Investor Pressure May Help APAC Companies Minimize Asset-Stranding Risk

Key findings

- A managed coal phaseout can help power generators reduce asset-stranding risk and help countries achieve their decarbonization targets.

- The Asia-Pacific region accounts for most of the existing and planned coal-power capacity globally, although some companies are more exposed than others.

- Investors can identify and work with companies to phase out their coal in an orderly manner by initially prioritizing engagement over divestment and exclusion strategies.

Changing market dynamics and policy have put coal-fired power generators at a cost disadvantage — three-quarters of new wind farms and solar plants now have lower generation costs than fossil-fuel power stations.[1] Furthermore, at COP28, almost 200 nations agreed on a roadmap to shift away from fossil fuels by tripling renewable-energy capacity and doubling the rate of energy-efficiency improvements by 2030,[2] while more than 20 countries pledged to triple global nuclear capacity by 2050 vs. 2020.[3] Global coal use may have peaked in 2023[4] and is projected to gradually decline in the coming years.[5]

In this blog post, we assess where the impact of these shifting dynamics may be felt the most, what this could mean for utilities companies and why active engagement strategies may be the way forward for investors.

Largest impact in APAC

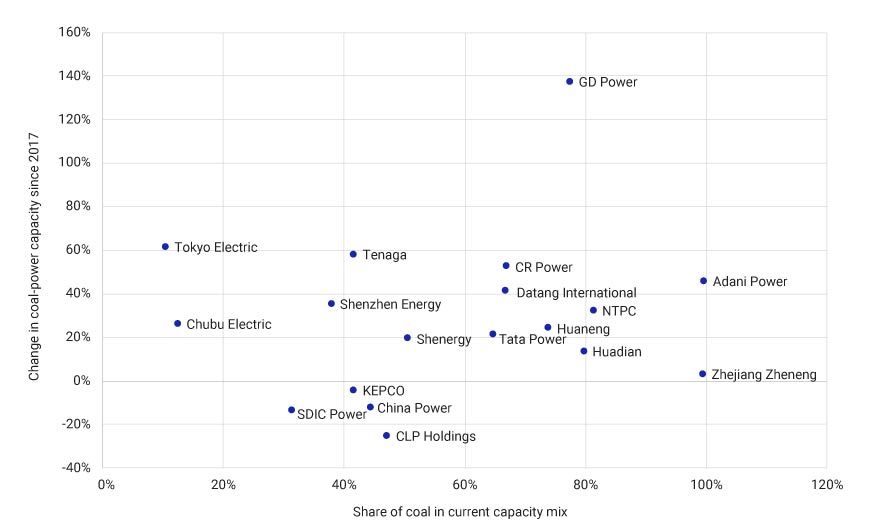

Utilities based in Asia-Pacific (APAC) could be hardest hit amid a risk of stranded assets and higher cost of capital. This is because many APAC-based electricity producers continue to invest in new coal-fired power plants even though most of their peers elsewhere have focused on shifting away from coal. Within APAC-listed power generators in our coverage, GD Power Development Co. Ltd., Tenaga Nasional Berhad (Tenaga), China Resources Power Holdings Co. Ltd. (CR Power) and Adani Power Ltd. stand out as utilities with both a significant (>40%) share of coal in their power mix and aggressive growth (>45%) in their coal-fired power capacity since 2017.

APAC utilities: Growth in coal-power capacity vs. coal share in current power mix

Utility constituents of MSCI ACWI Investable Markets Index (IMI) as of Jan. 15, 2024, incorporated in the APAC region with at least five gigawatts (GW) of installed coal-fired power-generation capacity. Estimates are based on the latest company disclosures as of Jan. 15, 2024. Source: MSCI ESG Research

As a result of its focus on coal, the APAC region accounted for 78% of operational and 96% of planned coal-fired electricity-generation capacity globally.[6] Based on our previous study, these APAC-based coal-power plants, if not phased out, could add approximately 215 gigatons of carbon emissions from 2024 to 2050, which is more than 40% of the remaining global carbon budget under a 1.5-degree pathway.[7] That said, a rapid coal phaseout would present practical challenges for APAC countries and utilities that still heavily depend on coal-fired power generation for both employment opportunities and a relatively cheap and reliable source of energy.

An orderly (i.e., managed) phaseout of coal power through early retirements, a commitment to no new coal development (excluding projects under construction) and an accelerated deployment of renewables may therefore help utilities reduce asset-stranding risk while achieving a more gradual (less disorderly) transition in a just and equitable manner for the affected employees, communities and consumers (also known as "just transition").

