Why index funds promote market efficiency

Blog post

April 26, 2018

Institutions and individuals increasingly invest through funds that track indexes. While index funds bring transparency and low cost, their critics claim that they allocate capital indiscriminately, hurting market efficiency. Is this claim supported by the evidence? It is not. Our analysis shows that, far from damaging market efficiency, index funds1 facilitate active portfolio management by offering investors diverse and efficient tools to express investment views and implement active investment decisions.

IN AGGREGATE, ETF PORTFOLIOS DIFFER FROM THE MARKET

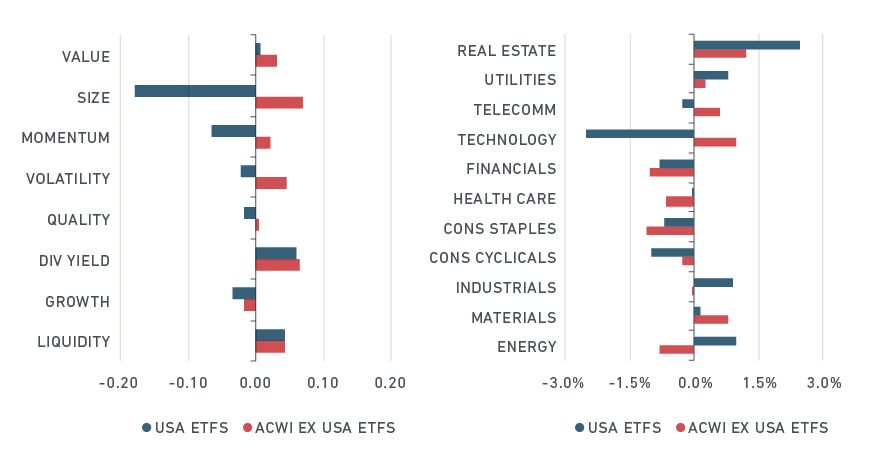

We analyzed over 1,000 U.S.-listed exchange traded funds (ETFs) with assets of $2.9 trillion as of Sept. 30, 2017. We split this sample into two groups: funds investing in U.S. equities, represented by the MSCI USA IMI Index, and international equities, represented by the MSCI ACWI ex USA IMI Index. We found that investors using ETFs did not just passively replicate the entire market. In aggregate, the investments held in ETFs differed from the underlying market in terms of their exposure to factors and allocation to sectors, as well as the amounts invested in individual stocks. These deviations represent active bets against the broad market.

ETF factor and sector allocations

Asset weighted active FaCS factor exposures and GICS® sector weights of 1,024 ETFs as of September 2017. GICS is the global industry classification standard jointly developed by MSCI and Standard & Poor's.

INVESTORS USE ETFS TO EXPRESS ACTIVE VIEWS

Broad market ETFs can be used to achieve specific investment objectives and implement active asset allocation decisions, such as changes in the equity allocation of a portfolio. While investors buying a broad equity market ETF do not select stocks, they are making an active decision to invest in the equity market, instead of allocating capital to other asset classes or markets.

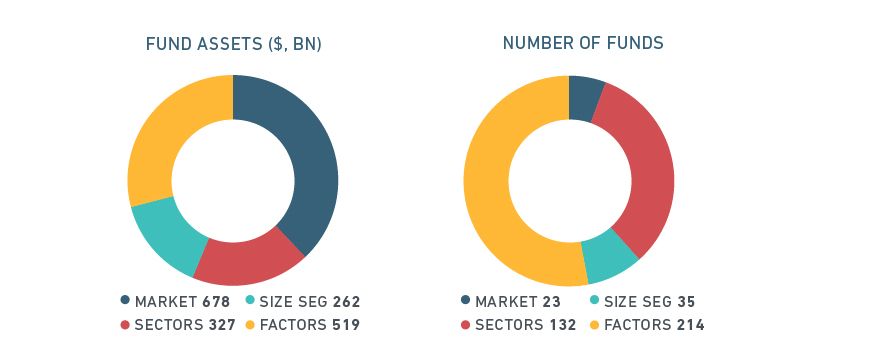

Most ETFs target specific countries, sectors, factors, themes and strategies

Total assets and number of funds split by category of a sample of 404 US equity ETFs as of September 2017

Indeed, we observe substantial diversity across ETFs in terms of their investment characteristics. Single country and sector ETFs within an asset class may be used to express active views regarding the prospects of different geographical regions and industrial sectors. Factor ETFs facilitate allocations to particular factors and strategies. Thematic ETFs offer the possibility to gain exposure to macro themes that are deemed to represent attractive long-term investment opportunities. These investment decisions, implemented efficiently through index-tracking funds, express active views on key drivers of portfolio performance and facilitate the active allocation of capital in the economy.

