When AI Meets Water Scarcity: Data Centers in a Thirsty World

- Artificial intelligence and cloud expansion are fueling a surge in data-center construction, often in water-stressed regions, with nearly one-third of new builds facing higher scarcity risks by 2050.

- The core challenge is managing the water/energy trade-off for data centers; thus, water use for cooling is emerging as a material operational and reputational risk for operators.

- Investors may need to assess location-specific climate risks, regulatory shifts and resource constraints in data-center investments.

Artificial intelligence (AI) is reshaping digital infrastructure and straining natural resources. The global stock of data centers, valued at around USD 245 billion today, is expanding at an unprecedented pace, with projects under construction representing an additional USD 550 billion in estimated completion value, led largely by the U.S.1

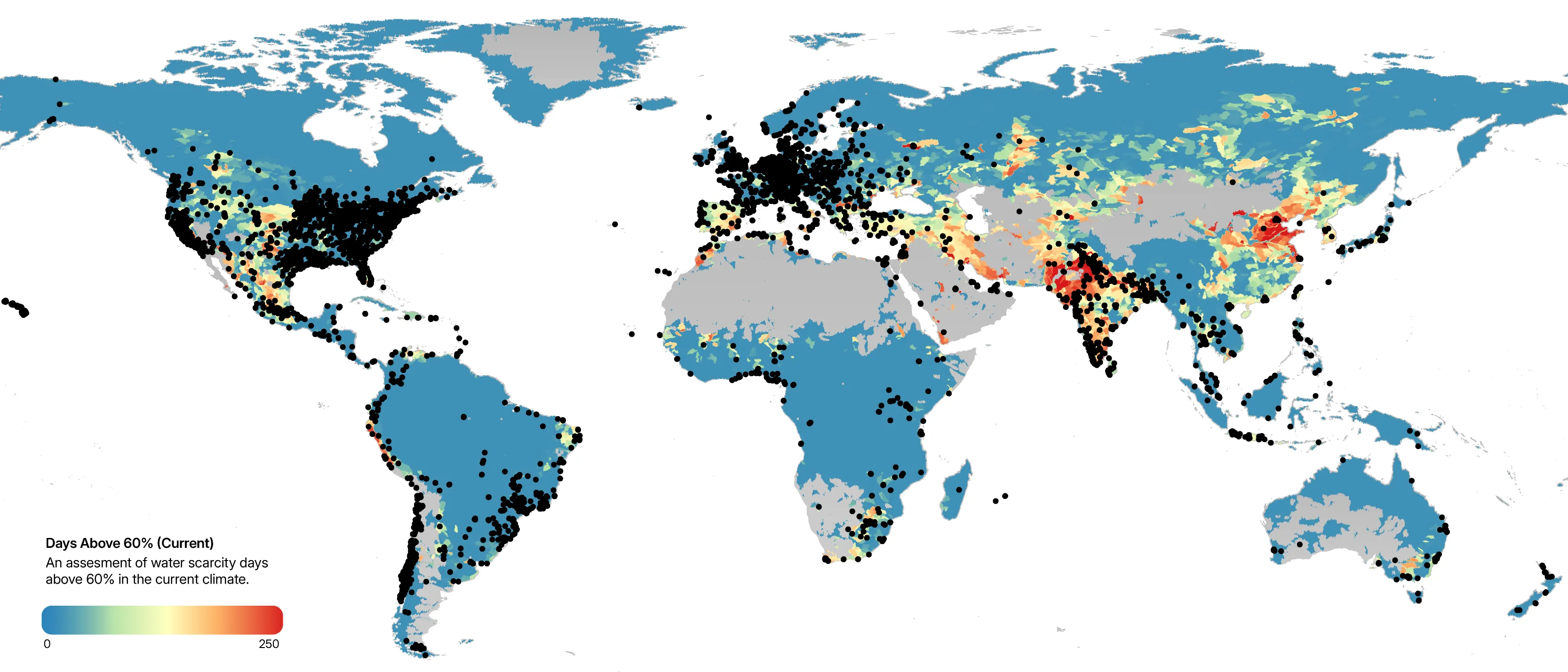

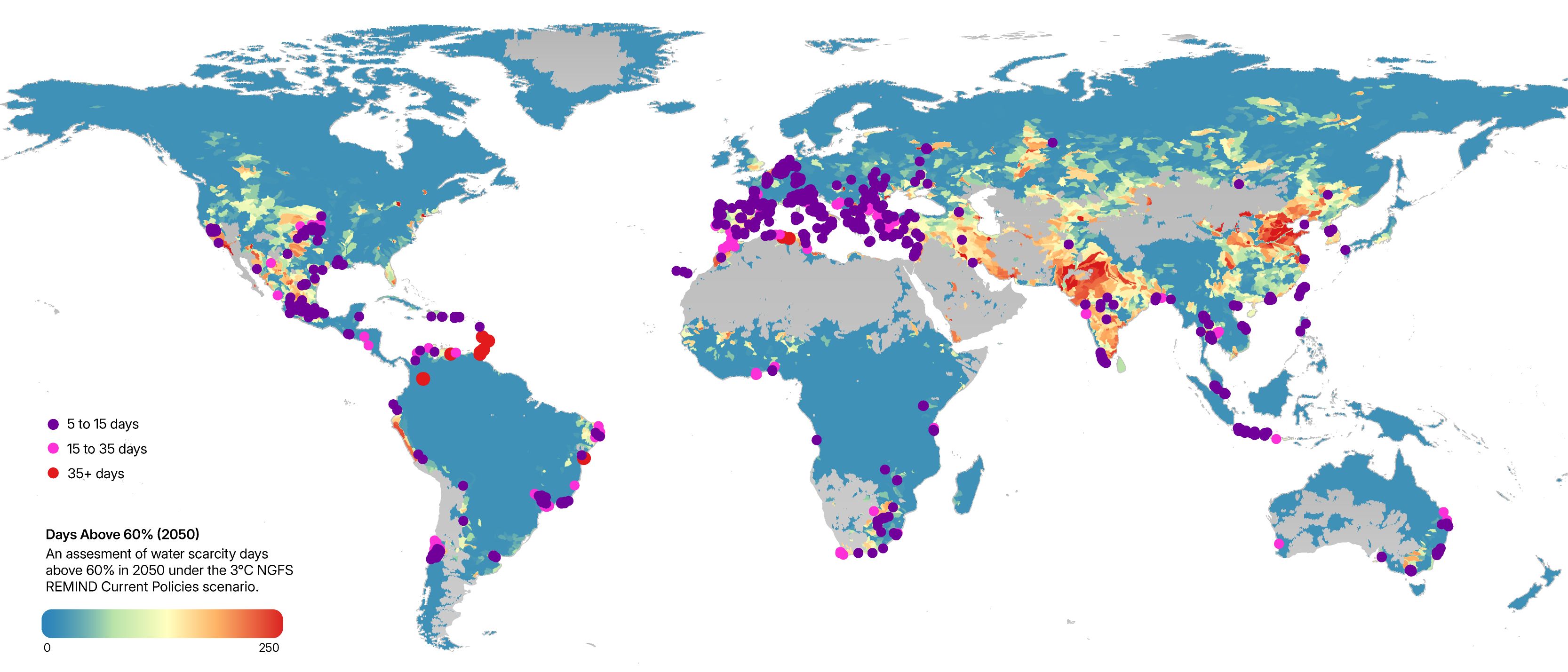

The rapid build-out of data centers to power AI and cloud computing coincides with intensifying global water stress.2 Around one-quarter of today’s facilities, and nearly one-third of those under construction, are in regions projected to face greater water scarcity by 2050. As climate change increases water stress, the industry’s ability to cool efficiently and sustainably may become a critical factor in operational resilience and, in turn, long-term investment performance.

Data as of Oct. 3, 2025. The map shows MSCI’s analysis of 13,558 data-center assets worldwide (MSCI GeoSpatial Asset Intelligence), comparing current (2024) conditions with projected water scarcity in 2050. Water scarcity is defined as the number of days when local demand exceeds 60% of supply under the NGFS Current Policies scenario. Black dots represent