What could stress emerging markets?

Blog post

May 24, 2019

Emerging-market equities and USD-denominated EM sovereign bonds started 2019 with a bang, rising roughly 12% and 7%, respectively, through May 1.1 But recent market turbulence caused by the U.S.-China trade standoff raises a pressing question: What could trigger the next EM downturn? We defined two stress tests: a "U.S. dollar strengthening" stress test assuming that the USD appreciates relative to the yuan, the 10-year Treasury yield increases and U.S. equities remain flat; and a "China slowdown" scenario, in which Chinese equities drop sharply and the spread of USD-denominated Chinese debt widens, hurting both the U.S. and EM stock markets.

The EM rebound in early 2019 is often attributed to the Federal Reserve Board's turn toward a dovish U.S. monetary policy — which might have lowered the cost of money worldwide, due to the dollar's status as the reserve currency.2 Even though U.S. monetary policy may not change in the near future, the USD could strengthen compared to EM currencies — e.g., if the U.S. economy performs more strongly than EM economies. Alternatively, a further escalation of the U.S.-China trade war could have severe implications for the Chinese economy with potential spillovers to other EM countries.

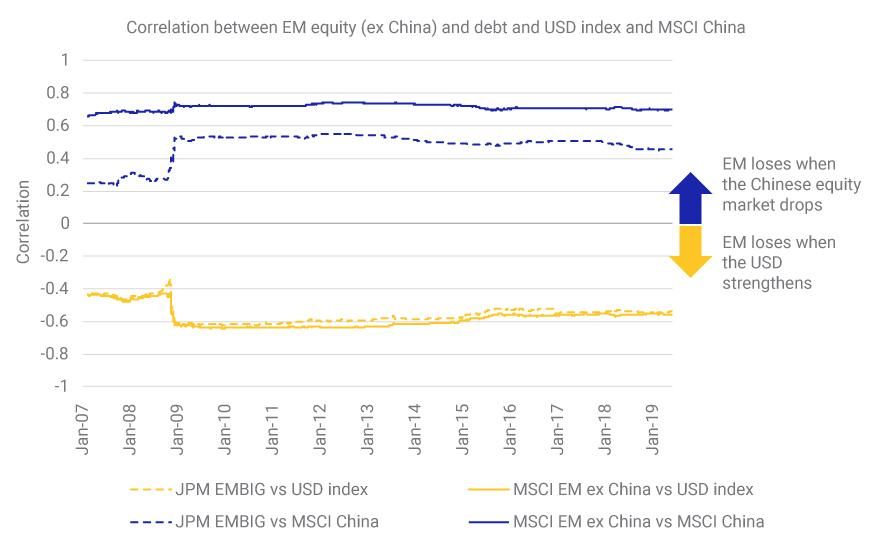

We assess the vulnerability of EM equity (excluding China)3 and debt through their sensitivity to the USD versus a trade-weighted basket of non-U.S. currencies.4 The exhibit below shows that this relationship was consistently negative over the past decade — i.e., as their correlation was persistently negative, EM debt and equity generally took a hit when the USD strengthened.

In addition, in the stress-test scenarios, a slowdown in China could affect many EM countries, in particular commodity exporters. Indeed, when gauging the correlation between EM equity (excluding China) and debt and the Chinese equity market,5 we see that, historically, EM debt and equity have usually declined when Chinese equities dropped.

When the dollar strengthened or Chinese equities weakened, EM equities and debt suffered

Correlation between EM debt and equity and the USD index and MSCI China Index. Correlations are estimated based on weekly overlapping returns using an exponentially weighted moving average with a three-year half-life.

We assessed the potential impact to hypothetical portfolios through two stress tests,6 summarized in the table below. In the "U.S. dollar strengthening" scenario, we assumed the U.S. economy performs well while the global economy weakens. In this scenario, the U.S. dollar appreciated by 10% relative to the yuan, the 10-year Treasury yield increased by 50 basis points (bps) and U.S. equities remained flat. The "China slowdown" scenario assessed the impact of a severe Chinese-equity-market shock, along with a 20-bp increase in the spread of USD-denominated Chinese debt and a yuan that weakened by 10% relative to the USD. We used historical correlations to propagate these shocks to EM equity and debt.7

Two potential EM stress-test scenarios

U.S. dollar strengthening | China slowdown |

|---|---|

U.S. dollar strengthening MSCI USA Index 0% | China slowdown MSCI China Index -10% |

U.S. dollar strengthening US 10Y sovereign yield +50 bps | China slowdown Chinese spread for USD-denominated debt +20 bps |

U.S. dollar strengthening USD/CNY +10% | China slowdown CNY/USD -10% |

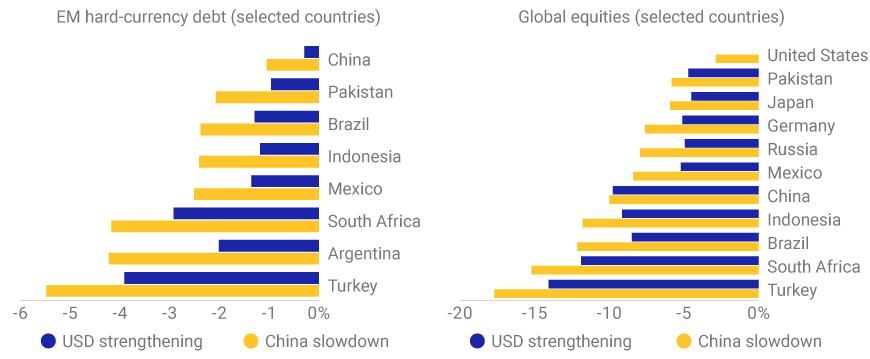

The exhibit below shows the impact to selected countries' debt and equity markets from the perspective of a USD-based investor. In both scenarios, EM currency depreciation was a strong driver, which explains the similar results. The main difference is that the U.S. equity market performed much worse in the China-slowdown scenario, something which was also seen in the recent trade-war tensions. Furthermore, Turkish, Argentine and South African markets seemed to be the most vulnerable, in line with their exposure to currency risk.8

Potential impact on select debt and equity markets

Our analysis of historical correlations points to two possibilities: While EM stocks and bonds rebounded well in the first four months of the year, markets could reverse if the USD strengthens relative to EM currencies; alternatively, a severe slowdown in China could hurt U.S. stocks but would have a harder impact on EM stocks and bonds.

The author thanks Monika Szikszai for her contributions to this blog post.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1 Emerging-market equities are represented by the MSCI Emerging Markets Index (in USD), while emerging-market bonds are represented by the J.P. Morgan Emerging Market Bond Index.2 See, for example: Johnson, S. “Emerging markets’ fate will ultimately be decided in Washington.” Financial Times, Feb. 13, 2019; and González, J.A. “Don’t let emerging markets be the ‘something that breaks.’” Financial Times, March 8, 2019.3 We proxy EM equity ex China with the MSCI Emerging Markets ex China Index.4 Board of Governors of the Federal Reserve System. Nominal Broad Dollar Index (Goods Only). May 10, 2019.5 We proxy the Chinese equity market with the MSCI China Index.6 Import files for MSCI's BarraOne® and MSCI's RiskMetrics® RiskManager® are available on MSCI's client-support site.7 We used the covariances estimated by MSCI’s Barra® Integrated Model.8 Smith, C. “Currency crisis redux?” Financial Times Alphaville, May 14, 2019.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.