Factors separated fact from fiction

- Factors have evolved to create transparency and be of use to a broad range of investors.

- We've used factors to challenge or confirm conventional wisdom and differentiate fact from fiction.

- As tools become more transparent and approachable, they may bring greater insight and clarity to portfolio characteristics and drivers of performance.

None | None | None | None | None | None | None | None |

Book-to-price Earnings yield Long-term reversal | Size Mid cap | Momentum | Leverage Earnings variability Earnings quality Investment quality Profitability | Dividend yield | Beta Residual volatility | Growth | Liquidity |

Factors and the fundamental investor

Traditional fundamental investors typically conduct deep research on a company to arrive at what they determine to be a fair or intrinsic value for the company. These investors generally start by analyzing a company's fundamentals — including its valuation ratios, profitability, leverage and capital structure — which are all factors. The analyst may conduct further research to arrive at longer-term projections and valuations, but the starting point and bedrock of the analysis is factors, regardless of whether the analyst uses that term.Factors and the markets

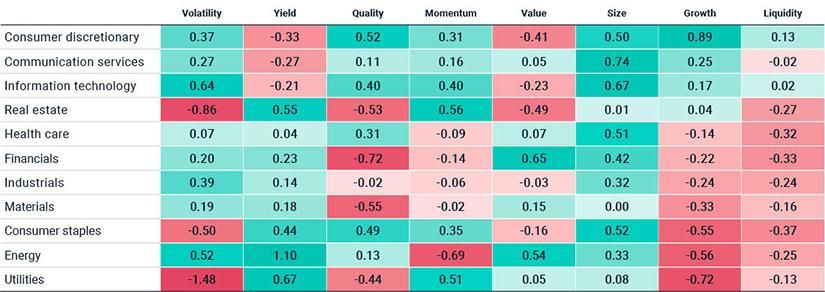

Just as a fundamental analyst may use factors to screen or rank companies, we can use factors to understand which companies and groups of companies drove various characteristics in the market. Some of the findings may run counter to conventional wisdom. For example, in looking at the average FaCS exposures by sector within the MSCI USA Large Cap Index as of Sept. 30, 2019, we see that the sector with the highest exposure to growth is consumer discretionary, though conventional wisdom suggests information technology should have the highest exposure. As detailed in The FaCS report, technology has actually exhibited a decline exposure to the growth factor since the 1990s, and today has only minor positive growth exposure. Digging deeper, we see that companies like Amazon.com Inc. and Tesla Inc. drove the high growth exposure in consumer discretionary. These firms have technology at the core of their businesses, but do not lie within the technology sector. At the other end of the spectrum, we see that the utilities sector had the lowest growth exposure. This may not appear surprising; however, we also see that utilities had the second-highest exposure to momentum, illustrating that growth and momentum were not the same, another common perception. As another example, while many may not be surprised that financials had the highest exposure to value, the most expensive sector (most negative exposure to value) was not information technology but real estate, which also happened to have the highest momentum exposure.MSCI FaCS exposures by sector

Market-cap-weighted average exposures as of Sept. 30, 2019, for the MSCI USA Large Cap Index universe. Sectors are ordered by growth exposure.Factors and mutual funds

We have previously examined the factor exposures of active mutual funds1 and found that, on average, funds with "value" in their names had positive exposure to FaCS value, "income" funds had positive exposure to FaCS yield and so on through different types of funds. However, we also found a small number that had negative exposure to the target factor implied by their fund name. With the poor performance of value and strong performance of momentum in the U.S. over the last several years,2 some value managers may have been tempted to drift away from their official mandate toward styles that were in favor. Factors have helped us identify such situations and understand the drivers of portfolio performance. Factor investing and advances in technology brought the application and language of factors to many institutional investors. What had been the realm of sophisticated quantitative investors has been made accessible to many, bringing greater transparency and potential insight. The FaCS report Factors in Focus: Momentum hits a valuation speed bump Do factors stand up to FAANG? Introducing MSCI FaCS

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.