data-center locations and the hazard map reflects water-scarcity days under current climate conditions. Source: MSCI Sustainability & Climate. MSCI Sustainability & Climate products and services are provided by MSCI Solutions LLC in the United States and MSCI Solutions (UK) Limited in the United Kingdom and certain other related entities.

Why water matters for data centers

Cooling is central to data-center operations. Servers generate significant heat as they process data, and most facilities rely on water — directly for cooling or indirectly through electricity use — to maintain safe operating temperatures. The International Energy Agency (IEA) estimates that global data-center water use is roughly 560 billion liters per year, potentially rising to 1.2 trillion liters by 2030, equivalent to the annual consumption of more than four million U.S. households.3, 4

This scale of demand has made water availability a critical operational — and, increasingly, reputational — issue. Hotter and drier conditions could limit supply in key regions, while communities and regulators are placing greater scrutiny on industrial water use.5 For data-center operators, managing consumption is not only an environmental priority but also a business necessity.

Which areas face the greatest pressure?

Data-center siting often prioritizes access to power, connectivity and land. Yet many of the world’s largest clusters are in regions that could face worsening water scarcity. MSCI’s GeoSpatial analysis of roughly 14,000 data-center assets worldwide shows that about one in four existing facilities may experience more frequent scarcity days (defined as periods when local demand exceeds supply by at least 60%) by 2050, especially in Chile, Brazil, Mexico, Turkey and Australia, where rapid digital expansion is intersecting with rising climate stress.

