ESG Factor Returns: 2022 in Review

- ESG factor returns were lower in 2022 than the previous five years but remained positive.

- Within the MSCI ACWI Investable Market Index (IMI), companies in the top ESG quintile outperformed those in the bottom quintile consistently over 1-, 3- and 5-year periods.

- Over longer time periods, the ESG factor has consistently shown positive or neutral performance across sectors, although results have been more mixed over shorter periods.

ESG factor return in detail

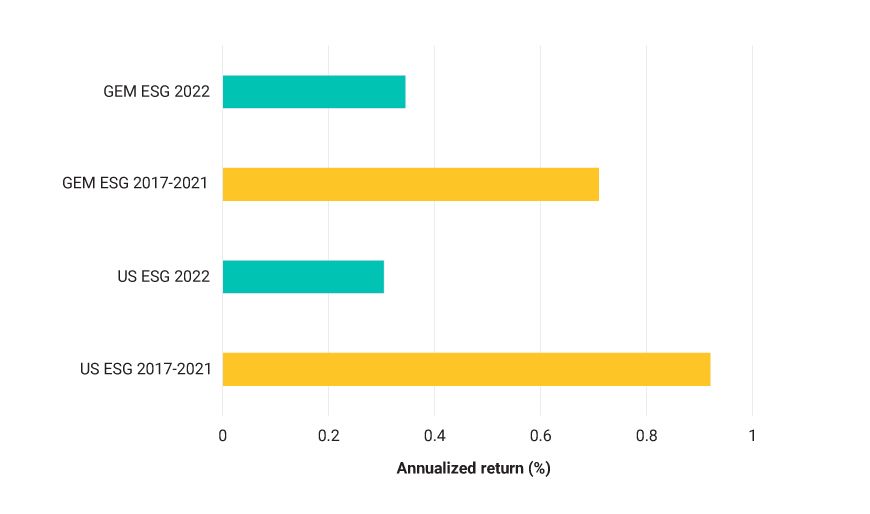

Based on the pure ESG factor performance within the MSCI Global Equity and MSCI USA Equity Factor Models,3 returns in 2022 were lower than during the previous five years but still positive (see exhibit below).

ESG factor performance for global and US equity markets

Note: GEM ESG refers to the ESG factor in the MSCI Global Equity Factor Model, US ESG refers to the ESG factor in the MSCI USA Equity Factor Model. Data as of Dec. 31, 2022. Source: MSCI ESG Research

We also assessed factor performance by sorting the ESG scores of constituents of the MSCI ACWI IMI in quintiles, from the bottom scoring constituents (quintile 1) to the top scoring (quintile 5).4 We observed that the top quintile companies outperformed those in the bottom quintile over 1-, 3- and 5-year time horizons. The same analysis for constituents of the MSCI World ex USA IMI, MSCI USA IMI and MSCI Emerging Markets IMI indexes yielded similar observations, although we found some variations for emerging markets over the 1-year horizon.5

Returns by ESG score quintile

Based on constituents of the MSCI ACWI IMI. Data as of Dec. 31, 2022. Source: MSCI ESG Research

A look at sector returns

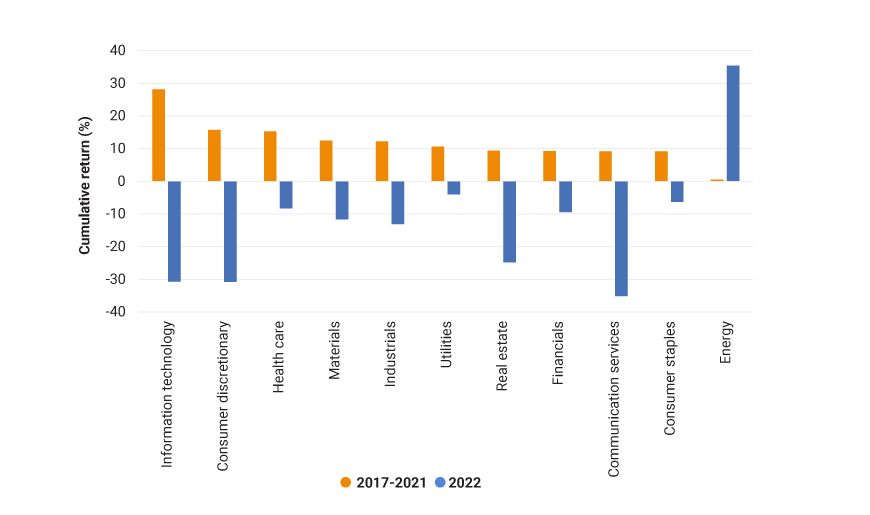

Global equity markets, as represented by the MSCI ACWI IMI, saw a strong sector rotation, as shown in the exhibit below. Energy was the best-performing sector, while the boom sectors of previous years — information technology and communication services — were the worst-performers.

