Using alternative data to spot ESG risks

Blog post

June 7, 2019

- Despite growth in ESG disclosures, investors still often lack sufficient indicators of financially relevant ESG risks. Alternative data sources can help fill the disclosure gap.

- Overlaying alternative datasets such as flood maps with our MSCI ESG Ratings model can bring new insights into potential future event risks.

- This approach helped us identify China as having one of the highest risk profiles for tailings-dam risks.

Satellite-derived imaging renders better understanding

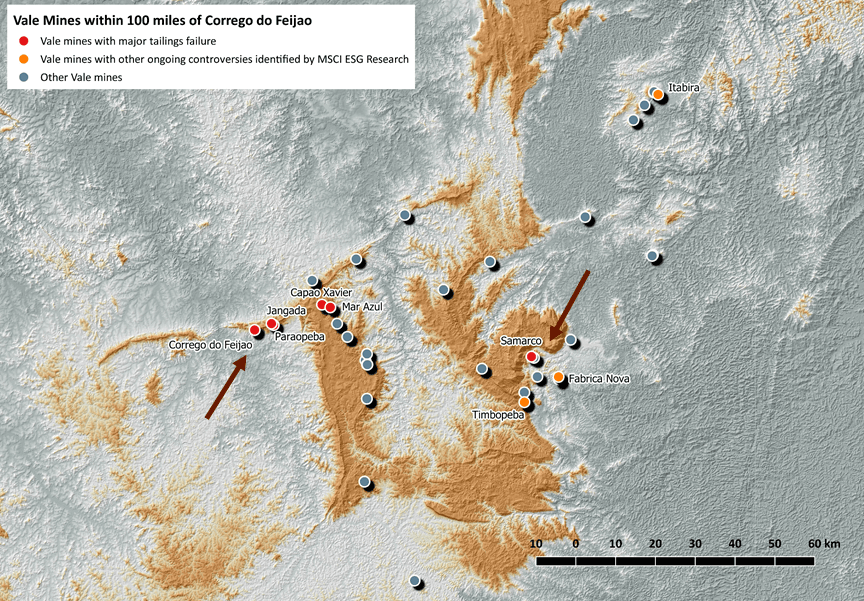

In Vale's instance, we employed geospatial analysis and satellite-derived imagery to identify repercussions and potential hotspots. Immediately, we could see not only that Córrego do Feijão and Samarco (the sites of the past two tailings-dam collapses) were very close together, but that a third of Vale's 2017 production value was located within a 100-mile radius and thus likely shared similar characteristics and risk factors.

Vale mines within 100 miles of Córrego do Feijão represented approximately 33% of 2017 production

Source: MSCI ESG Research, S&P Global Market Intelligence, ALOS World 3D – 30m (AW3D30) Version 2.1

Layering risk factors, looking for patterns

Two risk factors account for about 80% of all dam failures6 : "overtopping," or floods that exceed outflow capacity, such as after too much rain; and quality problems, or defects that reflect failures of oversight and risk management. We suspect both weather and weak governance may have played a role at the Córrego do Feijão incident,7 but neither problem is limited to Brazil.

