Identity Check — ESMA’s New Name Guidelines for ESG and Sustainability-Related Funds

Blog post

June 5, 2024

Key findings

- Roughly 30% of the SFDR Article 8 and 9 funds universe, representing EUR 1.9 trillion in assets, could be affected by ESMA’s fund-naming guidelines due to their use of sustainability-related terminology.

- European funds using restricted terms in their names must apply specific fossil-fuel exclusions. Nearly 26% of the Article 8 and 9 funds universe could face a choice between divestments or a name change.

- Funds with sustainability-related names must invest “meaningfully” in sustainable investments as defined in SFDR Article 2(17). Self-reported figures suggest a wide range of current allocations, with higher figures for Article 9 funds.

In May 2024, the European Securities and Markets Authority (ESMA) published its final guidelines on fund names using ESG- or sustainability-related terms.[1] The rules impose quantitative thresholds and mandatory exclusions on funds using restricted terms, meaning affected funds will need to either meet requirements or change their names.

Checking names

Across more than 14,000 SFDR (EU Sustainable Finance Disclosure Regulation) Article 8 and 9 funds, approximately EUR 6 trillion is invested in strategies with an ESG or sustainability focus. The new name guidelines outline six term types: transition, environmental, social, governance, impact and sustainability. Notably, the rules apply to any words in a fund's name that might give investors the impression of a focus related to one or more of these six areas. The specific rules depend on which type of terms are used.

