Finding Value: Understanding Factor Investing

Blog post

July 9, 2015

Despite agreement on the principles of value investing, the investment community uses a number of different metrics to describe the value factor. Each metric (or descriptor) has its own advantages and pitfalls.

For example, book value per share, representing common equity available to shareholders, is a stable measure, but backward looking. Earnings yield can be forward-looking, but it is subject to accounting distortions, does not reflect financial leverage and can be subjective.

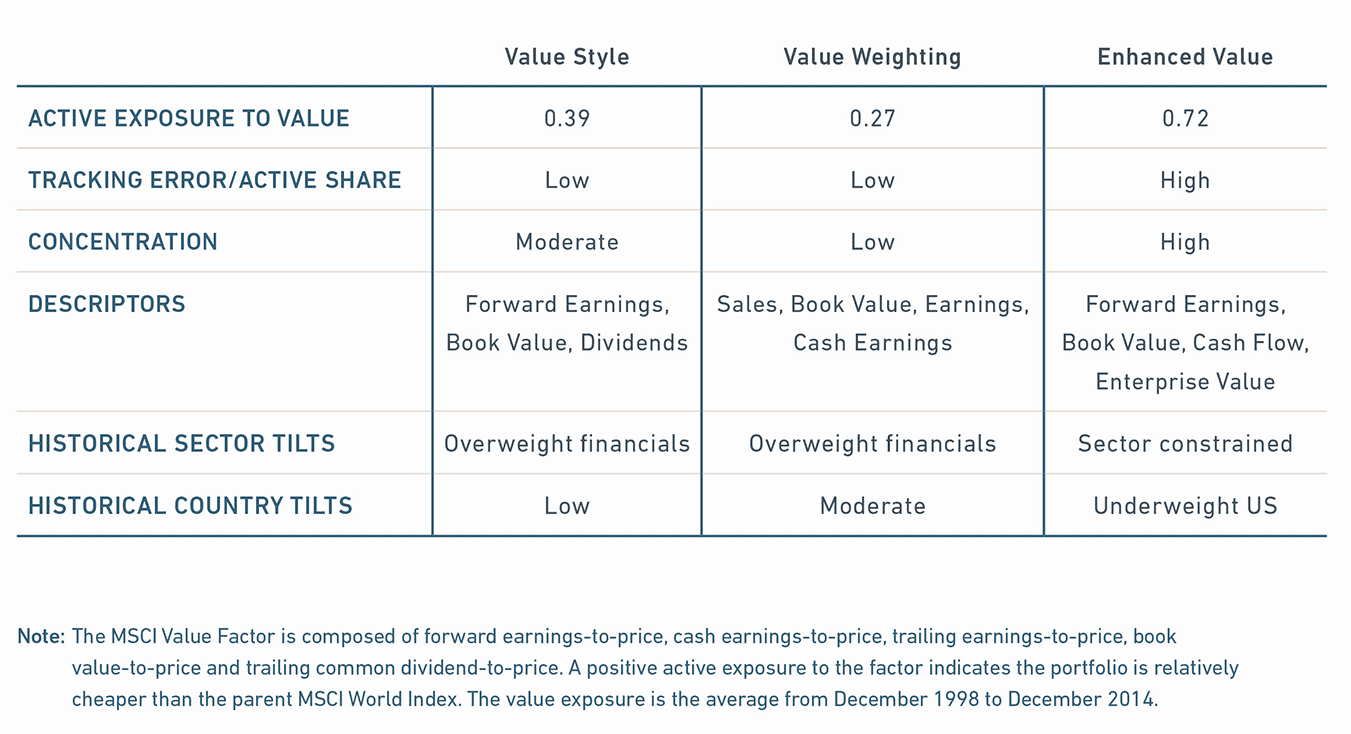

MSCI has created a common definition of value that includes multiple descriptors. Combining descriptors helped achieve a more consistent risk-return profile and better captured the value factor, one of six factors that MSCI has identified as offering a premium over long time periods. To implement the value factor in passive portfolios, three generations of value indexes are now available:

- Traditional value indexes. First-generation style indexes were introduced as benchmarks in the 1980s. However, their use of capitalization weighting may introduce unintended sector and other factor biases.

- Fundamentally weighted or Value Weighted Indexes. Developed in the 2000s, these approaches decouple an asset's index weight from its price. They tend to have low tracking error and high capacity but can have unintended sector tilts and offer a relatively low exposure to the value factor.

- High exposure indexes. Introduced in 2014, MSCI Enhanced Value Indexes combine multiple descriptors. High exposure indexes provide higher tracking error and higher active drawdowns when value is out of favor.

Summary of MSCI's Global Value Index Construction Methods

MSCI's Enhanced Value Indexes provide the purest approach to the value factor, as well as mitigating pitfalls that affect earlier iterations of value indexes. However, investors needing very high capacity or with very tight risk budgets might look instead to the second-generation approaches used in MSCI's Value Weighted Indexes.

Read the paper, "Finding Value," the first in a series.

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.