Thinking Broadly About Emerging Markets

Blog post

April 18, 2016

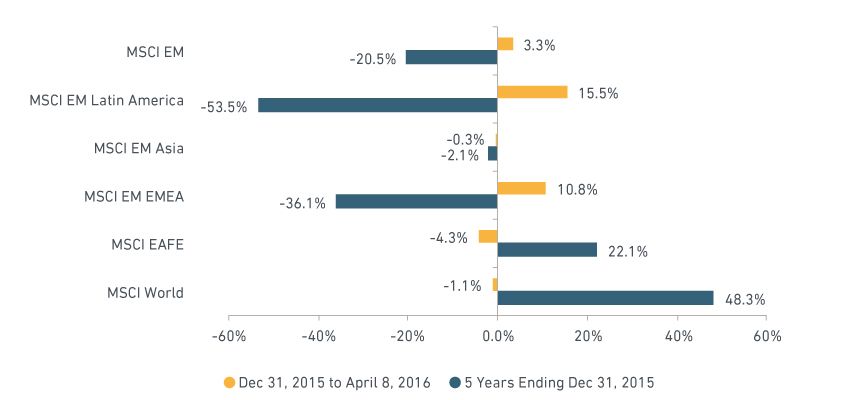

Emerging-market equities revived in the first quarter after a rather dismal performance over the past five years. The pickup has left investors to wonder whether the gains might continue and to think anew about how to approach the segment.

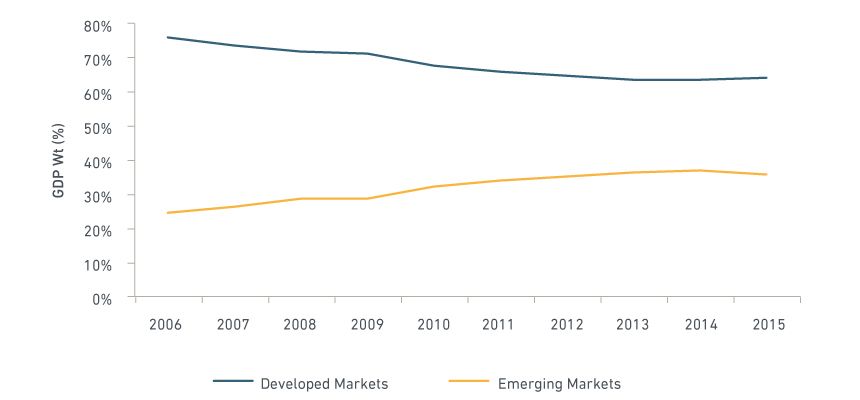

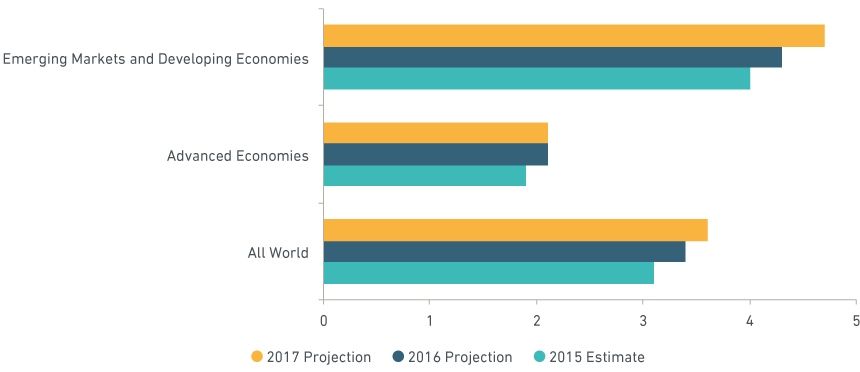

Economic development and the interconnectedness of financial markets have redefined the characteristics of emerging markets to such an extent that emerging markets now represent engines of global growth. As the charts that follow show, emerging markets have contributed a growing share of gross domestic product worldwide and seem likely to add more than developing countries to growth globally for some time to come.