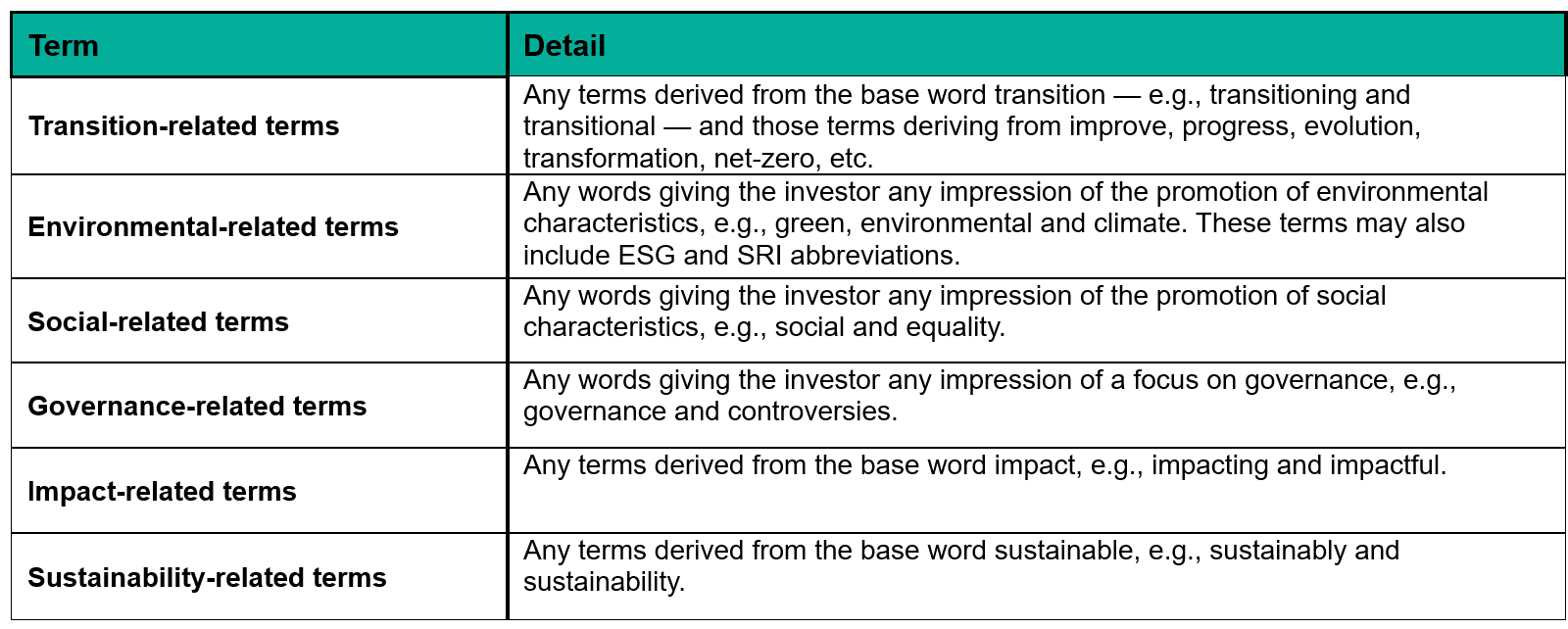

Terms governed by ESMA fund-name guidance

As of May 14, 2024. Source: ESMA

Where relevant terms appear in the European fund universe

We applied a text-based algorithm to the universe of over 14,000 Article 8 and 9 funds to identify those with names that might fall under the new rules.[2] Although ESMA has not provided a comprehensive list of keywords, we flagged fund names that included a range of associated terms. For example, we classified funds under the environmental category where names included keywords such as environment, planet, ecosystem and nature.[3] Nearly all (99%) of the analyzed funds were under UCITS or AIFMD and therefore in scope of the regulation. Very few Article 6 funds (<200) had ESG- or sustainability-related names.

About 30% of the Article 8 and 9 fund names included keywords that appeared relevant to the naming rules. This group of 4,297 unique funds (excluding their numerous share classes and currency lines) accounted for EUR 1.9 trillion in assets as of the second quarter of 2024. Specifically, we estimate that 26% of Article 8 funds and 81% of Article 9 funds had names that could be affected by the new guidelines. For the remaining funds, our algorithm did not identify any relevant terms in their names.

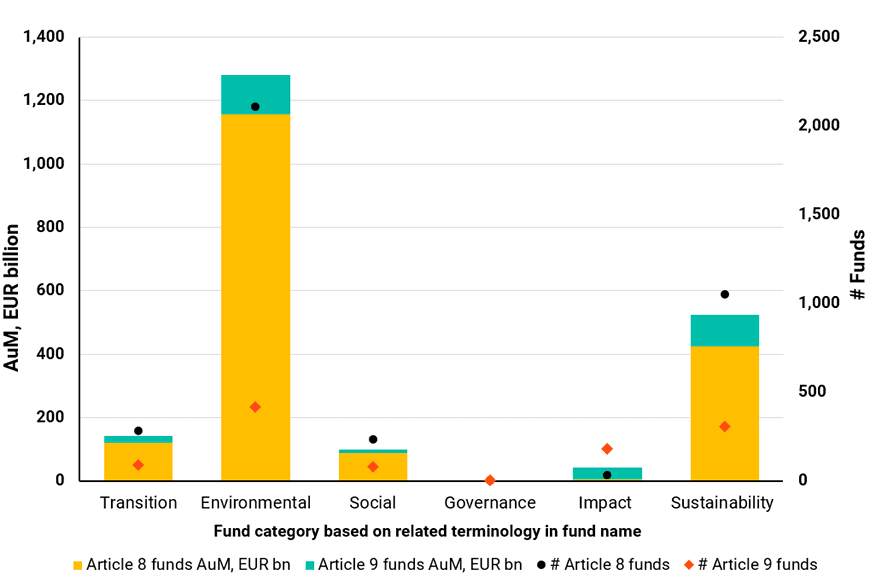

Terms related to environmental and sustainability accounted for the largest portion of identified fund names, followed by transition and social. Impact and governance had the least, with very few funds including governance-related terms in the name.

It should be noted that categorizing funds based on names and keywords is not entirely straightforward. European funds are named in a variety of languages and some names include multiple terms (e.g., SRI Sustainable Impact Fund). For combinations, ESMA's guidelines state that relevant requirements apply cumulatively unless they include transition-related terms; then only the less-restrictive transition requirements apply.

