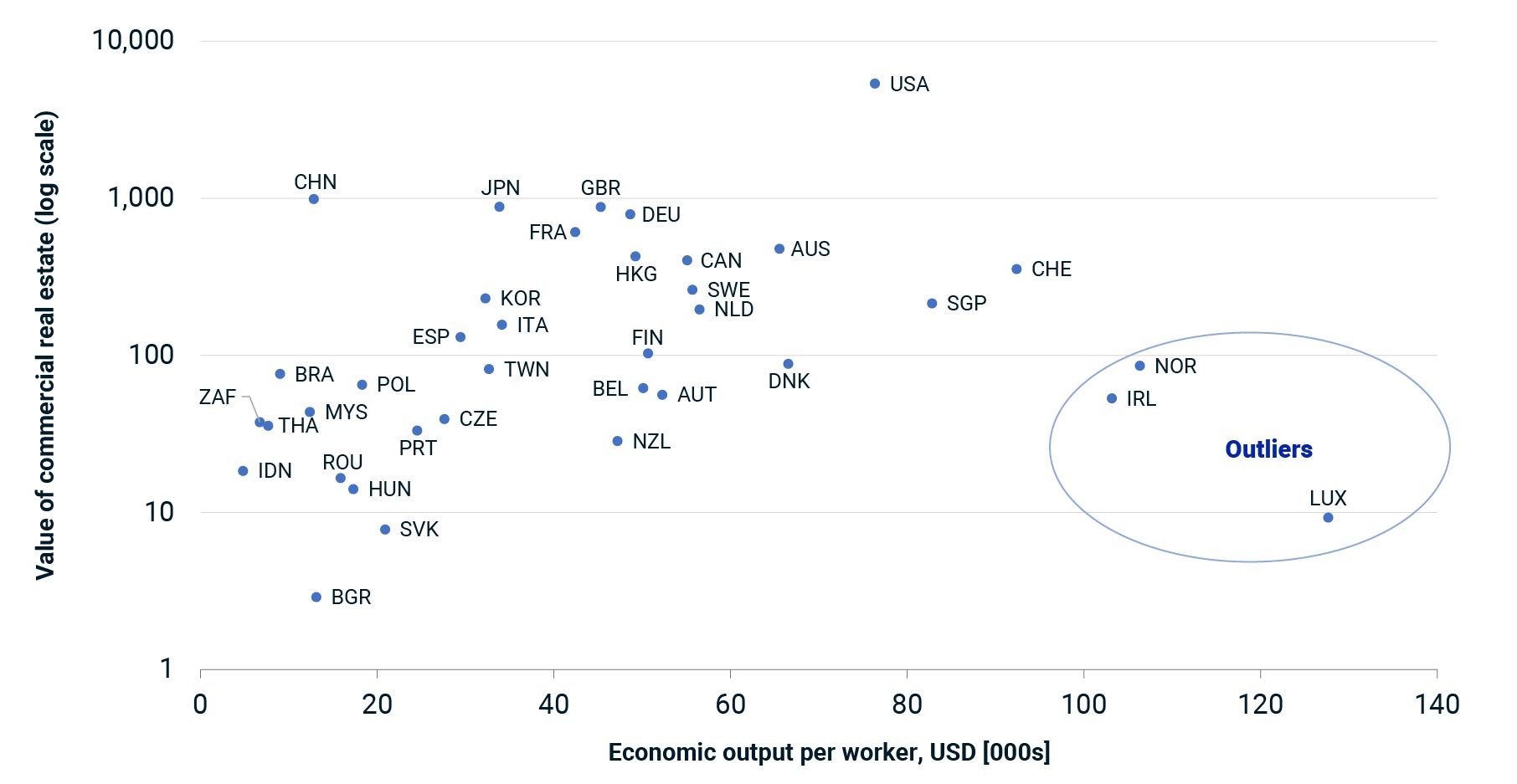

Data from the latest edition of the MSCI Real Estate Market Size report suggests that, with higher rates of economic productivity, even more commercial real estate is needed. The exhibit below shows the relationship between output per worker and the value of commercial real estate in each country, analyzed for 2022. (The value of the commercial real estate market in each country is expressed in a logarithmic scale as the relationship is nonlinear.)

Value of commercial real estate generally increases with economic output

GDP per worker, 2022. Size of professionally managed real estate markets, 2022. Source: International Monetary Fund World Economic Outlook, MSCI Real Estate Market Size

The chart shows that as the output per worker increases, the value of commercial real estate in each country generally increases as well. With more output, income, along with the need for commercial real estate to service the flow of earnings into consumption and investment activity, grows.

There are some outliers in the chart. Consider Luxembourg, for instance, which is the most economically productive country analyzed in the MSCI Real Estate Market Size report. Data from the International Monetary Fund shows that the GDP per worker stood above USD 127,000 in 2022 versus, say, only just over USD 76,000 for the U.S.1 The value of commercial real estate in the U.S. stood trillions of dollars larger than that of Luxembourg for 2022 as the size of an economy is an important driver of demand as well. When considering the value of commercial property in each country, many factors drive the need for it, including both the size of the economy as well as the relative productivity.

Do not fear the future. The hype cycle on AI is just beginning, and we are likely to see a lot of nonsensical takes on the future of commercial real estate driven by linear thinking. Yes, there are industries that may undergo disruption of traditional workflows and job losses. This transition where some workers are substituted with AI tools will be painful for all involved. For the economy overall, however, the promise of higher rates of productivity may provide a boost to overall demand and a need for additional commercial real estate.

How AI could spur property demand

Yes, the type of commercial real estate that is needed may change as the economy evolves and grows. Maybe there is a knock-on effect to the current turmoil in the office market that further constricts office demand as capital is brought in to replace labor. (And maybe there is more demand for data centers from such substitution.) But the increase in economic activity will generate demand for other sorts of commercial real estate, with travel and consumer spending potentially generating more demand for hospitality and retail property from the wealth effect.

Will the substitution effect or the income effect win out, though? That we do not know. But in the coming months, for any hot take you read on the impact of AI on commercial real estate, if the author only considers the substitution effect and not the income effect, take it with a grain of salt.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1“World Economic Outlook Update.” International Monetary Fund, July 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.