Investment Trends in Focus: Five Key Themes for 2024

Research Paper

January 2, 2024

Preview

2024 could be the year when major structural shifts in the economy start to have a significant effect on institutional and individual investors alike. MSCI remains committed to providing the data, models and tools that will help investors navigate both cyclical and structural challenges.

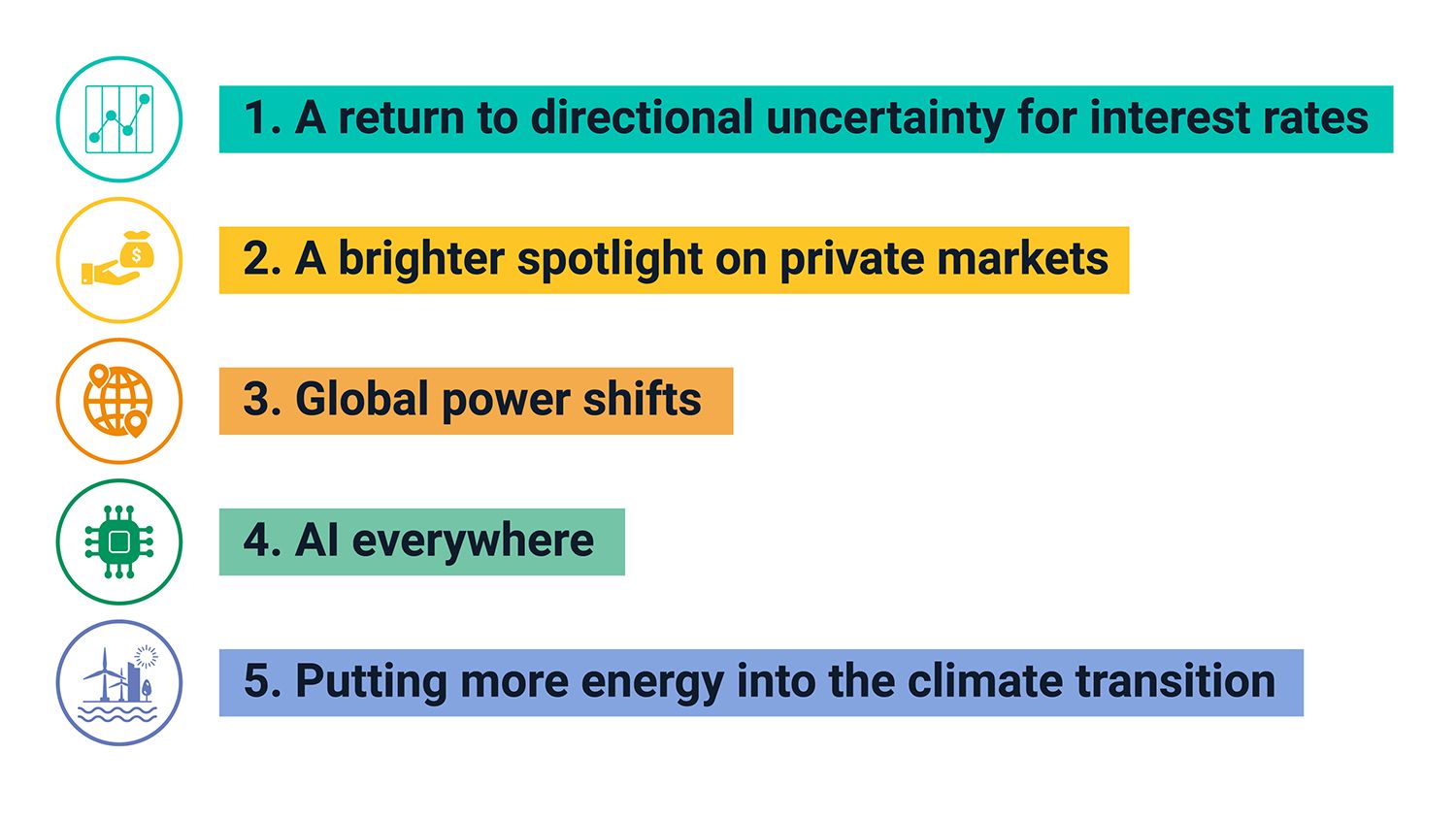

With this backdrop, MSCI's chief research officer, Ashley Lester and team have identified five key themes for this year. The macro backdrop will continue to dominate short-run concerns. But some major strategic shifts will be playing out simultaneously, including an acceleration in the growth of private credit, ongoing global power shifts, and the widespread deployment of artificial intelligence (AI). The long shadow cast by climate change lurks behind all these themes, with investors increasingly turning their attention towards the investment necessary to fund the transition.

Key investment themes

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Markets in Focus: Concentrating on Diversification in 2024

Join this webinar where BlackRock and MSCI experts will discuss key investment themes for 2024 considering changes in diversification and high index concentration.

Ashley Lester: Don’t Call it a Comeback

We sat down with MSCI's global head of research for a wide-ranging discussion, including why he chose to return to the company now, the challenges and opportunities facing the investment industry and a unique take on risk management, ESG and climate and AI and technology.

In Focus

Our quarterly roundtable examines markets, and market-moving events to help institutional investors as they determine the best way forward; across asset classes and parsing out differences between developed and emerging markets.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.