Macro Scenarios in Focus: Adapting to the New Normal

Key findings

- Markets seem to be priced for a soft landing, in which inflation returns close to target levels and recession is avoided. We consider, however, two distinct downside-risk scenarios: a hard landing and a resurgence of inflation.

- In our most optimistic scenario, productivity growth — potentially fueled by AI — could bolster long-term growth prospects, creating an environment favorable to equities.

- The value of a diversified portfolio of global equities and U.S. bonds could gain 4% under the soft-landing scenario, while a hard landing or inflation resurgence might lead to losses of 1% and 8%, respectively.

Concerns about a recession faded during 2023, as the U.S. economy showed surprising resilience and inflation rates steadily decreased. The much-talked-about economic "soft landing" seems increasingly attainable: A recent survey revealed that the majority of polled economists believe there is only a small chance of a recession in 2024.[1] This view is aligned with our soft-landing scenario, under which the value of a diversified portfolio of global stocks and U.S. bonds could gain 4%. Downside-risk scenarios, such as "hard landing" and "inflation resurgence," could result in 1% and 8% losses, respectively. Our most optimistic scenario, assuming a positive productivity shock potentially driven by AI, could lead to a portfolio gain of 12%.

Adapting to the new normal

In our recent paper, we explored five key investment themes for 2024. These include strategic developments like global power shifts, the widespread deployment of AI and the ongoing energy transition, all anticipated to gain momentum this year. The macro backdrop will continue to drive short-term investor concerns, however. We revised our four scenarios for 2023, accounting for updated economic forecasts and recent market prices. While high long-term bond yields are somewhat at odds with the high valuations of equities, the potential for productivity increases from large-language-model-based innovations, along with the resilience of economic growth in 2023, might justify current equity prices. But geopolitical conflict remains a risk factor, as escalating conflicts could result in rising energy prices and increased inflationary pressures.

We used the MSCI Macro-Finance Model to assess one-year expected returns under the soft-landing scenario in which the Federal Reserve successfully gets inflation under control while avoiding recession. We then compared the returns to the historical model-implied baseline expected returns. The exhibit below shows that U.S. fixed income has become significantly more attractive compared to the past 25 years. Equities' expected returns slightly decreased compared to the previous quarter's forecast, further narrowing the gap between equities and bonds.

One-year expected returns for major US asset classes under the baseline soft-landing scenario

Expected returns are generated by the MSCI Macro-Finance Model, as of December and September 2023. The blue bars represent the average and one-sigma bands of historical estimates of the asset classes' expected returns between 1998 and 2023.

In addition to updating the soft-landing scenario, we also revisited the risk-factor shocks for three alternative scenarios, two reflecting downside and one upside risk:

- Hard landing: Overaggressive monetary policy effectively curbs inflation but at the cost of a U.S. recession in 2024. The Federal Reserve slashes rates to try to correct course. Slowing demand puts downward pressure on oil prices.

- Inflation resurgence: Central-bank policy does not tame inflation, eroding central banks' credibility. Inflationary pressures resurface, and oil prices surge. High prices and interest rates weigh on growth for an extended period.

- Increased productivity: Productivity growth — potentially fueled by AI — leads to robust economic expansion without strong inflationary pressures. This scenario assumes AI's downside risks are avoided.