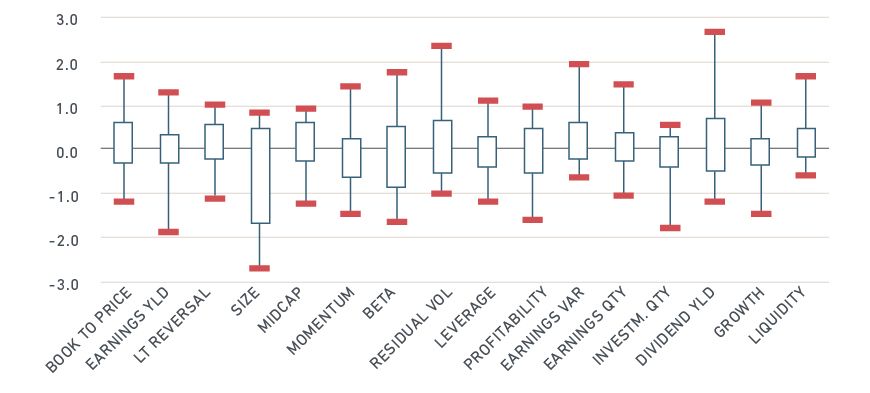

Factor ETFs offer opportunity to fine-tune factor exposures

Barra GEMLT factor exposure dispersion of a sample of 214 US equity smart beta ETFs as of January 2018

Factor ETFs, also known as "smart beta," represent an increasing slice of index fund investments. Instead of holding all stocks in a market segment in proportion to their market capitalization, these strategies only hold stocks with desired characteristics, such as attractive valuations or low market capitalization. The ETFs in our sample had substantial dispersion in terms of factor characteristics. This diversity enables investors to express active investment views on individual factors and tailor the factor exposures of their portfolios.

FACTOR ETFS BUY AND SELL STOCKS BASED ON INVESTMENT CRITERIA

Moreover, through the replication of the regular rebalancing of the indexes they track, factor ETFs sell stocks that no longer meet their criteria and buy other newly eligible stocks. This rebalancing process enables factor ETFs to direct capital towards companies that meet a set of investment criteria, similar to the stock selection process practiced by fundamental active portfolio managers.

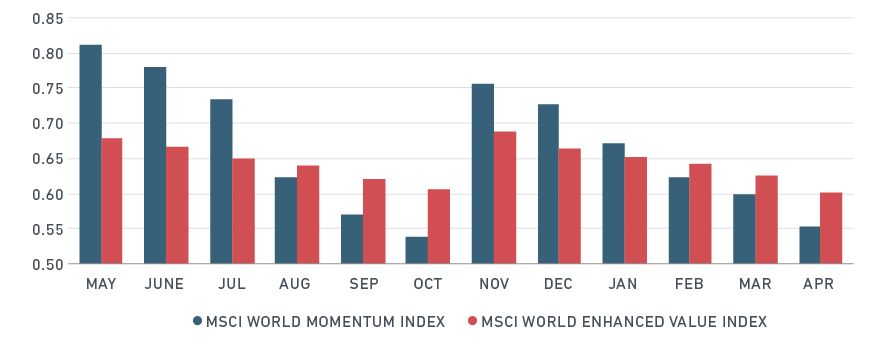

Factor indexes seek to remove stocks with unattractive characteristics through regular rebalancing

Average month-end active exposures to FaCS target factors over the period January 1999 to March 2018. Target factor exposure increases at semi-annual rebalancings and deteriorates in next six months.

INDEX FUNDS ARE TOOLS FOR ACTIVE PORTFOLIO MANAGEMENT

Index funds facilitate active portfolio management and promote market efficiency by enabling asset allocation and security selection decisions. They provide investors tools to express views about the future prospects of different asset classes, markets, sectors, factors, themes and strategies. Through this process, index funds enhance market liquidity and promote the efficient allocation of capital in the economy.

The author thanks Leon Roisenberg for his contribution to this blog post.

1 Our analysis focuses on a sample of 1,024 U.S. listed ETFs investing in U.S. and international equity markets. We consider this sample to be representative of both index mutual funds and exchange traded funds. According to the Investment Company Institute 2017 Fact Book, available on www.icifactbook.org, at the end of 2016, total investment company assets were $19.2 trillion, index mutual fund assets were $2.6 trillion and ETF assets were $2.5 trillion.

Further reading:

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.