Why More Short-Dated Options Did Not Increase Market Volatility

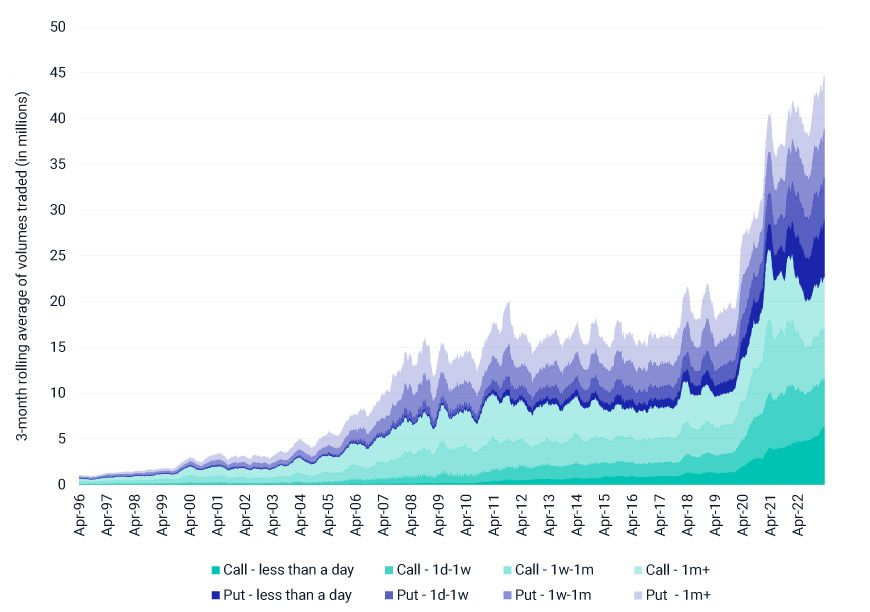

- U.S.-listed index and equity options were traded at record volumes in the first quarter of 2023, with maturities of less than a month accounting for 26% of total volume.

- Dispersion in sector performance and pressure on option market makers may have helped dampen market volatility, despite the banking crisis.

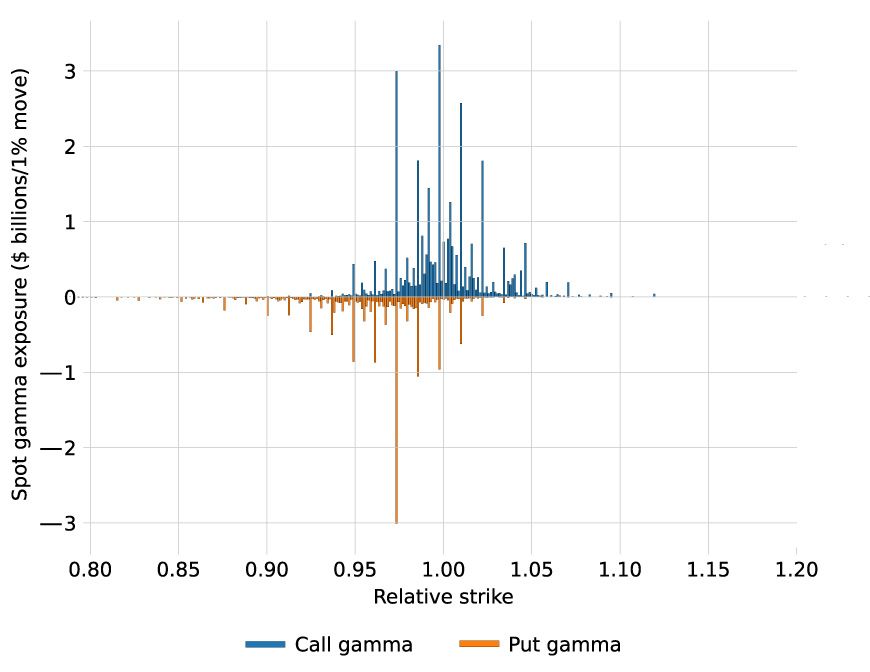

- We estimated the amount of futures needed to be bought (sold) for a 1% down (up) move in the U.S. equity market to be USD 16.5 billion based on April 2023 expirations.

