ESG in Mexico: At a Fork in the Road?

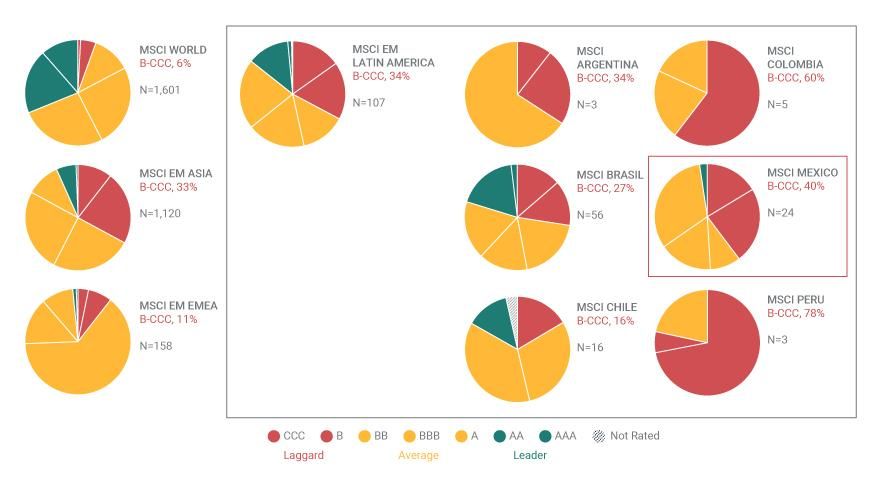

- Emerging markets are not all the same when it comes to ESG. In Latin America, the proportion of lower-ESG-rated companies ranged from 16% to 78% of individual country indexes, based on market capitalization.

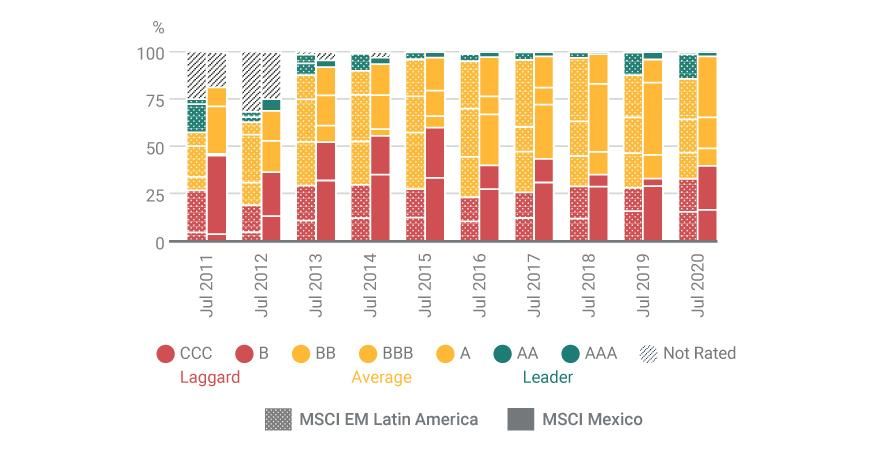

- While Mexican issuers' ESG risk mitigation has lagged Latin American efforts for a decade, this gap began to narrow in 2015, though it started to slip in the past two years.

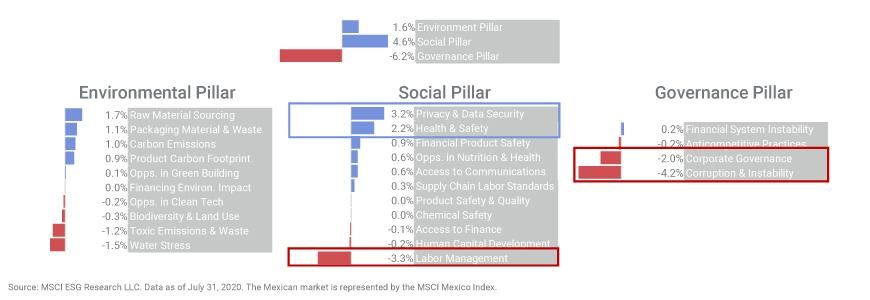

- Lagging anti-corruption, labor-management and corporate-governance practices threaten to reverse previous improvements, though a growing focus on ESG investing from regulators and investors may boost ESG practices.

Uneven Mitigation of ESG Risks in EM

The MSCI World Index represents large- and mid-cap equities across 23 developed-market countries. Data as of July 31, 2020. Source: MSCI's BarraOne®, MSCI ESG Research

Are Mexico's ESG Efforts Slipping?

Still, 40% represented a significant improvement from five years ago, when 60% of the MSCI Mexico Index's market cap was from ESG laggards. In addition — although the market cap representing top-rated companies remained small (2%), with no AAA-rated companies — the segment of the market with average ESG ratings increased to nearly two-thirds of the overall market. In prior research, we found that the potential financial upside for companies that had recently improved their ESG ratings, even if that improvement were limited, was greater than for companies that simply had higher ratings. There is evidence of slippage, however, as the market cap of bottom-rated companies had declined to 33% a year ago. By company count, the tally is similar: The number of lowest-rated companies increased to 42% this year from 35% in 2019 and 32% in 2018. See our interactive chart.

Ratings Distribution for MSCI EM Latin America and MSCI Mexico by Market Capitalization

Data from July 31, 2011, through July 31, 2020. Source: MSCI's BarraOne, MSCI ESG Research. See our interactive chart.

Top Issues: Anti-Corruption Measures, Labor Management and Corporate Governance

Different ESG considerations pose different risks to different industries, but often we can see patterns across markets regarding how companies manage — or fail to manage — specific issues. Among Mexican companies, we found the top three ESG issues were lagging anti-corruption measures, labor management and corporate governance. These three exhibited the largest gaps between companies' risk-exposure levels and strength of risk management. The exhibit below lists all of the relevant ESG issues we identified for constituents of the MSCI Mexico Index, based on the standardized MSCI ESG Ratings methodology, where each company typically is evaluated on the top four to eight issues most relevant to its particular business model. This exhibit also shows the gap for each issue, by ESG pillar, relative to the overall systemic ESG risks and opportunities that characterized the Mexican market in general, as of the end of July 2020.2 This allows us to see clearly which ESG issues were more — or less — successfully addressed by Mexican companies.

Systemic ESG Exposures in the Mexican Market

Data as of July 31, 2020. Source: MSCI's BarraOne, MSCI ESG Research

Despite Mexican issuers' two-year slippage in their ESG ratings, domestic regulators and pension funds have been paying closer attention to ESG investing, which could put issuers under increased pressure to improve.3 As domestic attention to ESG increases, it may be useful to examine where individual Mexican firms fall along this spectrum, and in which direction they have been traveling, particularly when it comes to anti-corruption measures, labor management and corporate governance.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1MSCI ESG Research LLC rates companies on a scale from AAA to CCC, according to their exposure to ESG risks and how well they manage those risks relative to peers. Companies rated as CCC or B are considered “ESG Laggards”; companies rated BB, BBB and A are considered “ESG Average”; and companies rated in the top two categories are considered “ESG Leaders.”2ESG pillars group environmental, social and governance Key Issues under each of these three categories.3“Afores invierten en proyectos sustentables de largo plazo y que dan mayores rendimientos a los trabajadores.” Amafore, June 5, 2020. “Climate and Environmental Risks and Opportunities in Mexico’s Financial System from Diagnosis to Action.” Banco de Mexico and United Nations Environmental Programme, February 2020.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.