Tariffs Raise the Specter of Stagflation: Three Macro Scenarios

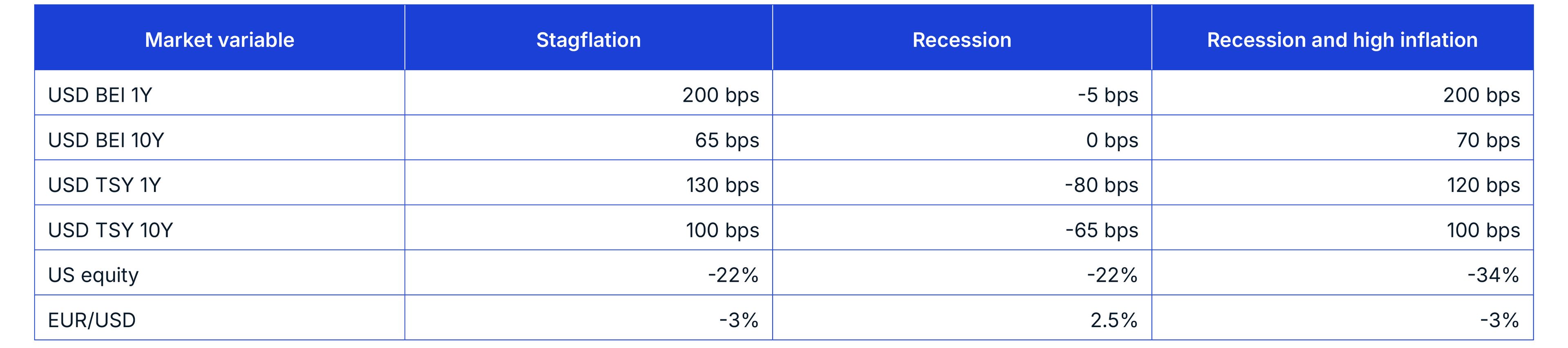

- We provide multi-asset-class investors with a framework to assess the portfolio impacts of three macroeconomic scenarios — including stagflation and recession — that could arise from escalating trade tensions.

- Stagflation is especially concerning, because the Federal Reserve would have limited ability to stimulate growth by lowering rates. In such scenarios, bonds and equities tend to decline simultaneously.

- In our most adverse scenario — a recession combined with rising inflation — the U.S. equity market could decline by nearly 35% from levels prior to the tariff announcement.

- In the stagflation scenario, economic growth falls to 0% while inflation rises by 200 basis points, amid supply shocks and trade fragmentation. To combat high inflation, the central bank raises rates, which weighs on growth longer term.

- The recession scenario assumes an economic contraction of 3%, while slowing demand reduces inflationary pressures. The Federal Reserve has room to cut interest rates, and growth recovers faster than in the stagflation scenario.

- Our worst-case scenario combines a recession and high inflation. Despite a sharp economic contraction, persistent trade disruptions sustain inflationary pressures and push interest rates up, like the oil-price shocks during the stagflation of the 1970s, when recessions coincided with high inflation.[3]

Subscribe todayto have insights delivered to your inbox.

1 Matthew Boesler, “Economists Slash US Growth, Boost Inflation Forecasts on Tariffs,” Bloomberg, April 4, 2024.

2 These scenarios are not forecasts but hypothetical scenarios. We used the MSCI Macro-Finance Model to translate macroeconomic assumptions to U.S. market impact. You can find the scenarios here: stagflation, recession and recession with high inflation.

3 Bill Dudley, “Stagflation Is Now America's Best-Case Scenario,” Bloomberg, April 7, 2025.

4 The results are generated by using model correlations to propagate shocks to the portfolios, using MSCI's BarraOne®. MSCI clients can download the correlated BarraOne stress test and RiskMetrics® RiskManager® stress test. Treasury inflation-protected securities (TIPS) are represented by the iBoxx TIPS Inflation-Linked Index provided by S&P Dow Jones Indices. U.S. Treasurys, equities and corporate bonds are represented by MSCI indexes. Private equity is represented by model portfolios. U.S. real estate is represented by the MSCI/PREA U.S. AFOE Quarterly Property Fund Index. The composite portfolio is 50% global equities (35% public and 15% private), 10% U.S. Treasurys, 10% TIPS, 10% U.S. investment-grade bonds, 10% U.S. high-yield bonds and 10% U.S. real estate.

5 A reversal scenario — reflecting up-to-date market data — can be implemented by using the by-date stress-testing functionality as described on the support site's pages: BarraOne stress test and RiskMetrics® RiskManager® stress test.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.