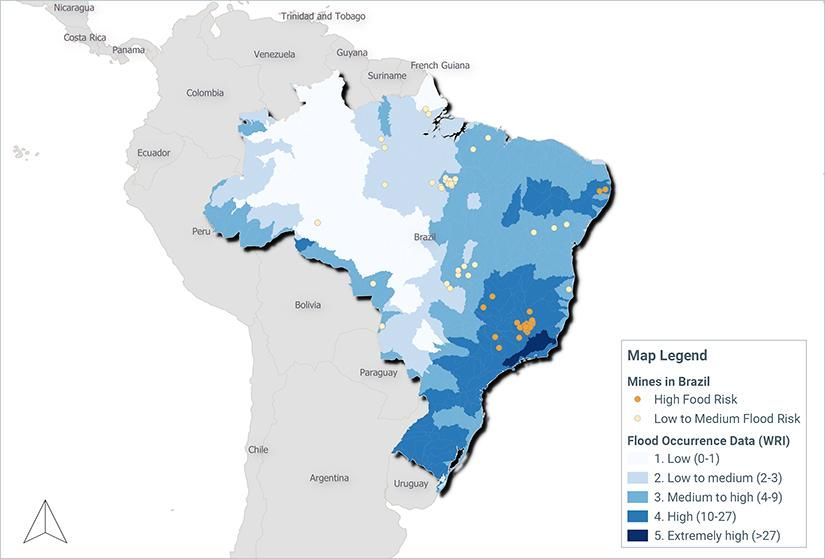

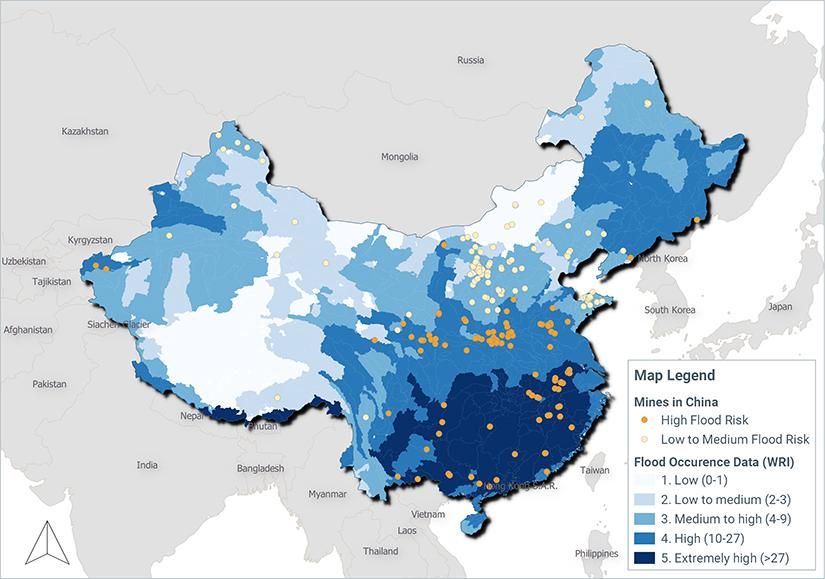

We mapped all the mines owned by a constituent of the MSCI ACWI Index globally8 and then layered on geographic data on flood risks and tailings volume and our own assessments of companies' environmental and governance risk management.

We found that China had almost as many mines (owned by MSCI ACWI Index constituents) in flood-prone areas as Brazil, and that many of them were operated by companies with poor governance and environmental risk management systems — indicating that investors might want to give these companies and these mines a closer look.

Source: MSCI ESG Research, World Resources Institute Aqueduct Global Maps 2.1 (2015), S&P Global Market Intelligence

Using unconventional methods and alternative data sources to understand ESG risks is not limited to tailings dams. We use alternative data sources such as regulatory emission data to inform us of where company assets are located or how pollutant-intensive their business lines are. We can also use regional statistics such as safety rates or wildfire frequency to help us measure companies' exposure to these risks. In fact, we estimate that only about 35% of the data inputs in our MSCI ESG Ratings model are derived from voluntary ESG disclosures.

Company disclosure is often missing key information investors may look for to understand financially relevant ESG risks. This may be particularly relevant in emerging markets, where ESG risks may be higher but ESG transparency is often lower than the level of disclosure to which investors in developed markets are accustomed.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1Magalhaes, L. and Pearson, S. “A Vale Employee Predicted the Dam Would Fail. He Died When It Collapsed.” The Wall Street Journal, May 30, 20192 “Vale has worst quarter ever.” Mining Journal, May 10, 2019.3“Q1 2019 Quarterly Results.” Vale.com, May 9, 2019.4Nogueria, M. and Teixeira, M. “Prosecutors seek $13 billion from Vale for environmental remediation.” Reuters, March 15, 2019.5“2017 Sustainability Report.” Vale.com, Dec. 31, 2017.6Zhang, L.M. and Xu, Y. 2009. “Analysis of Earthen dam failures: A database approach.” Georisk Assessment and Management of Risk for Engineered Systems and Geohazards.7While there was no single extreme weather event preceding the dam collapse, in nearby Brumadinho, the average rainfall in January 2019 was in the 13th percentile of the previous 10 years, and that month was preceded by the three months with the highest average rainfall since January 2009, according to World Weather Online.8As of Feb. 5, 2019. Total of 2,554 mines

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.