Data as of Oct. 3, 2025. Colored dots indicate the projected increase in the number of water-scarcity days between 2024 and 2050. Purple dots represent an increase of 5–15 days, pink dots an increase of 15–35 days and red dots an increase of 35 days or more. Source: MSCI Sustainability & Climate

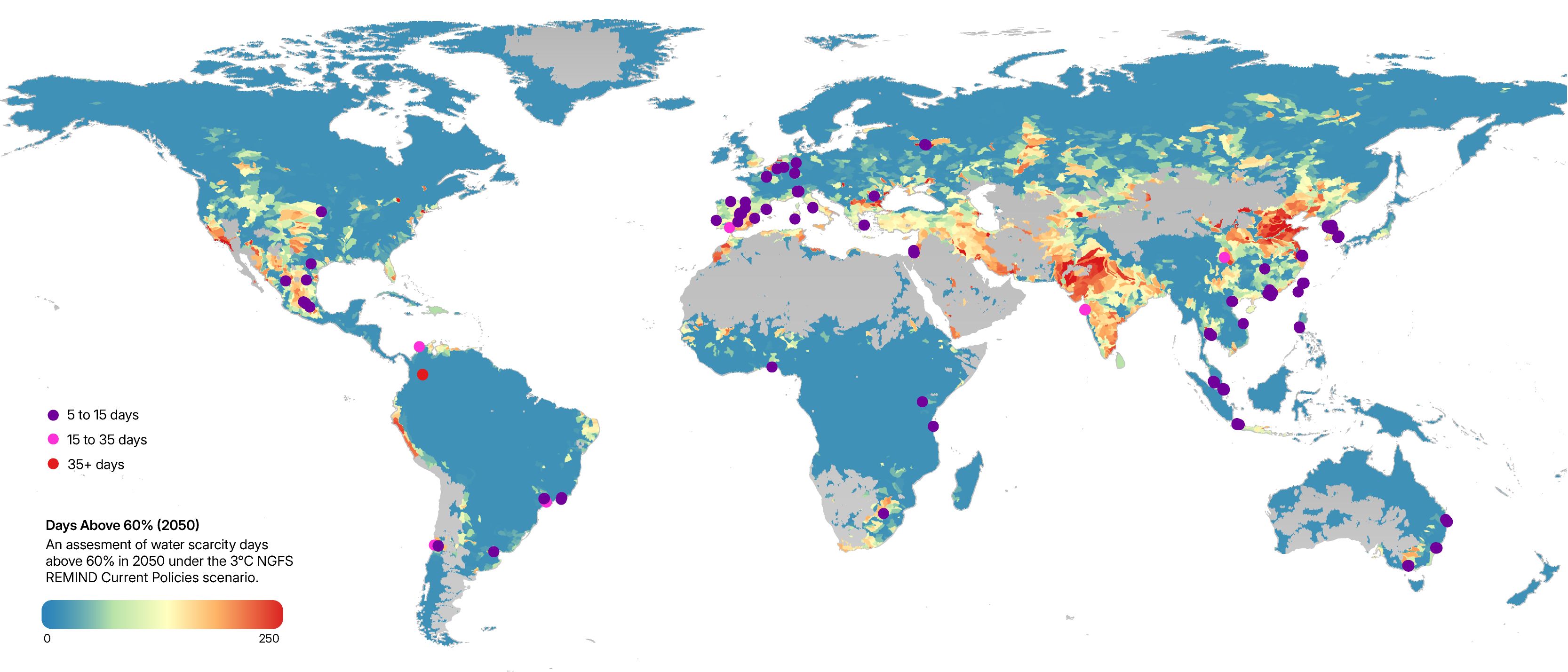

Among projects currently under construction, about 30% are in regions where water scarcity is expected to intensify.6 This suggests that the next wave of AI infrastructure could deepen resource risk if water considerations are not integrated into development decisions.

Data as of Oct. 3, 2025. Colored dots indicate an increase in the number of water-scarcity days between 2024 and 2050. Purple dots represent an increase of 5–15 days, pink dots an increase of 15–35 days and red dots an increase of 35 days or more. Source: MSCI Sustainability & Climate, MSCI Real Capital Analytics

The water/energy trade-off

Cooling typically accounts for 20%–40% of total energy use in data centers.7 Water and energy efficiency goals often pull in opposite directions: Water-based cooling can be more energy efficient but increases water consumption, while air-based cooling systems conserve water but require more electricity.8

The optimal balance is highly location specific. In water-stressed regions, operators may favor air-based cooling or dry cooling systems that minimize water use, even at higher energy cost.9 In areas with limited power capacity or carbon-intensive grids, evaporative or liquid cooling may be more practical because they are more energy-efficient and require less electricity than air-based systems.10

As AI drives greater computational intensity, these trade-offs are becoming more material for operators and investors.