Sector returns

Based on constituents of the MSCI ACWI IMI. Sectors based on GICS classification. Data as of Dec. 31, 2022. Source: MSCI ESG Research

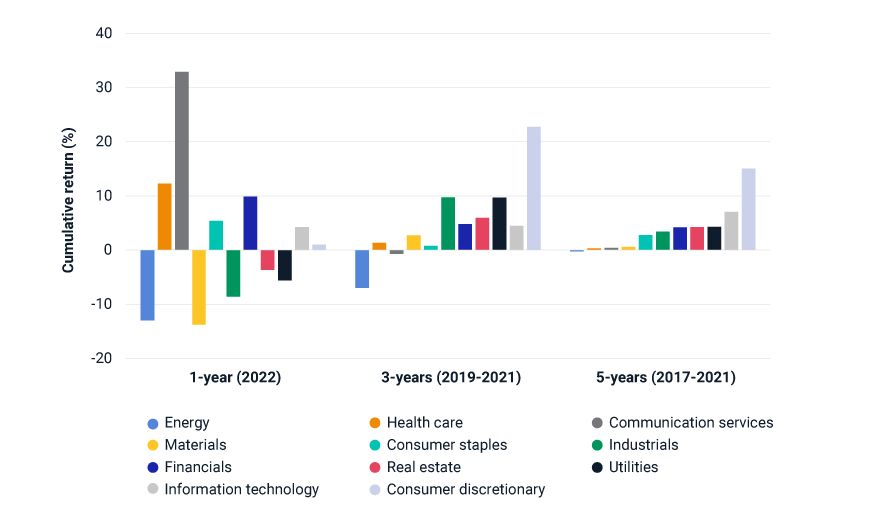

To get a clearer understanding of the impact of ESG on returns, we looked at its sector-performance contribution.6 Companies in the top ESG quintile outperformed those in the bottom ESG quintile for every sector over the 5-year horizon. It was a similar picture over the 3-year horizon too, with the exceptions being the energy and materials sectors. The picture was mixed for the 1-year horizon (2022), with outperformance of companies in the top ESG quintile observed in only six of the 11 sectors.

Active returns: Top ESG quintile vs. bottom ESG quintile

Based on constituents of the MSCI ACWI IMI. Data as of Dec. 31, 2022. Source: MSCI ESG Research

Our findings highlight that over longer periods of time, the ESG factor consistently showed positive or neutral performance across sectors, while over shorter periods of time results were more mixed, despite a positive performance at the global level.

The significance of sector, time and region

Based on our analysis, ESG factor performance remained positive in 2022, but was slightly below the level seen in previous years and not equally distributed across sectors and regions. This suggests that time horizons as well as specific sectors and regions may be significant in assessing the return characteristics of ESG portfolios.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1The MSCI ESG Score represents the ESG Ratings Final Industry-Adjusted Score that indicates how well an issuer manages its most material ESG risks relative to industry peers. Please refer to the MSCI ESG Ratings Methodology for more details.2Sectors in our analysis are based on the Global Industry Classification Standard (GICS®). GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.3This is the pure ESG factor return from the MSCI Global Equity Factor Model and from the MSCI USA Equity Factor Model. Details of the factor models and the estimation universe can be found at support.msci.com.4This approach is consistent with previous MSCI research: Foundations of ESG Investing; The Drivers of ESG Returns.5For emerging markets in 2022, top quintile companies did not outperform the bottom quintile companies.6MSCI ESG Ratings are industry-based and are intended to be interpreted relative to a company’s industry peers. For more information please refer to What MSCI’s ESG Ratings are and are not, and MSCI ESG Ratings Methodology.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.