Environmental- and sustainability-related terms account for the bulk of Article 8 and 9 fund names

Number of unique SFDR Article 8 and 9 funds with identifiable keywords related to ESMA guidance classification: 4,297. Data as of May 20, 2024. Source: MSCI ESG Research

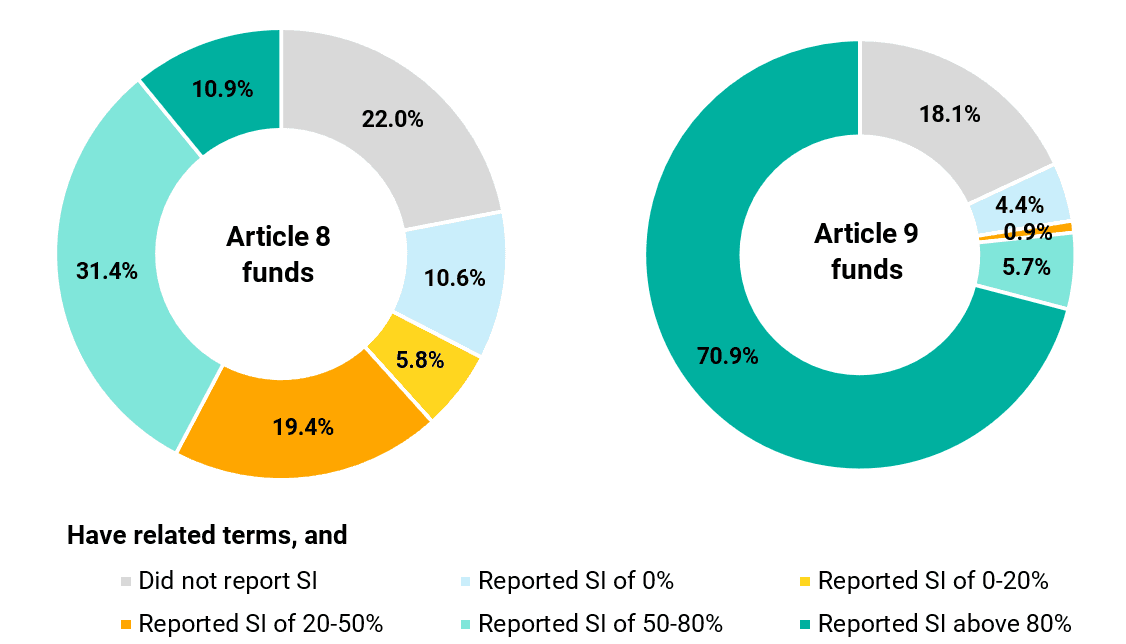

Meeting 'meaningful' sustainable-investment thresholds

ESMA requires funds across all naming categories to meet an 80% threshold for investments tied to environmental or social characteristics or sustainable-investment objectives. Funds with sustainability-related names must also commit to invest "meaningfully in sustainable investments referred to in Article 2(17) of the SFDR." "Meaningfully" has not been further defined. Using MiFID's sustainable-investment (SI) disclosures for Article 8 and 9 funds from the latest European ESG template (EET), we found over 70% of Article 9 funds reporting SI above 80%, while figures were generally lower for Article 8 funds.

