Macro Scenarios in Focus: Are US Markets Priced for Perfection?

Key findings

- Economic forecasters suggest the U.S. still seems on track for a soft landing, in which inflation returns close to target levels and recession is averted.

- Due to the recent rally in equities, one-year expected equity returns decreased compared to our December analysis, while the two downside-risk scenarios, hard landing and inflation resurgence, could result in more-severe portfolio losses.

- The value of a diversified portfolio of global equities and U.S. bonds could gain 3% under the soft-landing scenario, while a hard landing or inflation resurgence might lead to losses of 7% and 11%, respectively.

The International Monetary Fund[1] suggests that "the global economy is poised for a soft landing," despite regional disparities and the weaker or negative growth observed in Europe and Japan. Equity markets have performed strikingly well in the first quarter of this year, with the MSCI USA Investable Market Index (IMI) and MSCI ACWI IMI (our flagship global equity index) up by 9.6% and 7.4%. U.S. credit spreads remain tight when compared to historical standards.[2] This raises the question whether markets are "priced for perfection," and how potential negative news could impact portfolio values. Compared to the previous quarter, the expected return on equities has decreased, while our downside scenarios of a "hard landing" and "inflation resurgence" now indicate more-severe impacts on the value of a diversified portfolio of global stocks and U.S. bonds, with projected losses of 7% and 11%, according to our model.

Equity investors optimistic

According to a recent survey,[3] economists' confidence in a U.S. soft landing rose compared to the same poll in December. With U.S. stocks at an all-time high and U.S. credit spreads at some of their tightest levels since the 2008 global financial crisis (GFC), it appears that equity investors share the belief in the Federal Reserve's ability to avert recession. Furthermore, as we recently discussed, equity-volatility metrics such as implied volatility, implied-volatility skew and put-option premia are at five-year lows, implying less investor concern about drawdowns and surging volatility in the near term. The prospect of higher rates for longer — also suggested by the economist survey — does not seem to scare equity investors as much as it did last year.[4] The big question is whether equity investors might be too optimistic in the face of high valuations and concentration, and whether markets are priced for perfection.

We revised our four scenarios for 2024, accounting for updated economic forecasts and recent market shifts. We used the MSCI Macro-Finance Model to assess one-year expected returns under the soft-landing scenario, in which the Federal Reserve successfully gets inflation under control while avoiding recession. We then compared the returns to the historical model-implied baseline expected returns. The exhibit below shows that U.S. government and investment-grade bonds remain attractive compared to the past 25 years. Equities' expected returns decreased compared to the previous quarter and are now at the lower end of the one-sigma bounds, while high-yield bonds' expected returns are at their 25-year average.

One-year expected returns for major US asset classes under the baseline soft-landing scenario

Expected returns are generated by the MSCI Macro-Finance Model, as of December 2023 and March 2024. The red and blue dots are expected one-year returns under the soft-landing scenario. The light-blue bars represent the average and one-sigma bands of historical model-implied baseline estimates of asset-class expected returns between 1998 and 2024.

Stress testing the soft landing

Despite the optimism about a soft landing, cautious investors may want to assess alternative downside scenarios — particularly because potential implications of downside risks have magnified due to the recent rally. We revisited the risk-factor shocks for three alternative scenarios, two reflecting downside risk and one upside opportunity:

- Hard landing: Overaggressive monetary policy effectively curbs inflation but at the cost of a U.S. recession in 2024. The Federal Reserve slashes rates to try to correct course. Equities fall steeply. Slowing demand puts downward pressure on oil prices.

- Inflation resurgence: Inflationary pressures resurface and oil prices surge, eroding central banks' credibility. High prices and interest rates weigh on growth for an extended period.

- Increased productivity: Productivity growth — potentially fueled by AI — leads to robust growth without strong inflationary pressures. This scenario assumes AI's downside risks are avoided.