Investor action can make an impact

This provides an opening for investor-led climate-related engagement strategies, such as the Asian Utilities Engagement Program by the Asia Investor Group on Climate Change (AIGCC), which represents 19 investors that collectively manage more than USD 12 trillion in assets. Following engagement by the AIGCC, Tenaga and Persero committed to retire some of their coal plants early,[8] while CLP Holdings Ltd.-owned EnergyAustralia recently announced an AUD 5 billion action plan for climate transition that involves early coal-power retirement as well as expanding renewables and energy-storage capacity.[9]

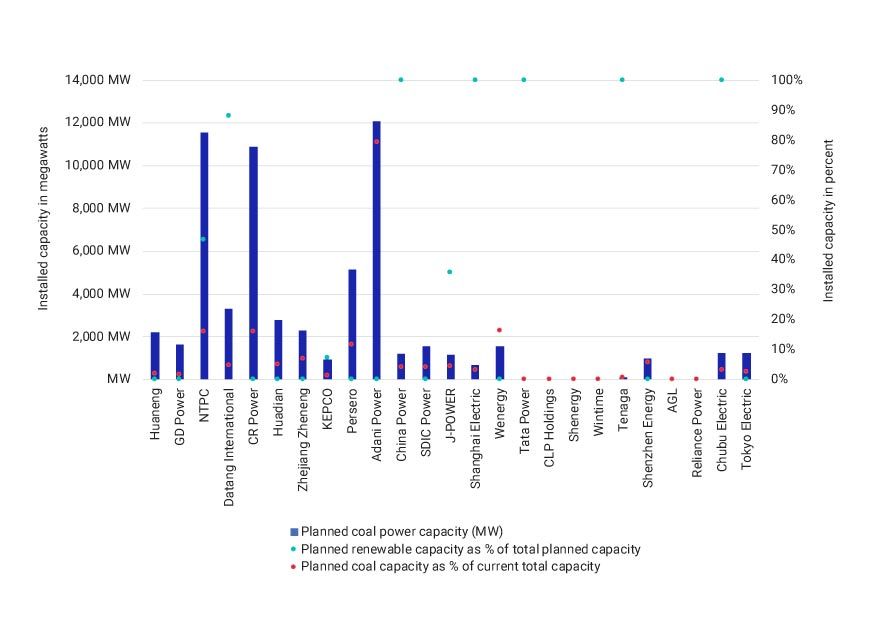

Among the major APAC-listed coal-fired power generators, NTPC Ltd. and Adani Power in India, China's CR Power and China Huadian Corp. and Persero in the Philippines are the utilities with the largest planned absolute coal-power capacity additions, as of Jan. 15, 2024. Among these five companies, only NTPC planned to add more renewable capacity than coal.

APAC utilities: Planned coal capacity vs. planned green capacity

Utility constituents of MSCI ACWI IMI as of Jan. 15, 2024, incorporated in the APAC region with at least 5 GW of installed coal-fired power-generation capacity. Estimates are based on the latest company disclosures. Source: Urgewald, MSCI ESG Research

