U.S. Market Brief - Momentum Strategies Outperformed in a Volatile Month

Blog post

February 2, 2015

January saw the return of volatility to the U.S. equity market. A confluence of factors led to this uncertainty: Investors were faced with the influence of a stronger dollar and the effect of lower oil prices on corporate earnings growth. Simultaneously, there was diverging monetary policy among major central banks in the world, along with disappointing results from U.S. GDP in Q4 and weak economic data from the eurozone, China and Japan. The upshot was that U.S. market indexes trended lower last month.

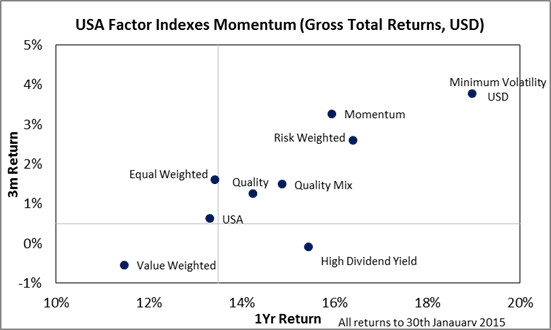

As a result, investors responded by becoming even more risk averse. The MSCI USA Minimum Volatility Index, which tends to outperform when investor risk aversion increases, has now outperformed the MSCI USA Market Cap benchmark by more than 3% during the three month period ending January 30th, 2015, as can be seen in the exhibit below.

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.