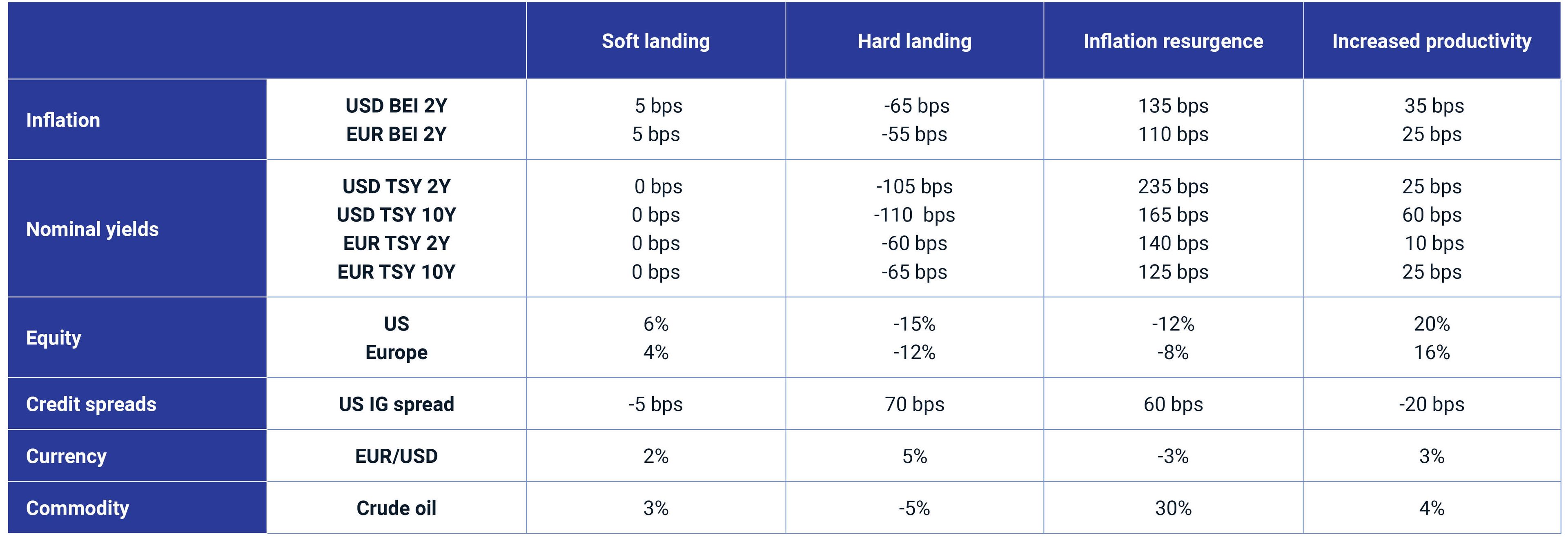

Our scenario assumptions

Assumptions about risk-factor shocks are informed by the MSCI Macro-Finance Model, analysis of historical data and judgment. Breakeven inflation (BEI) is measured in basis points (bps). These are not forecasts, but hypothetical narratives of how the macroeconomic scenarios could affect multi-asset-class portfolios over a horizon of one year. A positive shock for EUR/USD means the U.S. dollar is weakening relative to the euro.

Potential implications for financial portfolios

To assess the scenarios' impact on multi-asset-class portfolios, we used MSCI's predictive stress-testing framework and applied it to a hypothetical global diversified portfolio, consisting of global equities, U.S. bonds and real estate.[5] The portfolio's value gained 3% under the soft landing. Under the more bearish hard landing, the portfolio's value dropped by 7% as rallying bonds offset the sell-off in equities. The inflation-resurgence scenario still hurts the portfolio most, with an 11% loss, as bonds and equities traded down simultaneously. Compared to the previous quarter, equities suffer more in the hard landing than in the inflation-resurgence scenario. In our most optimistic scenario, assuming AI's positive impact, the portfolio gains 11%. The exhibit below shows more-detailed results.

Impact to portfolio values under our scenarios

Loading chart...

Please wait.

Portfolio impact of the scenarios based on market data as of April 1, 2024. Note that the above stress-test results capture the effect of repricing the assets, not the income component. Treasury inflation-protected securities (TIPS) are represented by the iBoxx TIPS Inflation-Linked Index provided by S&P Dow Jones Indices. U.S. Treasurys, equities and corporate bonds are represented by MSCI indexes. Private equity is represented by model portfolios. U.S. real estate is represented by the MSCI/PREA U.S. AFOE Quarterly Property Fund Index. The composite portfolio is 50% global equities (35% public and 15% private), 10% U.S. Treasurys, 10% TIPS, 10% U.S. investment-grade bonds, 10% U.S. high-yield bonds and 10% U.S. real estate. Source: S&P Global Market Intelligence, MSCI

After market rally, deeper downside risk?

The scenario of a U.S. soft landing still aligns most closely with current economic expectations, but given the recent equity rally and spread tightening, the downside risk of a hard landing or inflation resurgence has deepened.

Subscribe todayto have insights delivered to your inbox.

1 “IMF's Georgieva 'very confident' on soft landing, sees rate cuts coming,” Reuters, Feb. 12, 2024.2 For example, option-adjusted spreads for 10-year U.S. corporate bonds rated AA, A and BBB are at the lower end of the range observed since the 2008 global financial crisis. See the Global Markets Overview for more equity and fixed-income market statistics.3 Claire Jones and Eva Xiao, “Fed will have to keep rates high for longer than markets anticipate, say economists,” Financial Times, March 17, 2024.4 Katie Marting, “Good news is good news again in markets,” Financial Times, March 15, 2024.5 The results are generated by using model correlations to propagate shocks to the portfolios, using MSCI's BarraOne®. MSCI clients can access BarraOne and RiskMetrics® RiskManager® files for these scenarios on the client-support site.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.