Raising Minimum Governance Standards

Blog post

December 4, 2015

Institutional investors concerned with excessive investor and corporate focus on short-term results are seeking to improve minimum corporate governance standards of their portfolio companies.

To date, active engagement has been widely recognized as an effective means to promote sustainable long-term growth and risk management of a portfolio. But such efforts can be costly and difficult to conduct at scale; this situation is especially challenging for universal owners who typically hold large size passive portfolios comprising thousands of companies.

To make a positive impact to the long-term return of a portfolio, investors can seek to improve the "beta" of the core portfolio. But how can investors influence companies in an efficient and scalable way?

We put forward a potential approach for institutional investors to systematically raise minimum governance standards for portfolio companies. Some academic research has shown that certain corporate governance attributes had positive correlations to the long-term performance of companies during the periods covered in their studies. If capital can be efficiently allocated to companies with strong financial qualities and good corporate governance profiles, it could potentially encourage more companies to follow suit, thereby generating a system-wide improvement.

We start with an established approach of gaining exposure to quality companies — those with durable business models: Research has shown that companies with high financial quality have produced a premium over long time periods. We then use a transparent set of corporate governance metrics as weighting criteria. This "governance-quality" index concept can be used as a tool to help institutional investors address the entire equity portfolio.

Our findings highlight that the MSCI World Governance-Quality Index demonstrated an annualized outperformance of 190 basis points and a risk reduction of 130 bps over the MSCI World Index for the period between December 2009 and June 2015. (Corporate governance data is available for only a limited timeframe, affecting the length of the study period.)

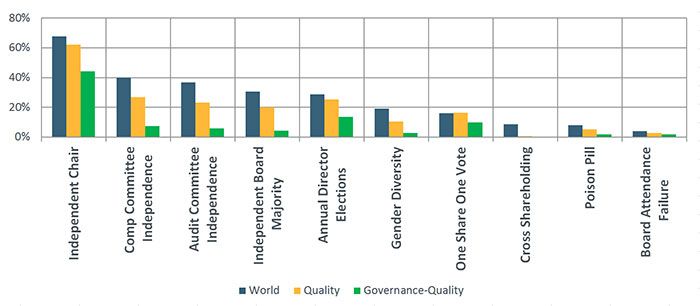

The Index demonstrated a significantly better corporate governance profile against the parent MSCI World Index across areas such as board independence, gender diversity and voting structure. Inclusion of companies with governance issues was greatly reduced. For example, less than 10% of the companies in the new strategy index lacked an independent audit committee, compared with nearly 40% of the MSCI World Index (see exhibit below). Finally, the index maintained a replicability and capacity profile broadly similar to the MSCI Quality Index, which may be used as the basis for large-scale passive allocation strategies.

As more investors embrace stewardship codes globally, such an index concept could potentially serve as a useful tool to complement active engagement strategies.

Data as of June 1, 2015

Read the paper, "Raising Governance Minimum Standards: Selecting Quality Companies for the Long Term"

For more information on the MSCI World Quality Index, read our blog post, "Flight to Quality."

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.