Orderly coal phaseout can reduce asset-stranding risk

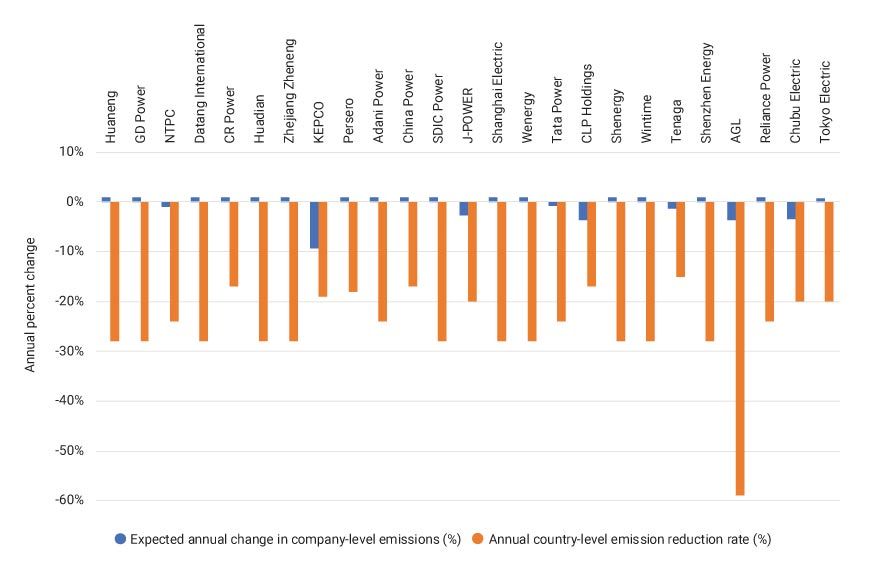

Our calculations suggested that for APAC countries to achieve an orderly coal phaseout in a 2-degree pathway, they would need to cancel all pre-construction and under-construction coal-power projects and reduce the power-generation output of existing coal-fired units by 13-81% annually between 2024-2050.[10] This could be done by replacing their coal plants with clean-power generation. We compared companies' projected emissions based on their existing reduction targets with what would be implied by a 2-degree-aligned path for the coal-power generation sector in their home country, to look for gaps between what countries may be aiming for and what companies are planning to deliver.[11] Our analysis suggests that Tenaga, CLP Holdings and Korea Electric Power Corp. (KEPCO) would have the smallest gap. By contrast, AGL Energy Ltd. and most coal-power generation peers based in mainland China would have the widest gap. Our calculations assumed that utilities would achieve their emission-reduction goals, if they have any, or increase their emissions by 1% per year if they don't have any valid decarbonization targets.[12] Engagement strategies by investors can help these utilities reduce their asset-stranding risk through an orderly coal phaseout.

Expected annual Scope 1 emissions reductions of countries vs. companies under a 2 degrees C scenario

Utility constituents of MSCI ACWI IMI as of Jan. 15, 2024, incorporated in the APAC region with at least 5 GW of installed coal-fired power-generation capacity. The annual country-level reduction rate is based on MSCI's estimate of coal-power generation volume in 2024 in a given country and cumulative projected coal-power generation volume between 2024 and 2050 in a 2-degree-aligned scenario. The 2-degree-aligned coal-power generation-volume scenario is based on the Network for Greening the Financial System's "Below 2oC" scenario (REMIND-MAgPIE 3.0-4.4). This analysis is based on modeling assumptions mentioned in our previous report "Simulating a Managed Phaseout of Coal-Fired Power Plants in the Asia-Pacific Region" and NGFS' "Below 2oC" scenario (REMIND-MAgPIE 3.0-4.4) for coal-power generation. Each company is being compared to its country of incorporation. Estimates are based on the latest company disclosures, as of Jan. 15, 2024. Source: MSCI ESG Research

Promoting an orderly transition

As the world prepares to move toward a low-carbon future, asset-stranding risk for coal-power producers, especially with plans for further capacity additions, is increasing. Abrupt closures of such plants in future years may create issues related to energy security and jobs. Investors who want to promote an orderly transition can use engagement strategies to help these utilities reduce their asset-stranding risk through an orderly coal phaseout and minimize the risk in their portfolios.

Subscribe todayto have insights delivered to your inbox.

1 “Renewables 2023: Analysis and forecast to 2028,” International Energy Agency, January 2024.2 “COP28 ends with call to 'transition away' from fossil fuels; UN Chief says phaseout is inevitable,” United Nations Sustainable Development Group, Dec. 13, 2023.3 “COP28 recognises the critical role of nuclear energy for reducing the effects of climate change,” OECD Nuclear Energy Agency, Dec. 21, 2023.4 Gavin Maguire, “Global coal exports and power generation hit new highs in 2023,” Reuters, Jan. 18, 2024.5 “Coal 2023: Analysis and forecast to 2026,” International Energy Agency, December 2023.6 “Global Coal Plant Tracker - January 2023 release,” Global Energy Monitor, January 2023.7 “Analysis: What the new IPCC report says about when world may pass 1.5C and 2C,” Carbon Brief, Aug. 10, 2021.

Joeri Rogelj et. al, “Mitigation Pathways Compatible with 1.5°C in the Context of Sustainable Development," Intergovernmental Panel on Climate Change, October 2018.8 “Asian Utilities Engagement Program: 2022-2023 Year in Review,” Asia Investor Group on Climate Change, August 2023.9 “Climate Transition Action Plan,” EnergyAustralia, Aug. 18, 2023.10 Based on the assumptions mentioned in our previous report “Simulating a Managed Phaseout of Coal-Fired Power Plants in the Asia-Pacific Region” and Network for Greening the Financial System's (NGFS) Below 2 oC scenario (REMIND-MAgPIE 3.0-4.4) for coal power generation.11 2-degree-aligned coal-power generation trajectory is based on NGFS' “Below 2oC” scenario (REMIND-MAgPIE 3.0-4.4).12 “Implied Temperature Rise Methodology,” MSCI ESG Research, February 2024.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.