A Framework for Attributing Changes in Portfolio Carbon Footprint

Research Paper

May 3, 2023

Preview

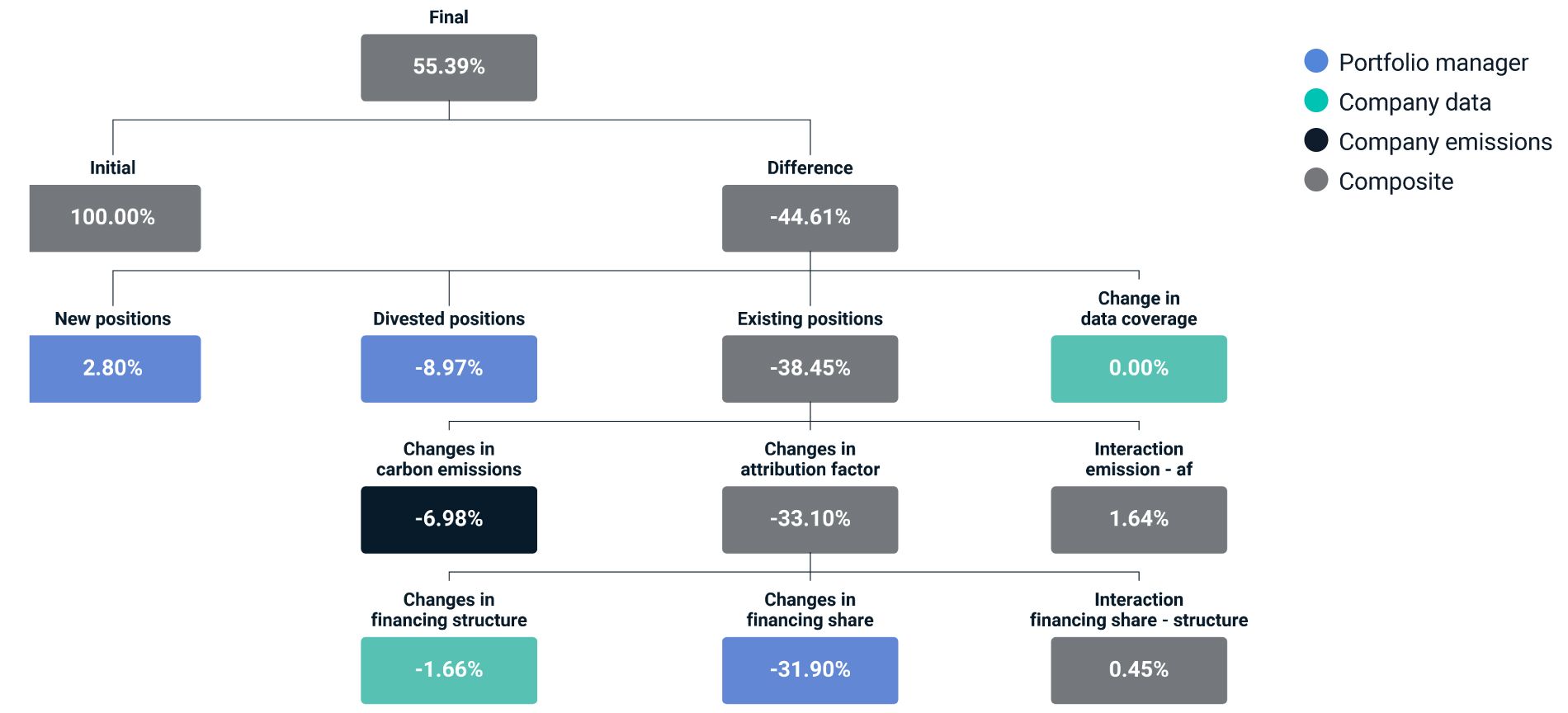

Tracking a portfolio's carbon footprint is a key requirement for setting and tracking net-zero targets. However, this is challenging in practice since changes in carbon footprints may be driven by changes in climate-related variables, portfolio rebalancing or financial variables. In this paper, we propose a framework that attributes changes in portfolio-level emissions to their primary drivers, including changes in the portfolio composition, changes in issuers' emissions and changes in the ownership and financing structure. The framework allows investors to understand to what extent changes in a portfolio's carbon footprint are due to companies' real-world decarbonization efforts, a portfolio manager's investment decisions or changes in companies' financing. ©2023 With Intelligence. Republished with permission from the , from: Zoltán Nagy, Guido Giese, and Xinxin Wang. 2023. "A Framework for Attributing Changes in Portfolio Carbon Footprint." 49, no. 8 (August 2023).

The drivers of financed emissions — a worked example

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Understanding MSCI’s Climate Metrics

With no one-size-fits-all solution to help investors identify the most suitable climate metrics, we take an in-depth look at MSCI ESG Research's climate metrics in terms of what they measure, how they are calculated and their potential use cases.

Implementing Net-Zero: A Guide for Asset Owners

Pension funds, sovereign-wealth funds, insurance companies and other institutional owners of capital are committing to reduce financed emissions across their portfolios. This guide from MSCI ESG Research outlines concrete steps to help asset owners convert climate commitments to action.

How to Evaluate Climate Metrics and Avoid the Big Confusion

Climate metrics can often be a daunting field, with misunderstanding and confusion rife. We present a two-step toolkit that can help investors identify the most suitable metrics as they look to gauge progress toward their climate-investing goals.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.