Measuring the Temperature of Your Portfolio

- Institutional investors are increasingly setting targets to align their portfolios with a 1.5˚-2 degrees C global warming scenario ahead of COP26.

- Measuring and reporting portfolio temperature rise remain challenging, as investors seek to meet the TCFD's new alignment guidance. How can institutional investors measure the temperature of their portfolios?

- The MSCI Implied Temperature Rise metric, which closely follows the TCFD's proposed guidance, offers a new metric to investors.

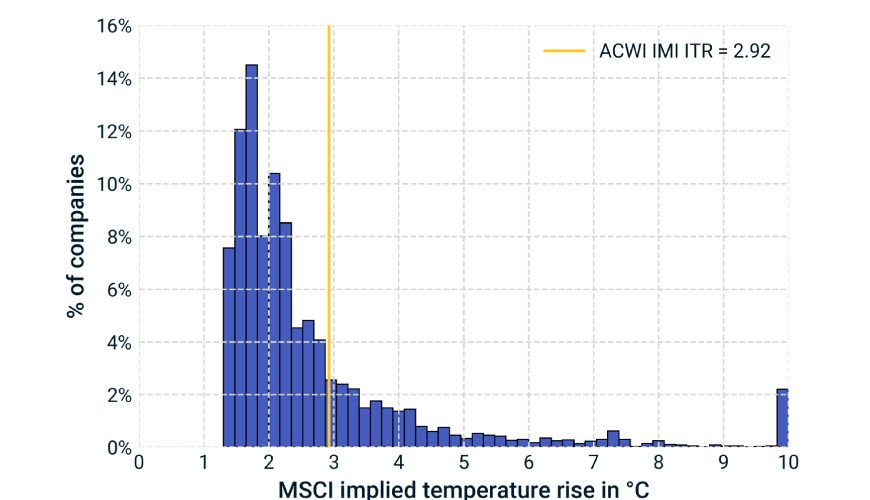

Less than 10% of MSCI ACWI IMI Constituents Had an Implied Temperature Rise of 1.5˚C or Less

As of Sept. 8, 2021. Source: MSCI ESG Research LLC

Reporting Performance in Degrees

An increasing number of investment institutions say they are serious about playing their part in limiting global warming. There is a long way to go, but intuitive, transparent, comparable metrics could help track progress and inform decision-making. And with regulators and standard-setting bodies such as the TCFD now looking at measuring portfolio temperature as a way to bring clarity to investors' positioning on climate change, investors may soon start reporting performance in degrees as well as in returns.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1Mooney, Attracta. “Investment industry at ‘tipping point’ as $43tn in funds commit to net zero.” , July 6, 2021. See also UN-convened Net-Zero Asset Owner Alliance hosted by the UNEP Finance Initiative (UNEPFI) and the Principles for Responsible Investment (UN PRI).2According to the Financial Stability Board’s “Report on Promoting Climate-Related Disclosures” (July 7, 2021), 16 jurisdictions currently use climate disclosure for their financial risk monitoring, including Australia, Canada, the EU, France, Germany, Hong Kong, India, Italy, Japan, Korea, Mexico, Russia, Singapore, Spain, Switzerland, U.K. and U.S. We also observe a trend towards mandating TCFD-compliant climate disclosure: E.g., the U.K.’s Financial Conduct Authority is currently consulting on TCFD-aligned climate-related disclosure for listed companies and asset managers, as is the Hong Kong Monetary Authority in its draft guidance for banks on climate risk management.3TCFD. 2021. "Measuring Portfolio Alignment: Technical Supplement."4The allocation base used to define a fund’s financed stake is Enterprise Value including Cash (EVIC).

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.