How Climate Transition Risk May Impact Sovereign Bond Yields

Research Paper

August 15, 2022

Preview

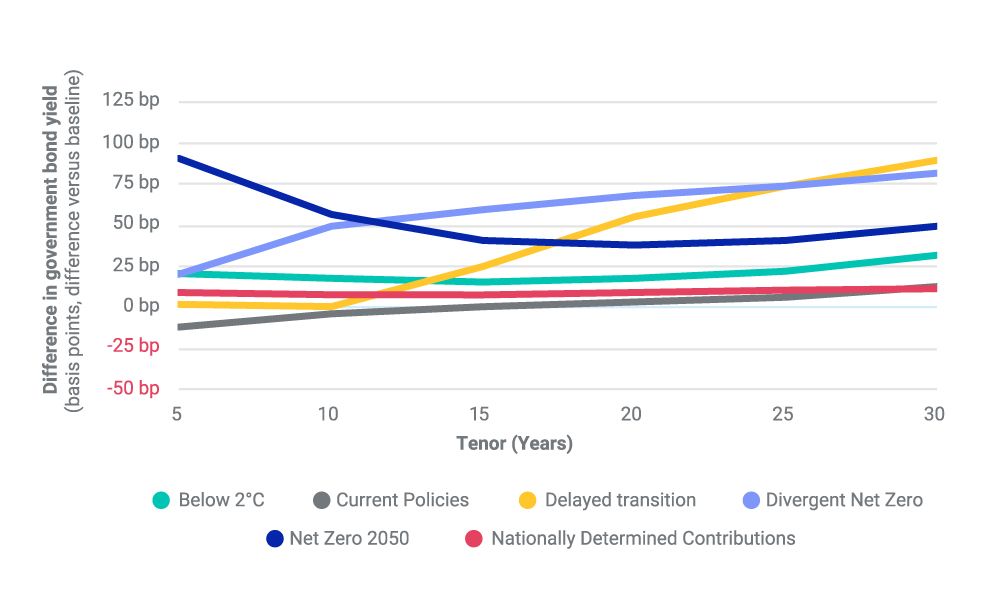

How might climate transition risk affect government bond portfolio performance? In this paper, we quantified the impact of transition risk on sovereign bond yields using MSCI's Sovereign Bond Climate Value-at-Risk model. We find that transition risk might affect sovereign bonds not only through the country/market choice, but also through the maturity composition of the portfolio. The size and timing of these shocks can vary considerably, becoming large factors in some scenarios.

U.S. Treasury bond yield curve shocks under various scenarios

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Government-Bond Yields and Inflation

This interactive plot shows how decarbonization could affect government-bond yields and macroeconomic variables across five major countries.

How ‘Greenflation’ Could Impact Bond Returns

Transition to a low-carbon economy could lead to "greenflation" — i.e., an increase in inflation in the medium term due to rising energy prices, among other things.

In Transition to a New Economy: Corporate Bonds and Climate-Change Risk

In this research, we focus on portfolios of developed-market corporate bonds and study the financial materiality of climate-change risk for these portfolios.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.