Article 9 funds with sustainability-related terms in the name reported a higher allocation to sustainable investments

Number of SFDR Article 8 and 9 funds with sustainability-related terms in their names from April 2024 EET disclosures: 900. Note: the EET disclosure file does not encompass the full Article 8 and 9 funds universe. Data as of May 20, 2024. Source: MSCI ESG Research

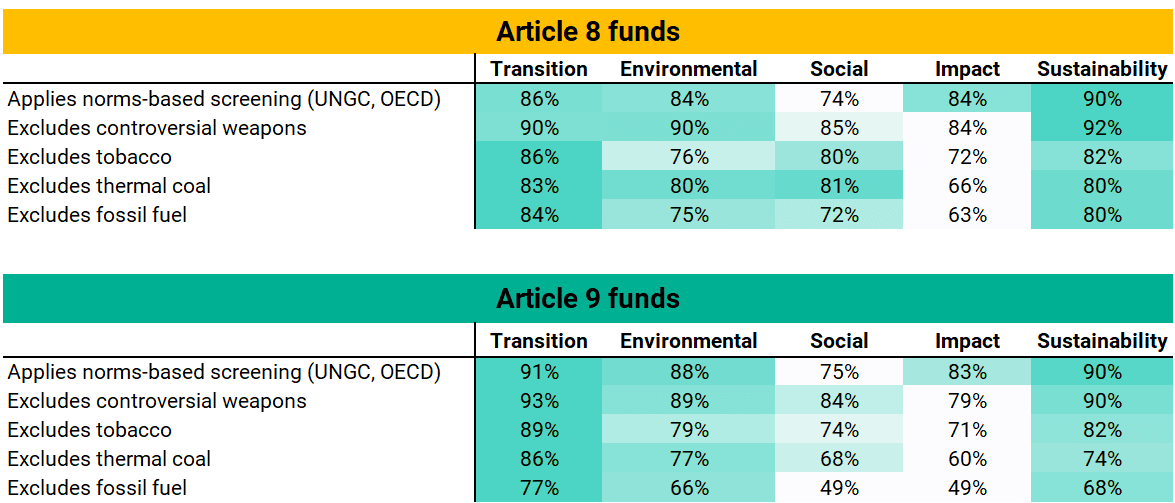

Exclusions for Paris-aligned benchmarks could apply to almost 26% of Article 8 and 9 funds

Alongside baseline exclusions on controversial weapons, tobacco and global-norms violations, funds with environmental-, impact- or sustainability-related names must apply exclusions related to fossil fuels, as required for EU Paris-aligned benchmarks (PAB).[4] We identified approximately 3753 European funds that may be subject to these requirements based on their current names, or about 26% of the Article 8 and 9 fund universe, with collective assets exceeding EUR 1.7 trillion. However, many Article 8 and 9 funds already exclude thermal coal and some fossil fuels, so the gap to full PAB alignment may not be too large for those that opt not to change their names.

Exclusions status quo of Article 8 and 9 funds

Number of unique SFDR Article 8 and 9 funds with identifiable keywords related to ESMA guidance: 4,297. Data as of May 20, 2024. Source: MSCI ESG Research

Possible regulatory divergence?

Much of the European fund universe is not fully aligned with the naming guidelines at present. Other jurisdictions have started to work on naming rules as well. ESMA noted existing regulatory approaches outside the EU, in particular the U.S. Securities and Exchange Commission's fund-names rule, which requires funds whose names suggest a focus on a particular type of investment to dedicate at least 80% of the value of their assets in those investments.[5] The degree of prescription between the jurisdictions varies substantially, however.

Subscribe todayto have insights delivered to your inbox.

1 “Final Report – Guidelines on funds' names using ESG or sustainability-related terms,” ESMA, May 14, 2024.2 Article 8 funds promote, among other characteristics, environmental or social characteristics or a combination of both. Article 9 funds must have a sustainable investment as its objective, in addition to adhering to good-governance practices and considering the principle of “do no significant harm” and adverse-impact indicators. For more information, refer to “The SFDR's Articles 8 and 9: The Funds Behind the Labels,” MSCI ESG Research, July 2021.3 Including variant forms of such words across European languages.4 For more information, refer to “Commission Delegated Regulation (EU) 2020/1818,” Official Journal of the European Union, July 17, 2020.5 “SEC Adopts Rule Enhancements to Prevent Misleading or Deceptive Investment Fund Names,” Securities and Exchange Commission, Sept. 20, 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.