Implications of Shorting on Cost of Capital and ESG: Empirical Evidence

Research Paper

April 19, 2022

Preview

Overall, shorting is an essential part of financial-market activity, though it is relatively new in ESG investing. Sometimes there is a debate around short-sales restrictions, and their timing and usefulness in managing market volatility and extreme events. But the debate about the relationship between the shorting of particularly low-ESG-scoring companies and its impact on cost of capital has been consistently one-sided, and this is the topic of this study.

Certain activist investors and advocates of penalizing ESG laggards have claimed that shorting stocks usually leads to an increase in the stock's cost of capital. While this may be the case for particular activist actions, it is not clear whether an increase in a stock's shorting demand per se will have a similar effect.

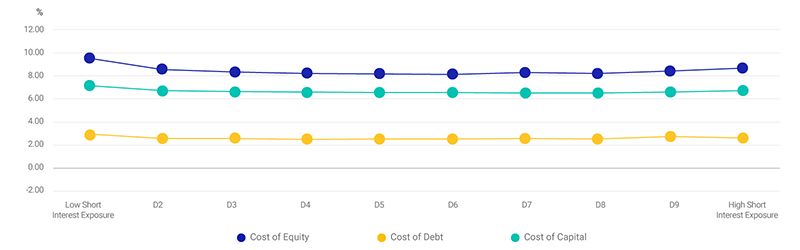

In this report we looked at the relationship between stock-shorting demand and the cost of capital of the constituents of the MSCI World Index, during the period between August 2015 and December 2021. Our findings do not support the hypothesis that an increase in shorting demand leads to an increase in cost of capital. If anything, we find that low-short-interest stocks have had slightly higher cost of capital compared to high-short-interest stocks, though these results were not economically significant.

No significant evidence that higher levels of short selling raise companies' cost of capital

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

ESG Reporting in Long-Short Portfolios

In this webinar, our speakers will provide an assessment of fund reporting approaches for ESG & climate metrics for long-short portfolios, with recommendations on best practice for ensuring the greatest level of transparency for ESG fund reporting.

Reported Emission Footprints: The Challenge is Real

Investors' ability to make comprehensive assessments of companies' climate profiles relies on being able to analyze trustworthy corporate disclosures of greenhouse-gas emissions. Yet the current state of disclosures remains challenging.

Is There a Short Interest Factor?

We introduce a new integrated short interest factor that combines multiple dimensions of short interest.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.