A fast-changing landscape of innovation and scrutiny

Operators are adopting new cooling approaches — such as liquid immersion and direct-to-chip designs — to manage higher heat loads and improve resource efficiency.11 At the same time, governments are introducing more stringent reporting and performance requirements for energy and water use in data centers. Major technology companies are also taking voluntary steps, such as setting targets to replenish more water than they consume through efficiency measures and investments in off-site water-restoration projects.12 Together, these developments underscore water stewardship as a strategic issue for the industry.

With AI driving rapid data-center expansion, communities and other stakeholders are paying closer attention to facilities’ water and power use — pressures that may be contributing to both regulatory action and operator innovations. Stakeholder scrutiny is rising, even for companies taking voluntary steps. MSCI Controversies data shows that several large operators — including Alibaba Group, Alphabet Inc., Amazon.com Inc., Digital Realty, Meta Platforms Inc., Microsoft Corp. and Tencent — have faced allegations involving community opposition and scrutiny over water and power use, as of November 2025.13 These cases highlight how water availability and consumption are emerging as growing sources of operational and reputational pressure for data-center operators.

Data as of Nov. 6, 2025. PUE (Power Usage Effectiveness) is a ratio of total facility energy use to IT-equipment energy use; lower values indicate higher efficiency. WUE (Water Usage Effectiveness) refers to the volume of water used per unit of IT energy (e.g., m³/MWh); lower values indicate lower water intensity. The list of policy measures is not exhaustive. Source: MSCI Sustainability & Climate

What it means for investors

Digital infrastructure is expanding rapidly, including in regions facing greater water stress. Increasing water scarcity raises questions about the long-term operational and financial resilience of data centers. Because water and energy efficiency are closely linked, improvements in one often affect the other. For investors, assessing the physical risks associated with data-center locations — and how operators manage water-energy trade-offs — is essential to evaluating total resource efficiency, risk and long-term value.

Subscribe todayto have insights delivered to your inbox.

Desire for Data Centers Creates Carbon Dilemma for Property Investors

Despite renewable-energy sourcing and offsetting strategies, data centers are tied to an increase in carbon emissions, forcing investors to square these assets with their own climate goals.

The data center boom: by the numbers

Global demand for data centers is surging — and investors are responding through development rather than acquisition.

MSCI Real Capital Analytics: Data Centers

Explore MSCI Real Capital Analytics: Data Centers — tap into global transaction volumes, development pipelines and investor networks in the data‑center asset class to uncover market trends and benchmark activity.

1 MSCI analysis of MSCI Real Capital Analytics data showed that, as of September 2025, over 47 GW of additional data-center capacity was under construction, with an estimated end value (based on current property prices) of over USD 550 billion.

2 Samantha Kuzma, Liz Saccoccia and Marlena Chertock, “25 Countries, Housing One-Quarter of the Population, Face Extremely High Water Stress,” World Resources Institute, August 2023.

3 “Energy and AI,” International Energy Agency, April 2025.

4 The IEA’s base-case projects global data-center electricity consumption to rise to around 1,200 TWh by 2035. This estimate assumes average water use of 82 gallons per person per day and 2.5 people per household, based on US EPA data.

5 “Water use in US data centers: Legal and regulatory risks,” Nixon Peabody LLP, September 2025.

6 Based on analysis using MSCI GeoSpatial On Demand Solutions and MSCI Real Capital Analytics data. The analysis covers 680 data-center assets worldwide and compares 2024 and 2050 water-scarcity projections, where scarcity is defined as the number of days when local demand exceeds 60% of available supply under the NGFS Current Policies scenario. We used MSCI GeoSpatial On-Demand Solutions to assess exposure to physical climate hazards at the asset level.

7 “Energy and AI,” International Energy Agency, April 2025.

8 Arman Shehabi et al., “2024 United States Data Center Energy Usage Report,” Lawrence Berkeley National Laboratory, December 2024.

9 Leila Karimi et al., “Water-Energy Trade-Offs in Data Centers: A Case Study in Hot-Arid Climates,” Resources, Conservation and Recycling, vol 181, 2022.

10 Nuoa Lei and Eric Masanet, “Climate- and Technology-Specific PUE and WUE Estimations for U.S. Data Centers,” Resources, Conservation and Recycling, vol 182, 2022.

11 Industry initiatives include testing closed-loop liquid-cooling systems that reduce evaporative water loss, as well as direct-to-chip designs that circulate liquid to dissipate heat more efficiently.

12 Amazon, Alphabet, Microsoft and Meta Platforms have all set targets to become water positive by 2030, committing to replenish more water than their operations consume.

13 For this analysis, we reviewed all active controversies across all levels of severity for constituents of the MSCI ACWI IMI Index, as of Nov. 26, 2025.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.