Source: MSCI, World Bank

Projected economic growth worldwide

Source: International Monetary Fund

A great divergence

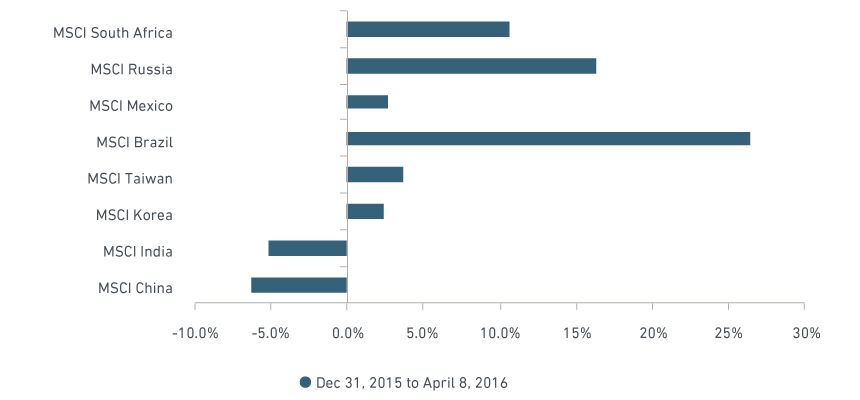

Digging more deeply into the recent rebound, through April 8 of this year, emerging market equities continued to diverge among one another in their performance as they have for at least the past decade. For example, stocks in Greece and Egypt lost 16% and 3%, respectively, over the period, while shares in Russia (16.3%), South Africa (10.6%) and Turkey (19.8%) all gained (see chart below).

Viewed regionally, emerging Latin America, which includes Brazil (+26.4%) and Mexico (+2.6%), outperformed the developed markets by 16.5% over the period. Emerging Asia, which includes China

(-6.4%) and India (-5.1%), fell 0.35% but outperformed developed countries, which fell 1.1% overall.

(-6.4%) and India (-5.1%), fell 0.35% but outperformed developed countries, which fell 1.1% overall.

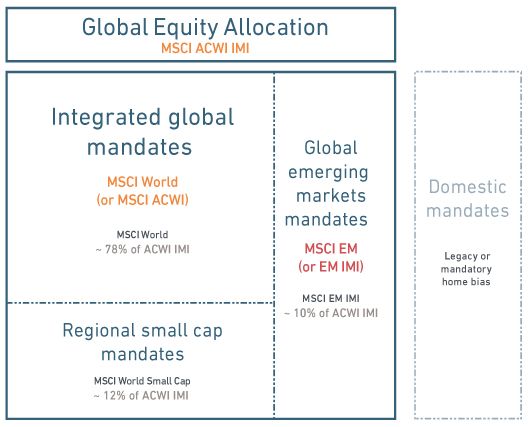

The divergence among returns in emerging economies reflects the variation among those economies and has led some investors to adopt strategies that aim to capitalize on the heterogeneity. Such strategies suppose that because some countries seem likely to grow faster than others, it makes sense to try and pick winners. The incentive to pick countries also corresponds with the evolution of investment mandates and the array of ways to address them. Still, in our view a broad-based portfolio, as reflected in the MSCI Emerging Markets Index, offers several advantages.

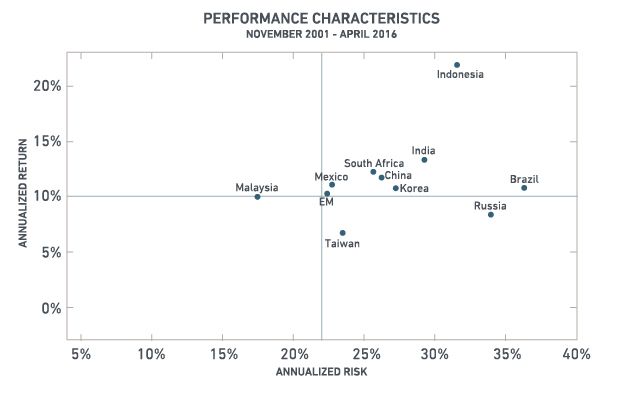

As noted, emerging markets are inherently dynamic, as is the notion of investing in them broadly. Second, as shown above, the default emerging markets allocation for asset owners remains a mandate benchmarked to a broad-based emerging markets index. Third, an emerging markets composite index can capture diversified returns across multiple countries without adding additional risk, at least historically (see chart below). Side note: The minimum volatility version of the MSCI Emerging Markets Index has outperformed its parent by nearly 6% over the five years ending March 31. Finally, broad investable benchmarks provide more opportunities for active managers to pick the best stocks as well as more opportunity to manage country exposures.

The evolution of mandates provides institutional investors with more choices – and challenges – in structuring their allocations to emerging markets. We believe that approaches to investing in emerging markets will continue to be influenced by the dynamic nature of such markets themselves. Their performance so far this year has showed that a broad-based approach remained as relevant as ever.

Further reading: Built to Last: Two Decades of Wisdom on Emerging Markets Allocations Emerging Markets: a 20-Year Perspective China A-Shares: Too Big to Ignore Seeking defensive yield in emerging markets and Asia

Further reading: Built to Last: Two Decades of Wisdom on Emerging Markets Allocations Emerging Markets: a 20-Year Perspective China A-Shares: Too Big to Ignore Seeking defensive yield in emerging markets and Asia

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.