Ownership Forms and Governance Control

Blog post

August 4, 2015

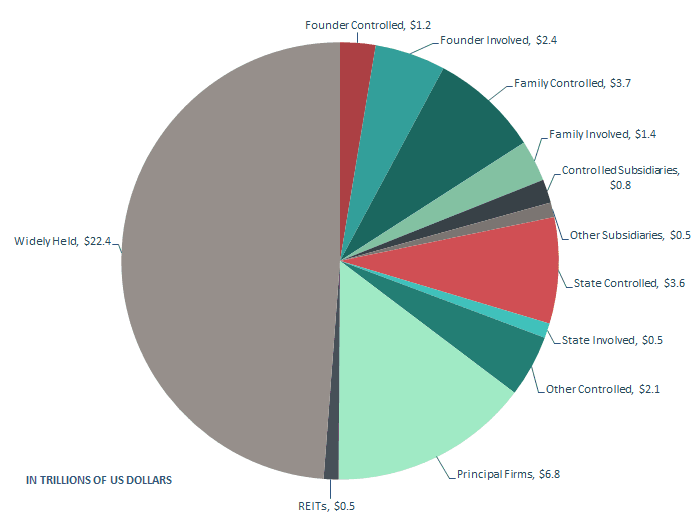

Just as the MSCI ACWI Index includes companies representative of a diversity of industries and equity markets, it also includes a diversity of ownership forms, ranging from fully controlled companies to those companies that are so widely held that their largest shareholder owns no more than 2% of shares. The chart below highlights this diversity as a percentage of current market capitalization.

MSCI ACWI Ownership Groups by Market Cap

The MSCI ACWI Index includes a wide range of ownership forms, just as it includes a wide range of sectors and domiciles, and each of these forms contributes its own unique combination of governance risks that can impact performance.

- Principle‐agent concerns are primarily applicable to widely held companies with highly dispersed ownership, which currently comprise approximately 37% of the MSCI ACWI by company count and nearly half its total market cap.

- For closely held companies, however, governance risk is primarily a function of the identity and degree of control wielded by the dominant shareholder.

- Passive investing does not mandate passive ownership, as indicated by a growing commitment on the part of global asset owners and managers to both passive index investing and active shareholder engagement.

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.