Investors gravitated in high volume toward short-dated options in the US

All U.S.- listed index and equity options from Jan. 1, 1996, to April 28, 2023. Source: OptionMetrics

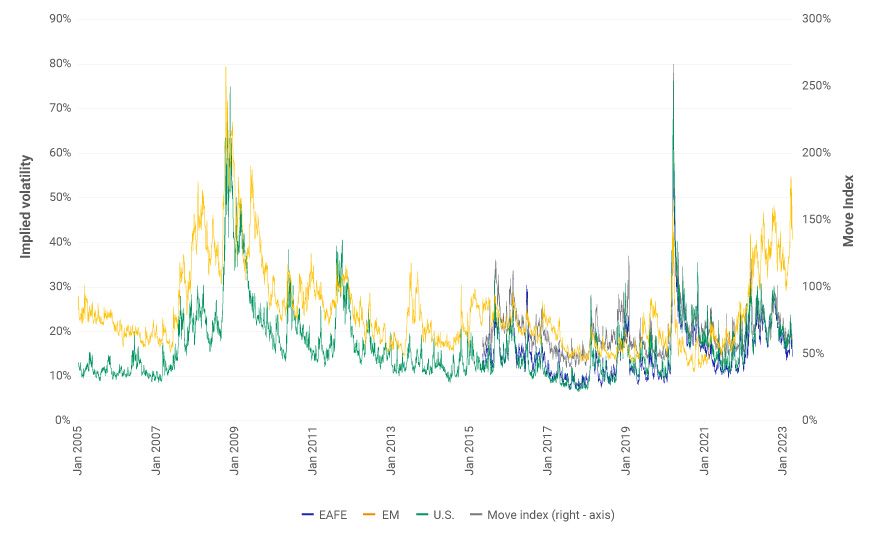

Wide gap between equity and Treasury-rate volatility during the first quarter

Along with the continued rise of short-dated options, 2023 witnessed the fall of Silicon Valley Bank and Signature Bank and UBS Group AG's takeover of Credit Suisse Group AG. This contributed to the highest level of U.S. interest-rate volatility since the 2008 global financial crisis (when it was around 200%). Despite the increased uncertainty around the banking crisis, volatility implied by equity-option prices remained relatively subdued in the U.S., as well as in emerging markets and the EAFE region.

Dislocation between equity and Treasury-rate volatility

Implied volatility is based on the implied volatility of one-month 50-delta call and put options. Options linked to the MSCI EAFE and Emerging Market Indexes and the S&P 500 have been used for the EAFE, EM and U.S. calculations. Source: OptionMetrics. ICE Data Indices, LLC; used with permission.

One of the reasons behind suppressed equity volatility could be the technology sector's outperformance, which offset negative returns from other sectors, such as financials, energy and health care.

A second reason could be the fact that short-dated options have high gamma exposure, meaning market makers would be more sensitive to market moves and buy and sell futures more often to remain delta-neutral. To understand the impact of short-dated options on market makers' hedging activity, consider the following positions:

- If market makers are long gamma, to remain delta-neutral, they would consider selling (buying) futures when the market rises (falls). In effect, this could dampen realized volatility.

- If market makers are short gamma, to remain delta-neutral, they would consider buying (selling) futures when the market rises (falls). In effect, this could amplify realized volatility.

Total net gamma for US options

Based on options linked to the S&P 500, as of April 3, 2023. Relative strike calculated as strike price divided by spot price. Source: Cboe

Keeping your options open

While no two market events are identical, investors looking to evaluate the potential effects of a rise in short-term options may find it helpful to consider that such a rise has not always led to greater volatility in global equity markets.

Further Reading

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.