The Fund-Name Challenge: Matching Investor Needs and Supervisory Expectations

- Funds that use sustainability-related language in their names may soon have to determine how to exclude specific investments to adhere to the ESMA Guidelines.

- Fossil fuel-linked exclusion-criteria are based on the EU climate benchmarks regulations, but data shortcomings make their application in this new context challenging.

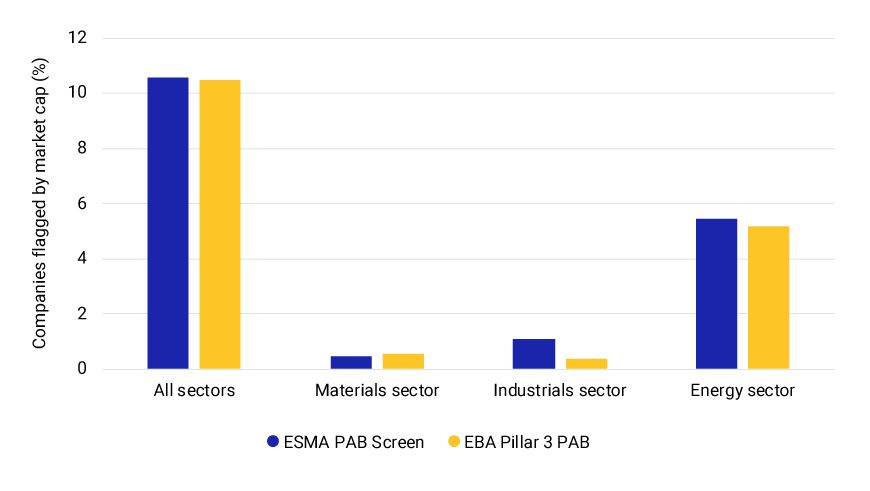

- Fund managers will have to make trade-offs — our ESMA PAB screen excludes nearly 11% of MSCI ACWI IMI constituents by weight, with half of these from the energy sector.

Criteria | Implementation challenge |

|---|---|

Criteria Companies that derive 1% or more of their revenues from exploration, mining, extraction, distribution or refining of hard coal and lignite. | Implementation challenge Revenue from coal production (or extraction) can largely be captured from company disclosures. However, revenue from the distribution or refining of coal remains elusive due to limited reporting. |

Criteria Companies that derive 10% or more of their revenues from the exploration, extraction, distribution or refining of oil fuels. Companies that derive 50% or more of their revenues from the exploration, extraction, manufacturing or distribution of gaseous fuels. | Implementation challenge Where companies report separate volumes of oil and gas produced and do not aggregate as "barrels of oil equivalent," oil and gas revenue can be separated. However, for value chain activities, this can be more challenging. For example, not all pipeline companies disclose a bifurcation between the revenue they generate for oil versus gas. |

Criteria Companies that derive 50% or more of their revenues from electricity generation with a greenhouse gas (GHG) intensity of more than 100g CO2e/kWh. | Implementation challenge Individual power plant emissions and production data are largely unavailable, hindering the use of production intensities consistently across power-generation companies. It is possible to use average production intensities based on GHG emissions across all operations and electricity generation, but this can lead to overestimations of the intensity ratio in the case of diversified utilities or where power generation is not 100% of a company's operations. |

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.