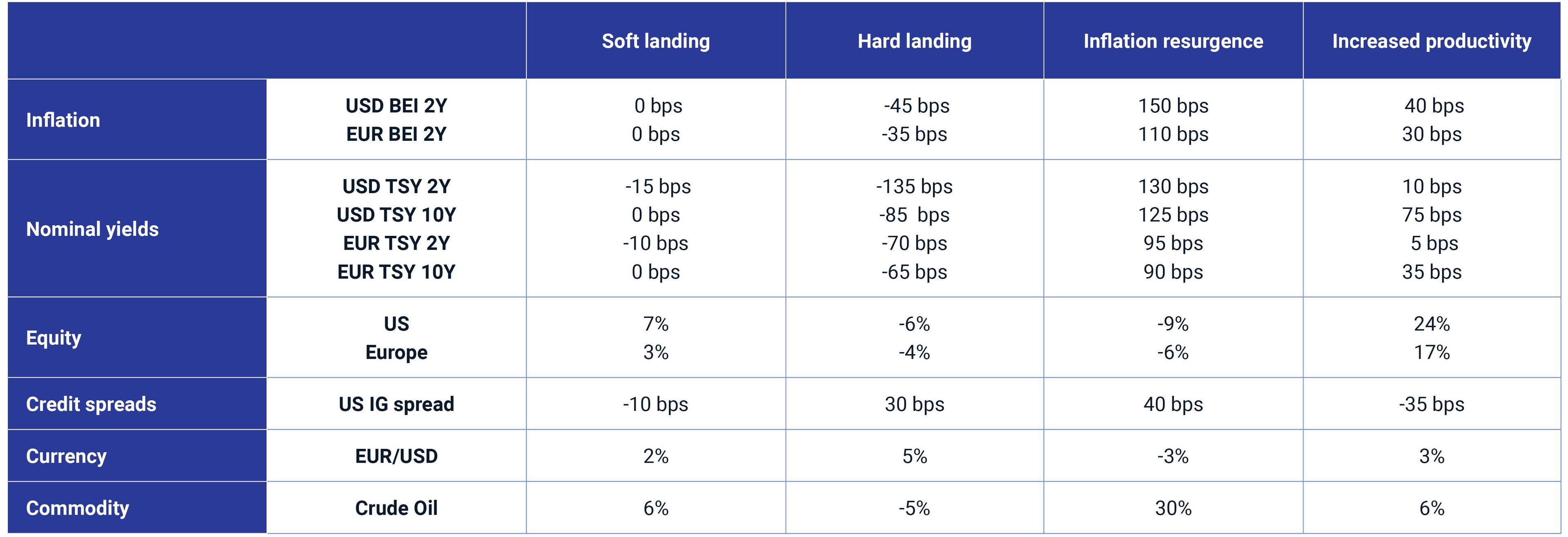

Our scenario assumptions

Assumptions about risk-factor shocks are informed by the MSCI Macro-Finance Model, analysis of historical data and judgment. Breakeven inflation (BEI) is measured in basis points (bps). These are not forecasts, but hypothetical narratives of how the macroeconomic scenarios could affect multi-asset-class portfolios over a horizon of one year. A positive shock for EUR/USD means the U.S. dollar is weakening relative to the euro.

Potential implications for financial portfolios

To assess the scenarios' impact on multi-asset-class portfolios, we used MSCI's predictive stress-testing framework and applied it to a hypothetical globally diversified portfolio, consisting of global equities, U.S. bonds and real estate.[2] The portfolio's value gained 4% under the soft landing. Under the more bearish hard landing, the portfolio's value dropped by 1% as rallying bonds offset the sell-off in equities. The inflation-resurgence scenario hurt the portfolio most, with an 8% loss, as bonds and equities traded down simultaneously. Our most optimistic scenario, assuming AI's positive impact, gained 12%. The interactive exhibit below shows more-detailed results.

Impact to portfolio values under our scenarios

Loading chart...

Please wait.

Portfolio impact of the scenarios based on market data as of Dec. 29, 2023. Note that the above stress-test results capture the effect of repricing the assets, not the income component. Treasury inflation-protected securities (TIPS) are represented by the iBoxx TIPS Inflation-Linked Index provided by S&P Dow Jones Indices. U.S. Treasurys, equities and corporate bonds are represented by MSCI indexes. Private equity is represented by model portfolios. U.S. real estate is represented by the MSCI/PREA U.S. AFOE Quarterly Property Fund Index. The composite portfolio is 50% global equities (35% public and 15% private), 10% U.S. Treasurys, 10% TIPS, 10% U.S. investment-grade bonds, 10% U.S. high-yield bonds and 10% U.S. real estate. Source: S&P Global Market Intelligence, MSCI

Summing up

The soft-landing scenario is most consistent with current economic and market forecasts and features modest gains across asset classes. The downside scenarios of a hard landing and inflation resurgence are most differentiated by their impact on fixed-income assets, with the hard-landing scenario assuming a transition back to a lower-rate environment. AI is expected to continue as a key theme, with its potential to increase economic productivity and thereby boost returns.

Subscribe todayto have insights delivered to your inbox.

1 Colby Smith and Eva Xiao, “Economists see Fed keeping rates at 22-year high until at least July,” Financial Times, Dec. 6, 2023.2 The results are generated by using model correlations to propagate shocks to the portfolios, using MSCI's BarraOne®. MSCI clients can access BarraOne and RiskMetrics® RiskManager® files for these scenarios on the client-support site.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.